Start simplifying your payroll management

Learn how to streamline your payroll process to save time and ensure accuracy.

Read our guideNew Ruling On Overtime And Holiday Pay In 2022

There was a new ruling on overtime and holiday pay in 2022. The following article will provide you with the necessary details on the changes in overtime and holiday pay so that you don’t miscalculate employee entitlements. Now, let’s start by defining the different types of overtime.

Skip right to the chase and download our staff holiday planner template today.What Are The Unique Types Of Overtime?

Employers and employees should be aware of the three different types of overtime work:

Voluntary Overtime – When an employer doesn’t have to provide or offer any kind of overtime time. In addition, the employee is under no obligation to accept the offer and provide overtime work for the employer.

Compulsory Overtime – When an employer requires their employees to stay later and work additional hours. In this scenario, the employees have to accept this request and work overtime. Typically, this is written into an employment contract.

Non-Guaranteed Overtime – When an employer is not being under any obligation to provide or offer overtime to their employees. In the event that they do, employees must accept overtime work once offered.

How Do You Calculate Regular Overtime?

Regular overtime is always calculated into the holiday pay of an employee. Overtime work also doesn’t have to be considered ‘direct work’ —it can take the form of training programs (attending training related to work), travelling for work (not including daily commuting) and/or on-call time (when an employee is expected at work on short notice).

What Kind Of Overtime Counts Towards Holiday Pay?

Employers should be aware of the overtime work that counts towards holiday pay for employees. The EAT (Employment Appeal Tribunal) made a ruling in 2017 that any regular overtime work has to be included in the holiday pay.

Under the Working Time Regulations legislation, employees get a minimum of four weeks of annual leave. On top of this, overtime holiday pay also grants employees an additional 1.6 weeks of annual leave, making it 5.6 weeks of minimum annual leave.

Also, there’s the case of East of England Ambulance Services NHS Trust vs Flowers & Ors, where the EAT ruled that employers must make regular payments when employees are on holiday pay for overtime work they accomplished.

The ruling occurred due to employees wanting to have their normal remuneration during their annual leave instead of being discouraged to take their four weeks of leave only to have a reduced holiday during that period of time.

The law is far from perfect for both employers and employees, and will change and evolve in the years to come. In this very moment, compulsory overtime pay also counts toward the full 5.6 weeks of leave.

Introducing Modern Holiday Planning & Management

Seamless absence tracking that scales with your headcount. See how Personio can help your team with absences today.

Book Your DemoHow Do You Calculate Holiday Pay?

Holiday pay has always been based on the week of pay. For individuals who don’t have a fixed working schedule, you would take an average pay over the last 12 weeks.

However, this has since changed in the Good Work plan. As of now, you must take into account the previous 52 weeks of pay.

When an employer makes calculations regarding holiday pay for their employees, they should keep in mind the Employment Rights Act of 1996.

For that reason, don’t forget to calculate in the following items:

Contractual commissions

Bonuses on key performance indicators

Travel allowances and expenses

All three types (voluntary, compulsory, and non-guaranteed) of overtime work

Best Practice: Making the right calculations is incredibly important. After all, the last thing you want as an employer are employees launching claims that their wages have been unlawfully deducted.

New Ruling On Overtime And Holiday Pay in 2022

When it comes to the new ruling on overtime and holiday pay from 2022, you should take into account the following:

From April 2020’s ruling, you should take overtime work into account when calculating holiday pay. For shift and part-time workers, the holiday pay calculation changed from basing it on the previous 12 weeks of pay to the last 52 weeks of pay.

There was another bank holiday in 2022 (Queen’s Platinum Jubilee) on the 3rd of June and May Day was moved to the 2nd of June.

According to the Good Work Plan, there will soon be a single body that will ensure that all employment rights (the minimum wage, holiday pay, agency workers’ rights) are being enforced.

The national minimum wage and the national living wage have been increased, taking effect from April 2022.

The national living wage increased from £8.91 per hour to £9.50 per hour.

The new national minimum wage is £9.18 per hour.

For the 18-20-year-olds, the minimum wage will be £6.83 per hour, while 16-17-year-olds will be paid a minimum of £4.81 per hour.

