Understanding employee benefits in the UK

In this article, we provide an overview of typical employee benefits — those employers must provide by law and those considered optional. Additionally, we provide in-depth overviews of each potential benefit and why it may be a good idea to include it in your employment package.

Key facts

Your business has to provide any mandatory benefits to the employee to avoid the risk of civil or criminal penalties.

The value of non-mandatory employee benefits depends on your company’s financial situation and the primary demographics of your workforce.

Health insurance benefits are beneficial if you have mostly older employees or work in a stressful environment.

Mandatory employee benefits

Mandatory employee benefits are benefits you must provide to your workers at the beginning of their employment as mandated by law. Businesses that don’t include these benefits as part of the employment contract are subject to criminal and civil penalties. These benefits include:

Pension

Employee pensions, sometimes called occupational, works, company or work-based pensions, are employee retirement funds to which the employer should regularly contribute. You’re required to sign up new hires to a relevant pension programme. Most pension programmes today are defined contributions, meaning that both you and the employee put in a set amount of money over time.

There are also defined benefit pension plans which pay out upon an employee’s retirement based on a formula. Some factors that might influence the amount in the account are the employee’s final salary, average pay overtime and how long they’ve worked for the company. However, this pension plan is seeing less use within the private sector.

Healthcare insurance

Healthcare is a mandatory benefit to help ensure an employee’s continued health and productivity. The National Health Service (NHS) is a government-backed healthcare option that aids UK citizens in:

Seeing doctors for examination and treatment of non-life threatening or chronic conditions

Having extended stays at the hospital to receive treatment

Getting emergency care from qualified healthcare professionals if dealing with a serious or life-threatening condition

Because the NHS is publicly funded, a lot of the money that allows these services is collected through the National Insurance Contributions. However, your company can also pay for private health insurance as part of your employee benefits.

Sick pay

The government requires that your company provides your employees with a minimum amount of statutory sick pay. The pay should equal £99.35 per week for up to 28 weeks. However, many businesses offer additional compensation above that. A typical strategy is to offer more sick pay for the first 2 weeks and gradually decrease it to the minimum amount.

Holiday pay

You are required to provide employees who work for five days a week with a minimum of 28 days of paid annual leave per year. However, most UK companies provide more than the legally required amount to stay competitive with benefits offered by other employers. In addition to the holiday pay, you can also offer paid time off for public holidays.

Maternity/paternity leave and pay

Employees who become pregnant are entitled to 52 weeks of maternity leave. Your company is required to pay 90% of the employee’s average earnings for the first six weeks of maternity and the minimum statutory rate for the remainder. Fathers are only legally entitled to two weeks of paternity leave, paid at the minimum statutory rate.

You decide whether to give your employee further parental leave or establish a flexible working arrangement past what the law requires. For example, some companies allow either parent to temporarily or permanently switch to remote working to help care for their child.

