A Breakdown On The Costs To Employ Someone in the UK

What are the costs to employ someone in the UK? There are many elements to consider. For that reason, in this article we help you to go beyond salary and consider all of the other factors that play into hiring someone for your organisation.

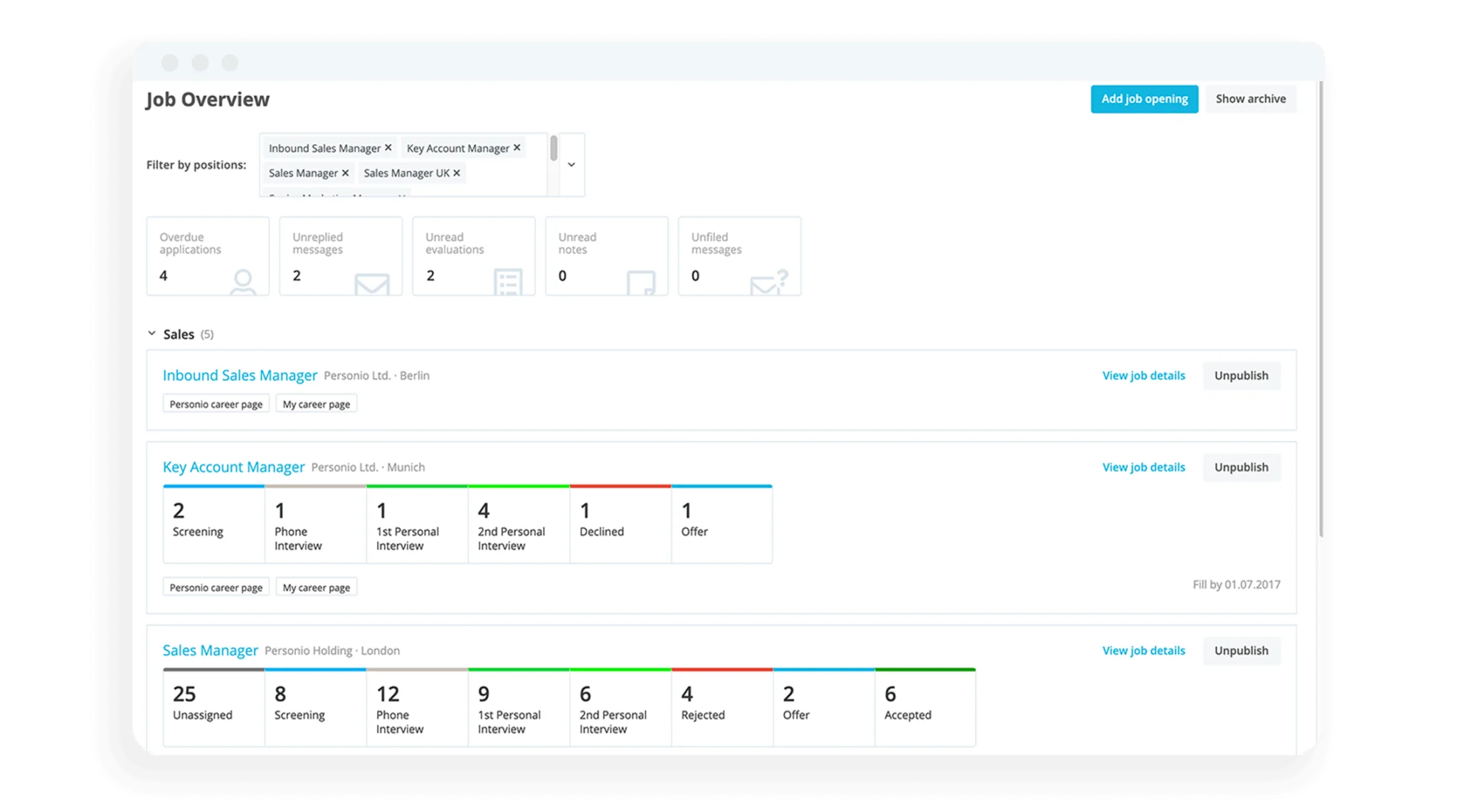

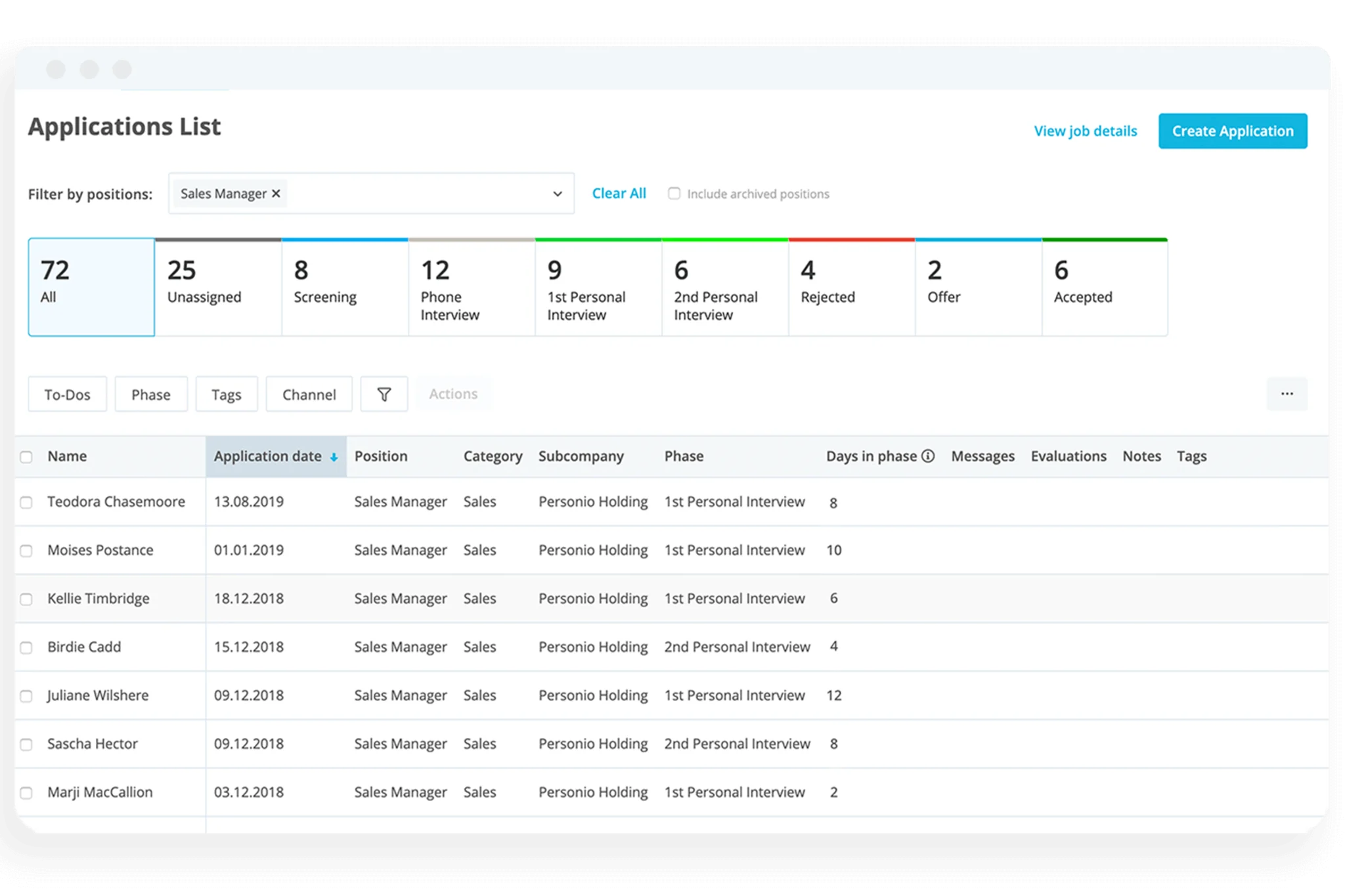

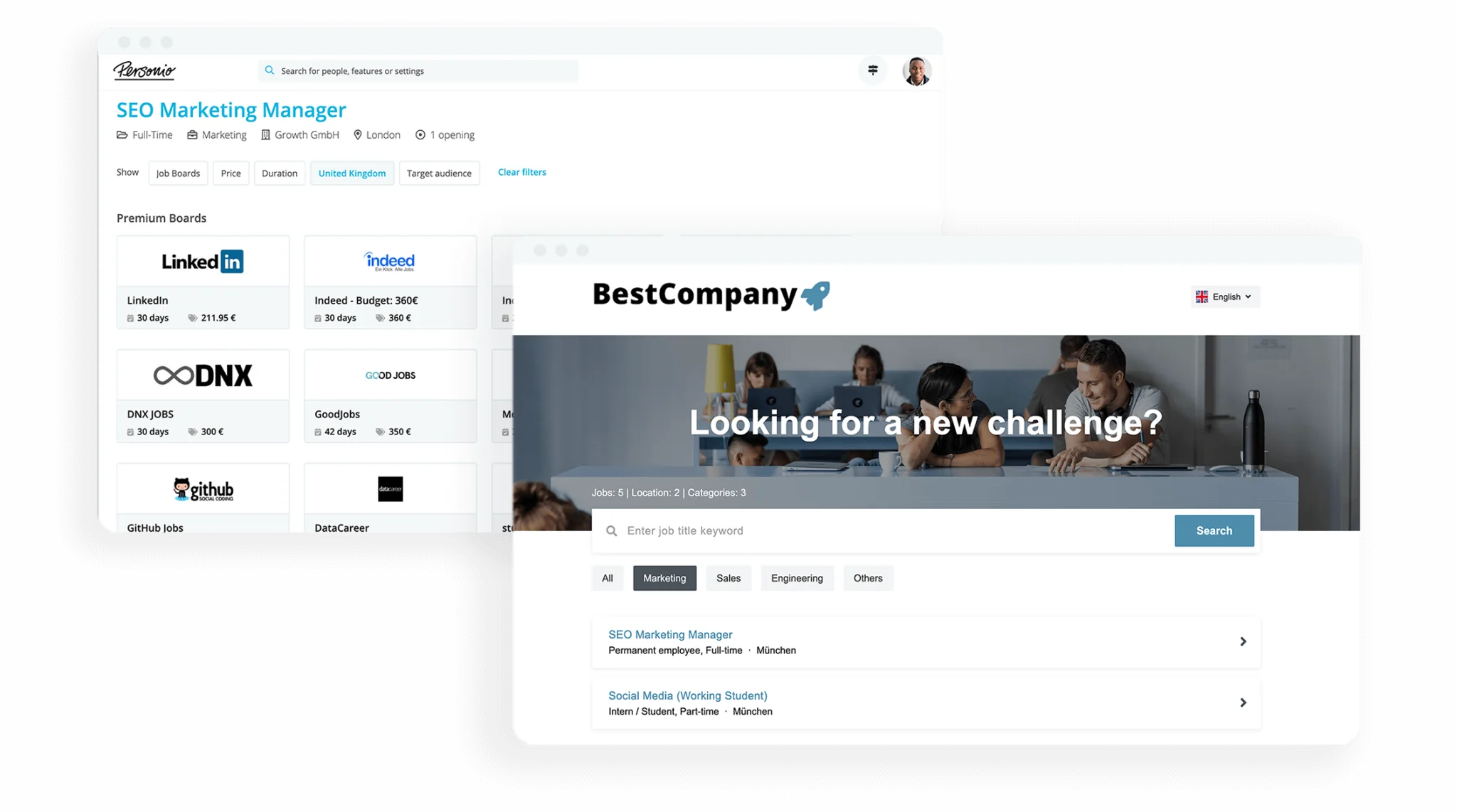

Hire in record time with a leading Applicant Tracking System (ATS).Overall Hiring Considerations in the UK

What is the actual cost of hiring an employee for your company? There are many costs to employ someone that we need to keep top of mind, including:

Pension

National Insurance

Overhead costs

Recruitment costs

Insurance

Holiday and sick pay

Maternity or paternity leave

Performance bonuses

As we go along, we’ll cover the general costs of employment in the UK, alongside NIC and pension contributions.

Then, we’ll cover the average salary, the minimum wage, and the real living wage in the UK.

Costs Of Employment In The UK

When it comes to the costs of employment in the UK, there are five main elements that you need to take into account:

1. National Insurance Contributions

The first cost that you need to take into account is the National Insurance contribution. You have to do this for every single employee. The contributions per employee vary from the amount they earn and also their age.