Employees can’t be forced to work more than 48 hours a week (on average).

Key Takeaway: As an employer, you need to remember that regular overtime needs to be included in holiday pay.

Do You Have A Leave Management System?

The world of work is only becoming more complex. The last thing you should be worrying about is calculating holiday entitlements, tracking them or ensuring you are legally compliant. Allow us to help.

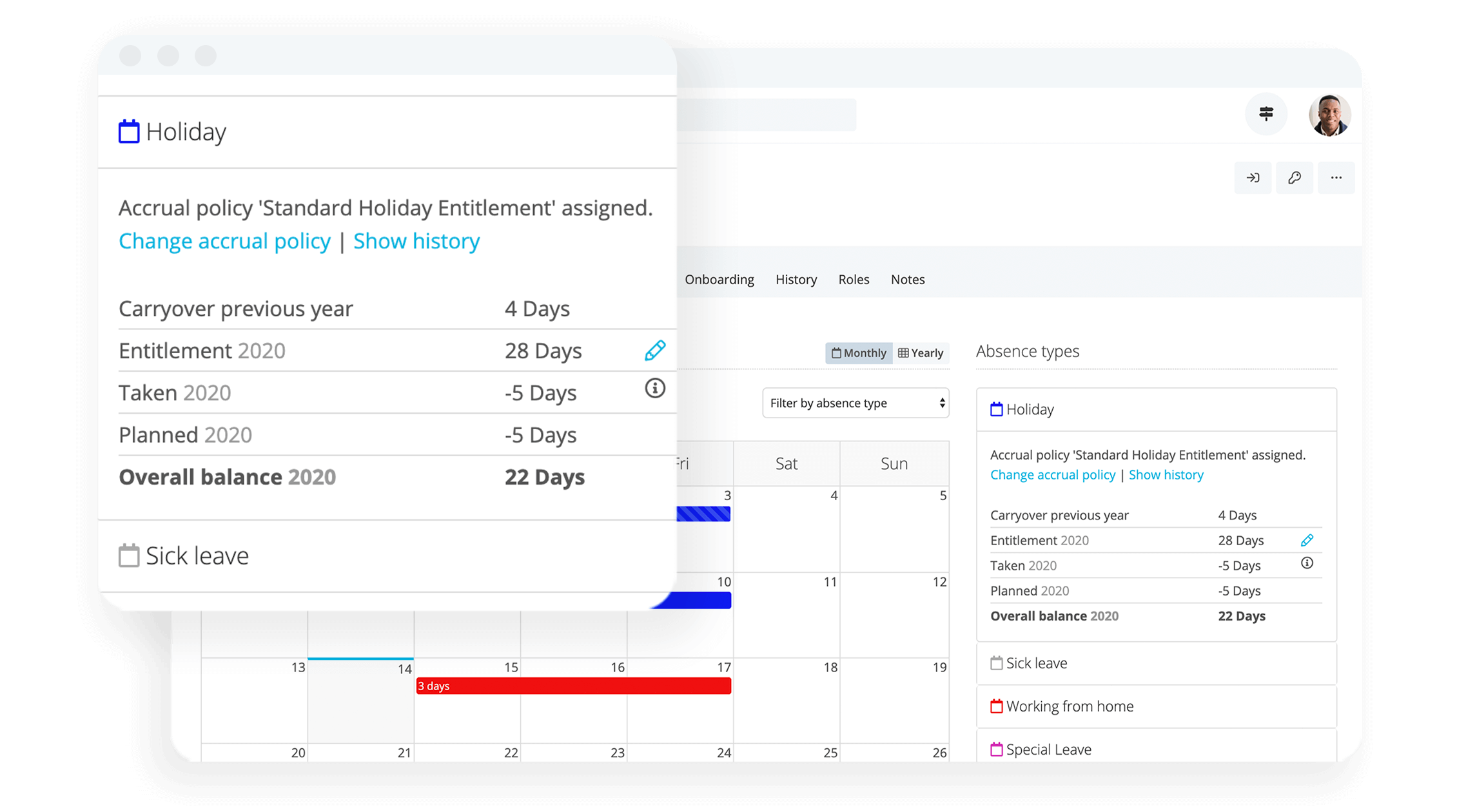

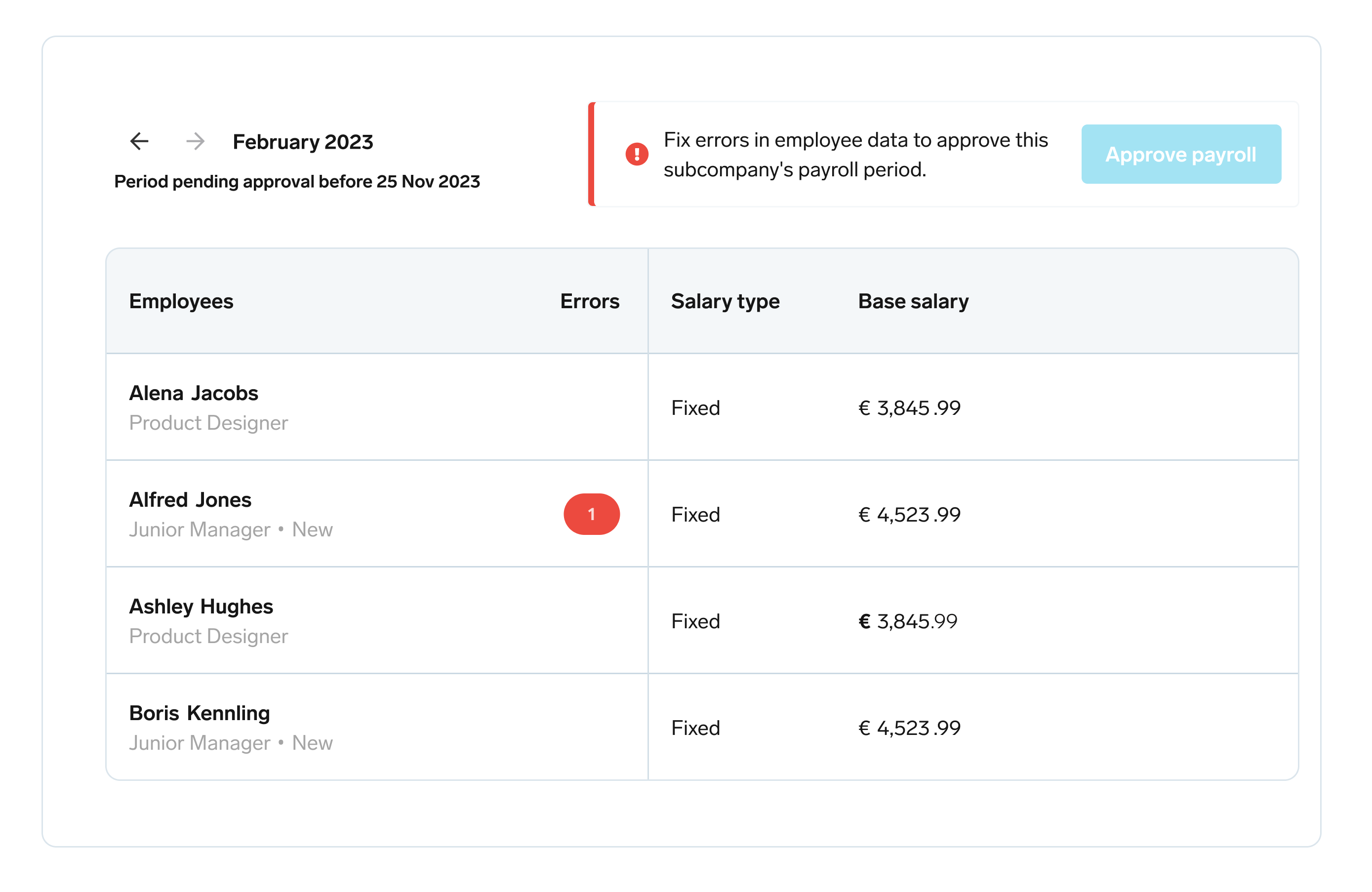

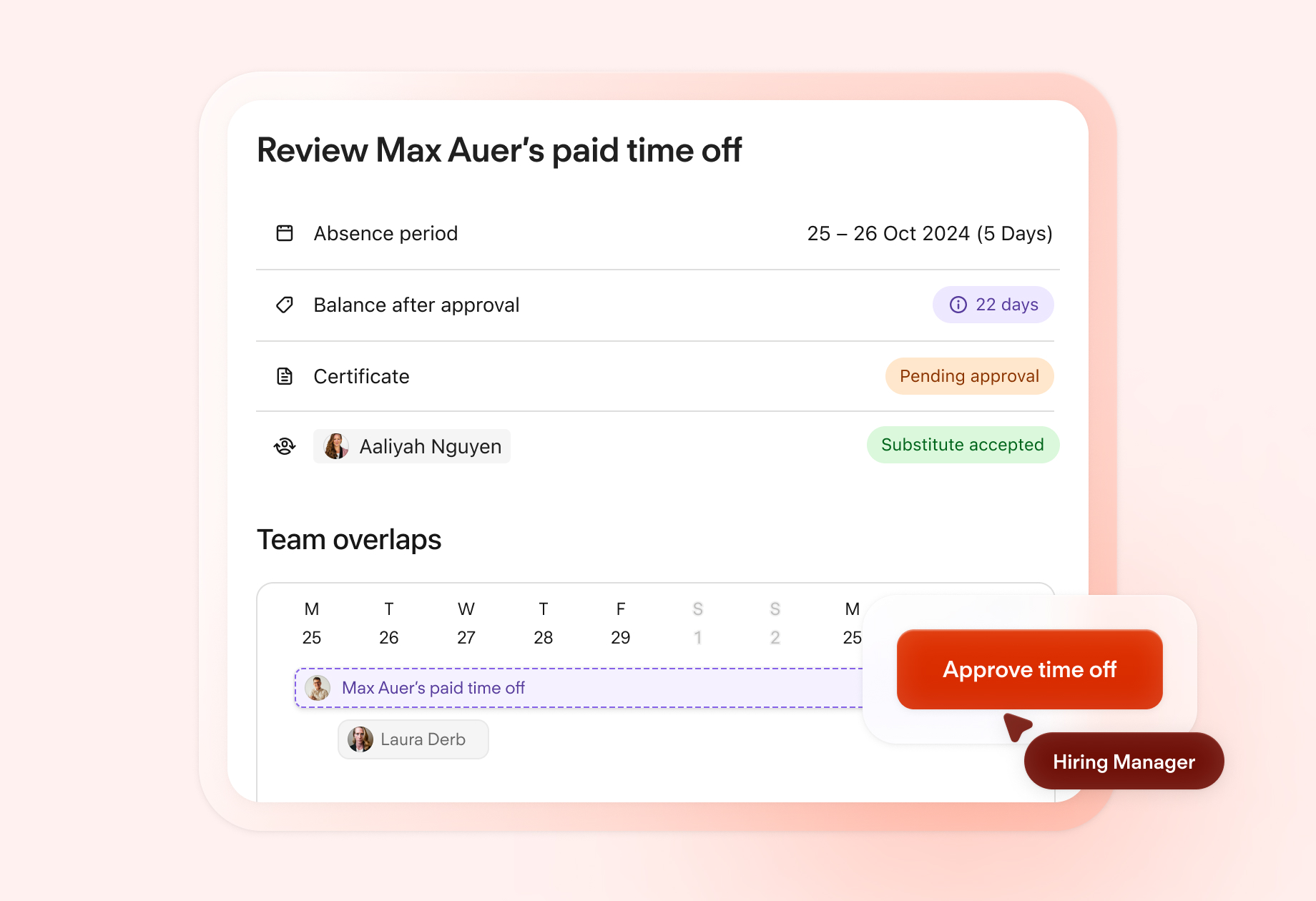

Personio is an all-in-one HR software that helps upgrade your people operations for now and the future. That includes a leave management software that can manage holiday requests, track every kind of leave (from emergencies to sicknesses and bank holidays) alongside all of your other core HR processes.

8,000+ customers in the UK and Europe trust us to help. Get in touch with one of our helpful HR experts today, or start your own free trial to give Personio a go right away.