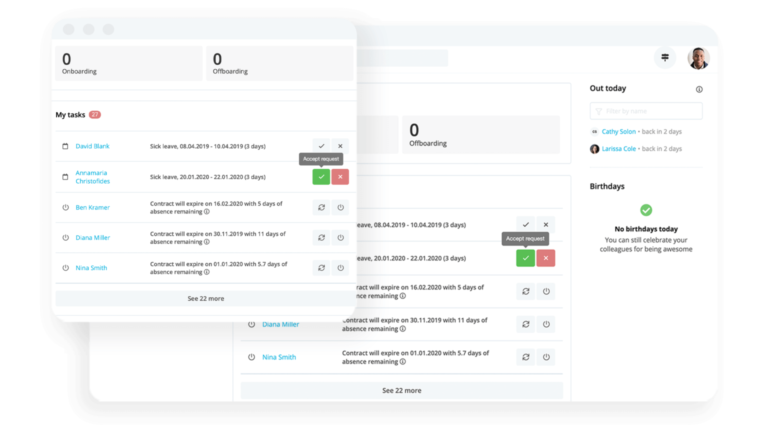

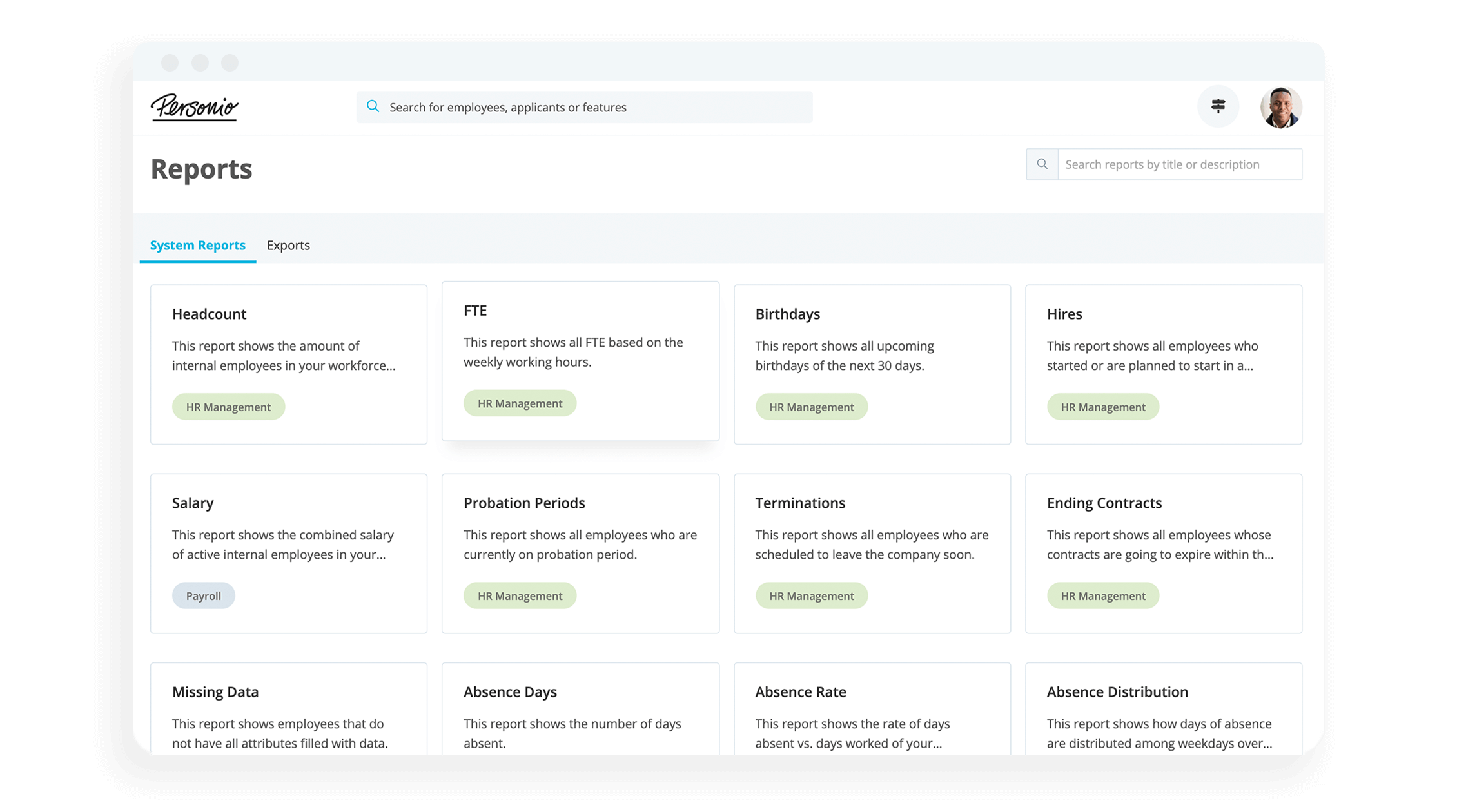

Track The Satisfaction Of Your Workforce

Personio offers a host of templated and custom reports to help make understanding your workforce even easier. Click the button below to learn more and to see things in action today.

HR Analytics With PersonioNon-mandatory employee benefits

You can offer several non-mandatory benefits to your employees on top of the mandatory ones. Some are extensions of the mandatory benefits, while others are specific to company operations. While offering them isn’t required, they tend to increase employee engagement and decrease turnover.

Critical illness insurance

Providing critical illness insurance means you pay out a large lump sum of money if an employee contracts one of a list of serious medical conditions and survives for a minimum period. Your critical illness policy should list the diseases that are eligible for payment. Some common illnesses included on this list include cancer, Parkinson’s disease, stroke, dementia, and heart attacks.