For employees that are over 21 years of age and are earning more than £175 per week, you will need to pay 13.8% of their earnings to National Insurance.

The calculation is different if you’re hiring an apprentice under the age of 25. And on top of the regular contributions, you will also need to pay National Insurance on each and every cash bonus you give to your employees.

2. Pension Contributions

When you’ve paid for the NI contributions, it’s time to contribute to the employee’s Workplace Pension. Pension contributions are a legal requirement and all employees who joined the company need to be on the pension scheme within three months of recruitment.

Employees can decide to opt out of the pension contribution plans. The minimum contribution to the pension fund is 8%, with the employer needing to provide a minimum of 3% and the rest by the employee.

3. Costs Of Benefits

As an employer, you will be in charge of providing your employees with benefits in the workplace. Employee benefits can vary from workplace to workplace and as an employer, you will have to include them as part of the costs of hiring someone to work for you.

Additionally, your reward and recognition program should offer benefits to your employees, and you will need to properly budget for that.

From rewards such as employee of the month to the office bingo, you will need to be the one to cover the costs of all those benefits. Additionally, transport subsidies (like a company car, bike or scooter) also come with their own cost.

4. Overhead Costs

When employing a new person, you will need to take into account all of the associated overhead costs. Overhead covers all the necessary equipment so that a new employee can work in their role successfully.

On top of that, you will need to provide them with a safe and comfortable working space which means additional office space, an increase in utility bills, etc.

5. Working Hours/Productivity Costs

Last but not least is the productivity costs. Even though your employees work from 9-5, they may not be able to focus on your core role all of the time.

Productivity improvements should be a pressing topic for just about any workplace in the world. Workforce productivity is incredibly important and is a key driver for success.

Take into the consideration the kind of ‘productivity costs’ your organisation may currently be dealing with – do you have cumbersome processes that are sucking up time?

Salary And Average Salaries In The UK

Let’s take the average, 35-hour work week, where a person is working on a 9-5 schedule.

The National Living Wage (NLW), which is the minimum hourly pay every employee above 25 years of age needs to get, says that the employee needs to get paid £9.50 per hour or more.

That means that, by the NLW, the employee should make a minimum of £17,290 a year.

On top of the National Living Wage, there’s the “Real” Living Wage which states that the person should receive at least £9.90 per hour and in London £11.05 per hour in order for people to get by.

According to the “Real” Living Wage, the employee should earn a minimum of £18,018 or £20,111 in London to actually get by.

Yearly Cost Of Employment: Example

When you’re looking to hire someone in the UK, a good rule of thumb would be to take their salary and add around 75-100% more to that in order to get the complete costs of the employment for that individual

This is an estimate, though. Sometimes, that number is even higher as we illustrate in the following table:

Expense | Annual cost |

Salary | £20,000 |

Office rent per desk | £10,500 |

Recruitment costs | £2,000 |

National Insurance | £2,600 |

Business energy bill (for five-person office) | £3,000 |

Training | £1,500 |

Pension contributions | £600 |

Work social function per head | £150 |

Employers’ liability insurance (lowest estimate) | £70 |

Total | £40,420 |

In short, it is better to know all the costs in advance then get surprised when the bills start coming in and adding up.

Additional Employee Entitlements

Employees will also have extra entitlements in their workplace which, as an employer, you will need to cover. These include:

All of these and many other extra entitlements need to be calculated in the costs to employ someone.

Frequently Asked Questions About The Costs Of Employing Someone

The following are the most frequently asked questions when it comes to the costs to employ someone in the UK…

What Are The Costs Of Employing Someone?

As a rule of thumb, they’re an additional 75-100% of the cost of an employee’s total salary.

How Much Do Pension Contributions Cost?

Pension contributions cost a minimum of 8% of yearly income, out of which the employer gives 3%.

Reach Peak Productivity in Record Time

The costs to employ someone go down when you make the most of their productivity. That means you need to have all of your HR processes in order – everything from onboarding to requesting vacations and running performance cycles.

Personio helps you with all of that, and more. We offer an all-in-one HR software to upgrade your people operations for now and into the future. Check us out today or book a demo right now to get an HR expert on your side.