4 Most Common Deductions from Wages in the UK

Deductions from wages, otherwise known as salary deductions, are standard practice in the UK. But, for business and people leaders alike, what do you need to keep in mind? In this article, we’ll run you through the main deductions from wages and what not to forget.

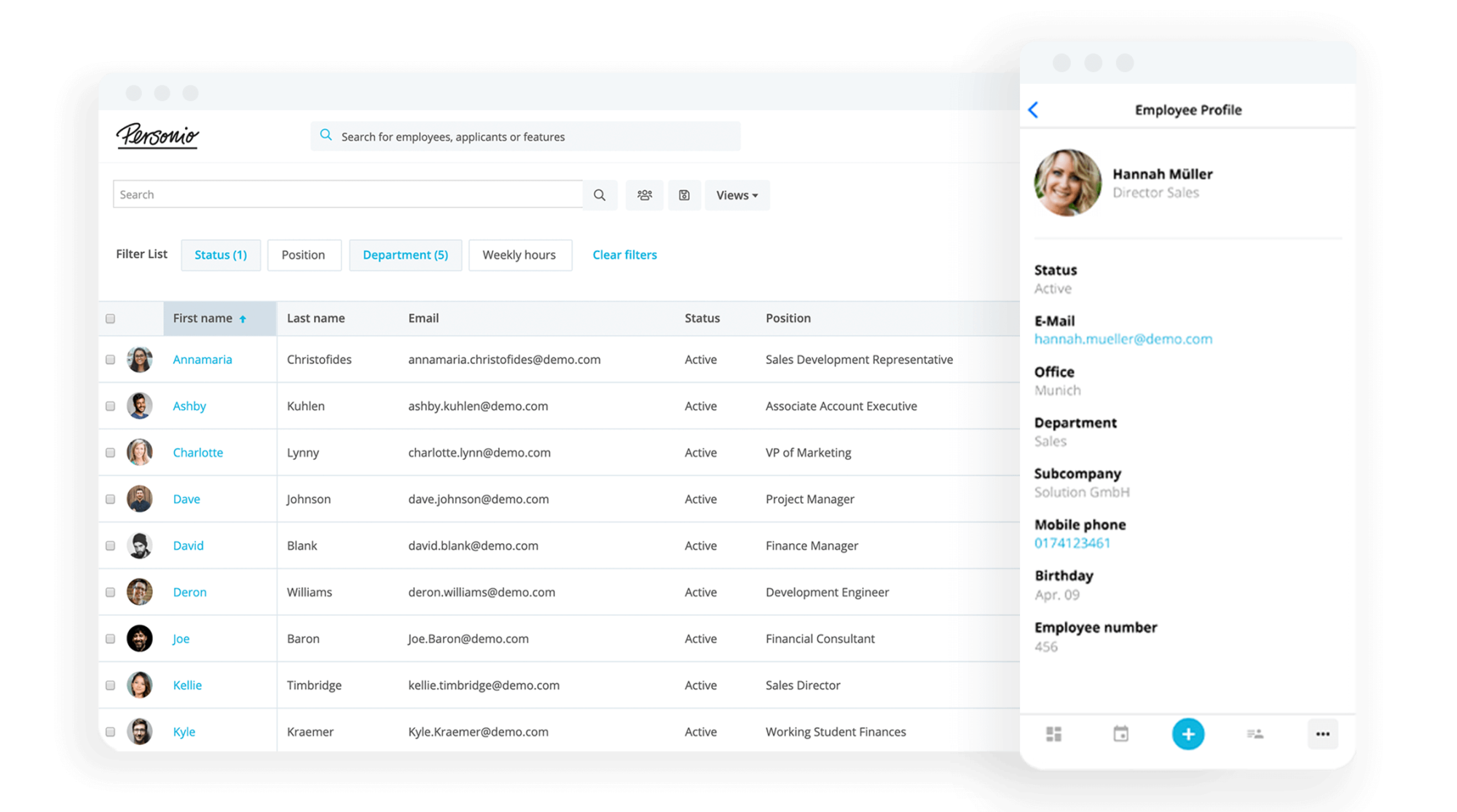

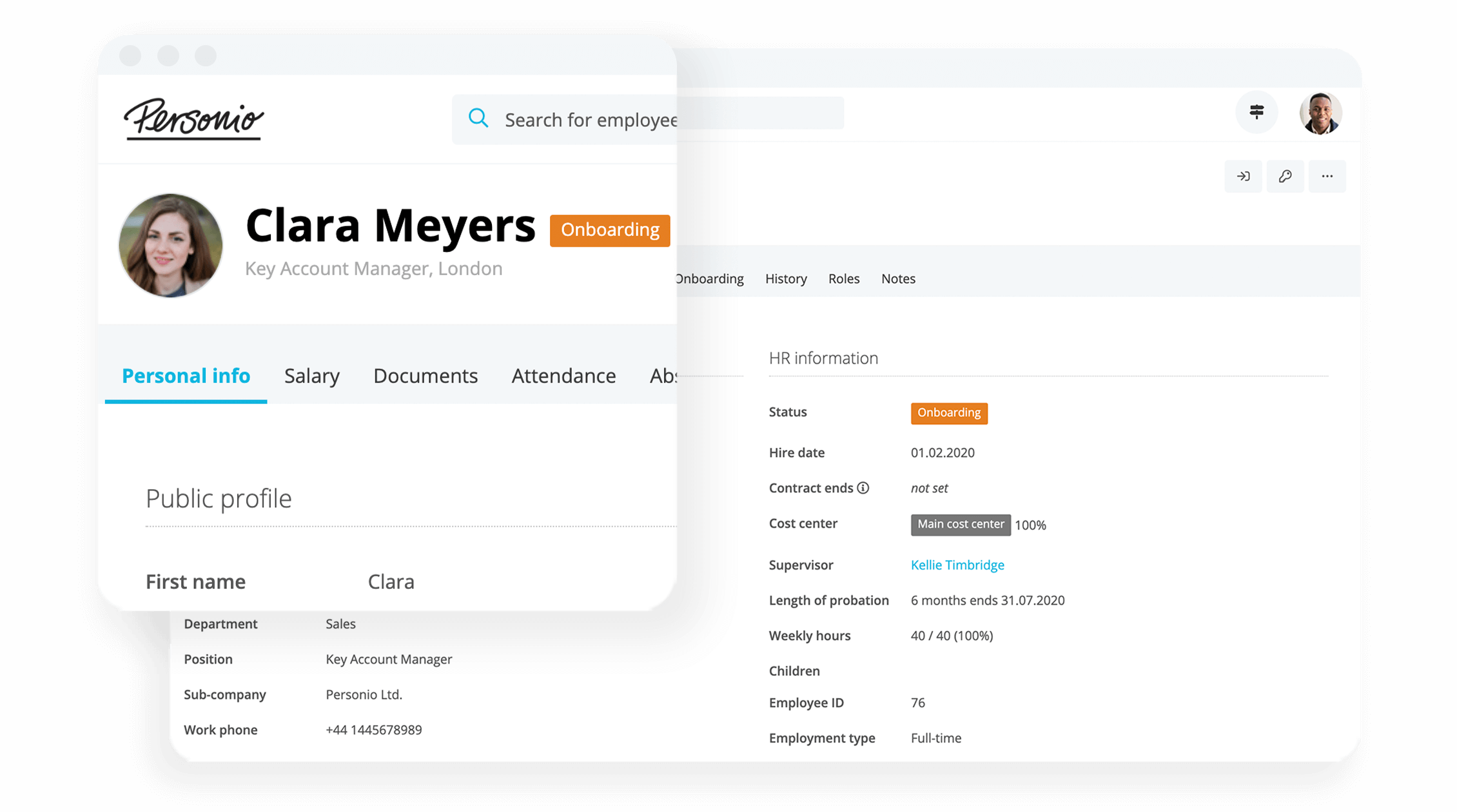

All your particulars in one place: Employee data storage with Personio.What Are Wage or Salary Deductions?

Employers are able to make deductions from wages, via an employee’s paycheque, to put toward taxes, benefits or court orders. Typically, wage or salary deductions can be sorted into two unique categories: voluntary and involuntary deductions.

Voluntary deductions from wages are where an employee chooses to give a part of their wage “back” to the company (as is the case for a workplace pension).

Involuntary deductions, on the other hand, are when an employee does not directly consent (or need to consent) to having their salary deducted. This could cover things like child maintenance or relevant court orders.

What are Statutory Deductions?

Statutory deductions are mandates from the government that employees need to pay, usually for government programmes and services.

They can include the following:

Pay-as-you-earn income tax

National Insurance

Student and postgraduate loans

Workplace pensions

The employee always needs to receive a relevant provision stating the purpose of the deduction. The following are used as relevant provisions:

Substandard quality of work

Damaging a company’s property or losing it

Personal use of company assets

When Are Employers Able To Make Deductions From Wages?

The National Minimum Wage is the lowest rate that the employer can pay their employees. It’s defined by the law and the National Minimum Wage is for people under the age of 23 and interns, while the National Living Wage is for people above 23 years of age.

The rates for both change every year and the 2022 minimum wages are:

National Living Wage— £9.50

National Minimum Wage, age 21-22— £9.18

National Minimum Wage, age 18-20— £6.83

National Minimum Wage for those under 18 and apprentices— £4.81

However, there are some exceptions when it comes to wage deductions, such as:

Tax insurance

Repaying loans

Buying shares and stocks

Contribution for pensions

Overpayments

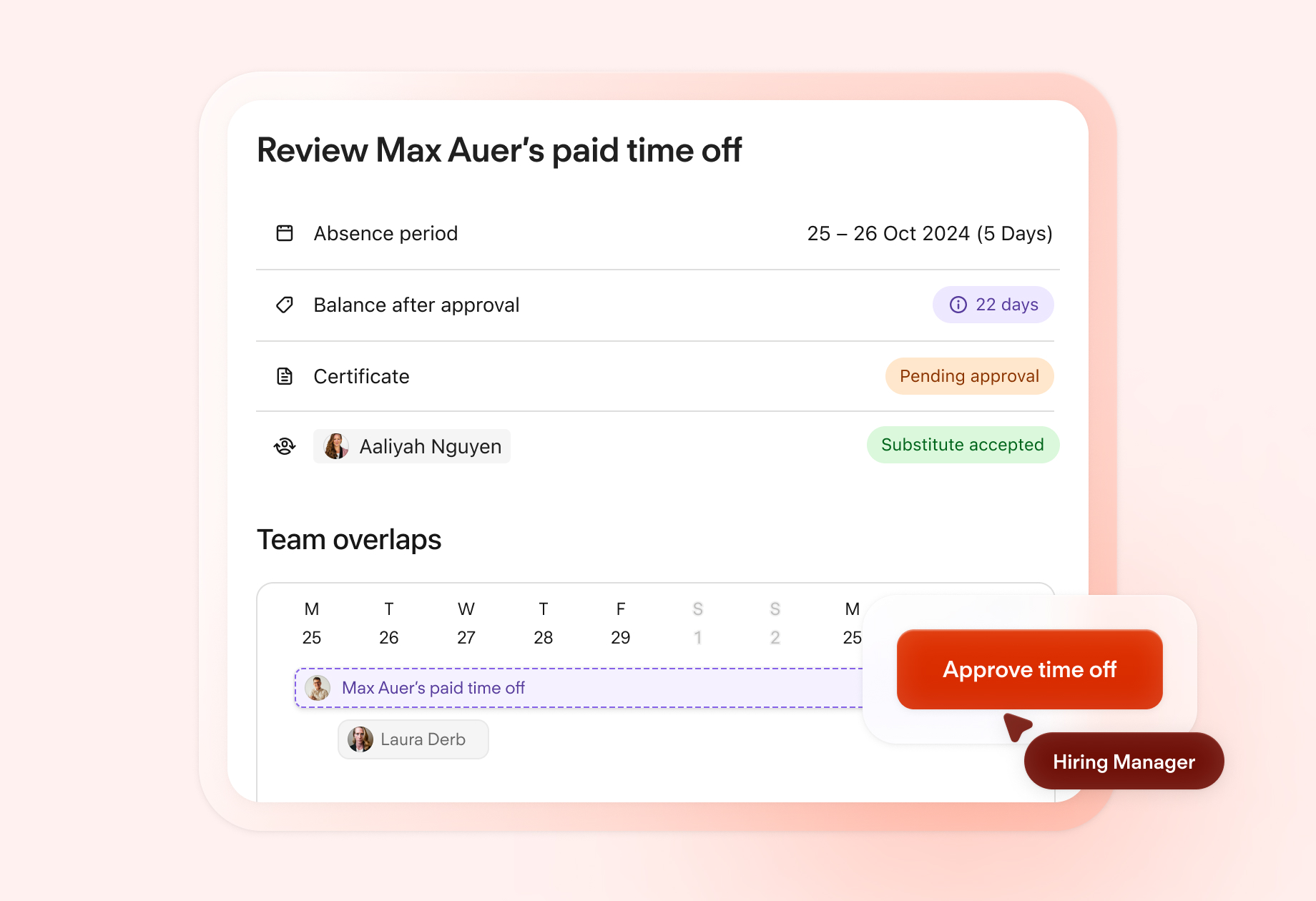

Introduce More Modern HR Processes

Seamless absence tracking, automated performance cycles and more. See how Personio can help your HR team today.

Book A Demo NowThe 4 Most Common Deductions from Wages in the UK

The following four are the most common wage deductions in the UK…

1. Pensions

The first and most common deduction from wages is for a pension fund. In this scenario, you have employees who have enrolled in your workplace pension fund that you set up. The payments are usually automated to deduct wages from the employee.

The employee either makes a net pay arrangement (before tax is calculated) or relief at source arrangement (after the tax is calculated).

2. Court Orders

There are cases of court orders that make deductions directly from the employee’s wages. The deduction comes after the wage has been taxed and after the NIC payment. Courts orders usually happen when the individual has outstanding payments toward a certain case.

This type of deduction can either be a specific amount or a percentage of the employee’s wage.

3. Student Loans

Students at universities in the UK can get government-funded loans for their studies. They process the loans through The Student Loans Company (SLC) and after the payments are due, HMRC collects them.

Students usually start repaying their loans as soon as their income threshold crosses a certain point and once they leave their courses. There are four different repayment plans (plans 1, 2, 4 and postgraduate loans).

The income thresholds are the following:

Plan 1— £20,195 a year

Plan 2— £27,295 a year

Plan 4— £25,375 a year

Postgraduate loans— £21,000 a year

Once the threshold has been met, the deduction will be around 9% of the employee’s income for plans 1, 2, and 4 and 6% for the postgraduate loans.

4. Child Maintenance

Last but not least, the most common deduction from wages in the UK is for Child Maintenance Services. The Child Support Agency (CSA) usually asks for deductions from the employee’s account. On top of that, they can ask the employee to provide information about the employer and the employee must give that information.

How Much Can You Deduct?

There’s no fixed amount when it comes to deducting employee wages. However, you can’t deduct their monthly to a level that’s lower than the National Minimum Wage or the National Living Wage.

If you work in the retail industry or in a restaurant, then there’s a deduction limit.

In short, employers can’t deduct more than 10% of the employee’s gross wage to cover any shortfalls in the till. However, if the employee leaves the company, then the employer is allowed to deduct the full amount from your last paycheque.

When are Wage Deductions Not Allowed?

In general, employers are not allowed to make a wage deduction. But there are some exceptions to this rule such as:

When it’s required by the law, such as in cases of income tax, student loan payment plans and National Insurance

If you have a contract with your employees where it’s stated that you can make wage deductions

If the employee agrees to have their wage deducted in written form

In case there’s a statutory payment due

When the employee hasn’t worked because they participated in a strike

If the employee has a court order that states that their wage needs to be deducted by either a per cent or a flat rate.

When the employer made an overpayment of wages for the employee in the previous period

Even in the above-mentioned cases, your employer should let you know when they’re going to make a pay deduction so that you can prepare for it.

Deductions From Wages Starts With Accurate Data

Whenever it comes to deductions from wages in the UK, it is imperative that you’re working with only the most accurate employee data. That’s why you need a single source of truth that is up to the challenge. May we introduce you to Personio?

As an all-in-one HRIS, Personio can house all your employee data, particulars, contracts and much more. HR can keep track of all changes, ensuring only the cleanest and most reliable data – speak with an expert and book a demo of your own today.