Private medical insurance (PMI)

While everyone can use NHS medical insurance, many health services have extensive wait times if they’re received through that programme. Private medical insurance is something your company can pay towards that helps your employees be seen faster for certain medical conditions. Not only can this help employees bypass long queues, but it also helps them get back on their feet faster.

Health cash plan

A health cash plan is something the company can offer to each employee to focus on routine medical needs while their insurance covers unexpected health issues. Routine, in this case, refers to services like dentist and optician appointments, specialist visits and physiotherapy.

Health cash plans are paid for in one of three ways:

Entirely by the employer

Partially by the employer with the option of total coverage for full-time workers

Voluntarily solely by the employee

Health screening

Free, regular health screenings are something your company can provide to help employees stay on top of their health. Providing health screenings helps keep your workforce stable by ensuring that your employees don’t get sick in the first place. It’s also a signal that you invest in your employees in ways beyond the legal minimum requirement.

Death in service benefit

Death in service benefit is a tax-free lump sum of money provided to an employee’s dependants (usually a spouse and/or children) in the event of the employee’s passing. Typically, the actual payout is a certain amount of times their average salary. So, someone who made £50,000 on a 4x salary life insurance policy would have their dependants receive £200,000. A workforce that knows the company will help care for their loved ones will be more motivated to perform at their best.

Company cars

A car is something that’s typically only provided to employees under certain circumstances, and particularly if their duties involve driving as a necessary part of the job description.

Some companies will give certain employees access to a company car to help perform their responsibilities. Since the car is often shared between multiple people, the manager will often set a strict mileage limit to ensure it stays in good working condition. However, other businesses will simply provide their workers with the money to buy or lease their own vehicles.

How to choose between employee insurance benefits

While mandatory benefits must be included in your company’s employment contract, offering non-mandatory ones is up to you. Choosing what to include generally depends on your business’s financial situation and what you feel is a worthwhile investment.

Critical illness insurance, the health cash plan and private medical insurance can help keep your employees healthy. Without worrying about NHS waiting times, your workers could potentially be seen and treated more quickly for common ailments that require sick leave, like a cold or an ear infection. Health screening helps your employees identify more serious illnesses earlier and start treatment before the problem becomes acute.

Death in service benefit gives your employees peace of mind knowing their dependants will be financially secure. A company car has more niche uses, but many employees would appreciate their company buying them a car or giving them access to one. That way, they won’t have to use their personal vehicle and risk a breakdown or won’t have to take public transportation.

Regardless of the non-mandatory benefits that make the most sense for your company, each can significantly improve employee morale because it demonstrates that your business invests in them.

Frequently asked questions about employee benefits

What are the mandatory employee benefits?

The mandatory employee benefits you’re required by law to include in employment contracts are:

Pension. You are required to pay into this retirement fund, with the option of the employee contributing as well.

Healthcare Insurance. For this government-mandated coverage, you need to deduct a certain amount from an employee’s salary as a contribution.

Sick Pay. Employees are entitled to around £99.35 per week for up to 28 weeks, so they are accommodated while indisposed with sickness.

Holiday Pay. You are required to provide employees who work for five days a week with a minimum of 28 days of paid annual leave a year.

Maternity/Paternity Leave and Pay. Mothers receive 52 weeks of maternity leave with 90% of their average earnings for the first six weeks and the minimum statutory rate for every week after. Fathers are entitled to two weeks of paid leave at the minimum statutory rate.

What are good employee insurance benefits?

Each non-mandatory benefit has its own benefits and financial drawbacks. Whether or not it’s good often depends on whether you believe the results are worth the cost and whether your employees will benefit from it.

How to choose between different employee insurance benefits

When choosing insurance options, there are a few factors you can look at to determine which benefit is right for your organisation, including:

Are they more experienced in their careers, or are they just starting out?

Do you want to invest in proactive care for your employees’ health?

How large is your workforce?

What’s your budget for insurance options?

Keep employment contracts in a safe place with Personio

Regardless of the benefits you sign your company up for, you’ll still require a lot of documentation before your employees can benefit. The larger your business, the harder it is to keep track of the paperwork, but Personio can provide a secure space to store all of your employee’s information. Book your free demo to learn how Personio can help you manage your workplace.

Disclaimer

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness.