The Guide to Payslip Templates

Looking for a template for payslips and context for the various sections that appear? Here is our quick guide on how to ‘read’ payslips in your business.

Key Facts

Payslips and certain information reported on them are required by law.

A template helps make the payroll process faster and more efficient.

A well-formatted payslip ensures that employees clearly understand where their money is going.

Payslip Template You Can Use

A payslip (or a wage slip) is an important document for employees showing how much gross income they made during the last pay period, what was deducted, and other similar adjustments. Payslips are legally required to contain certain information, so below, we’ve provided templates to help ensure you comply with the law.

Company Name: | Employee Name: | ||

Pay Period: | Department: | ||

Payment Method: | Employee Payroll Number: | ||

Payment Period: | Employee Tax Code: | ||

Bank Sort Code: | Bank Account Number: |

PAYMENTS | DEDUCTIONS | YEAR TO DATE | |||

|---|---|---|---|---|---|

Description of payments | Amount of hours worked multiplied by rate = wage amount | Insert Deductions (Tax, National Insurance etc.) | Insert Amount | Total Pay to Date: | £ Amount |

Taxable Pay to Date | £ Amount | ||||

Tax Paid to Date | |||||

THIS MONTH | |||||

Gross Pay: | £ Amount | ||||

Income Tax: | £ Amount | ||||

National Insurance: | £ Amount | ||||

Total Gross Payments: | £ Amount | Total Deductions: | £ Amount | Net Pay: | £ Amount |

Employer NI | |||||

Number: |

6 Things Payslips Must Have

Whether you use the payslip template provided in this article or one you’ve created in-house, it must contain the following information:

Gross pay. That’s the employee’s full pay before taxes and National Insurance are deducted.

Net pay. This is the amount of money an employee takes home after all deductions have been made.

Variable deductions. This is the total amount of any deductions that can vary from payday to payday, including tax and National Insurance. This section also explains what each deduction is used for.

Fixed deductions. This is the total amount of deductions that don’t change from payday to payday, like union dues. You don’t have to explain what these deductions are for if you provide a separate statement at the end of the year.

Part payments. This is how wages are dispersed to an employee if they request more than one payment method. For example, some money may go into a checking account and some may go into a savings account.

Hours worked. Since April 2019, employee payslips must include how many hours they’ve worked if they are hourly workers.

How To Use Payslip Templates: Tips for HR Professionals

Templates like the ones provided within the article are formatted to help HR professionals determine what information goes where. Not only does filling out a template help you save time while doing payroll, but it also provides clear and concise payment information to your employees. That way, they can catch any issues that occur and bring them up as soon as possible. They also ensure you meet any legal requirements.

Frequently Asked Questions About Payslip Templates

How To Create a Payslip Template

You can have a payroll program generate one that works for your company. Otherwise, you can manually create one using Microsoft Word or Excel, or use the ones supplied by us in this blog.

What Makes a Payslip Valid?

A valid payslip includes an employee’s:

Gross pay

Net pay

Total amount of variable deductions

Total amount of fixed deductions

Breakdown of how wages are distributed, if more than one distribution method is used

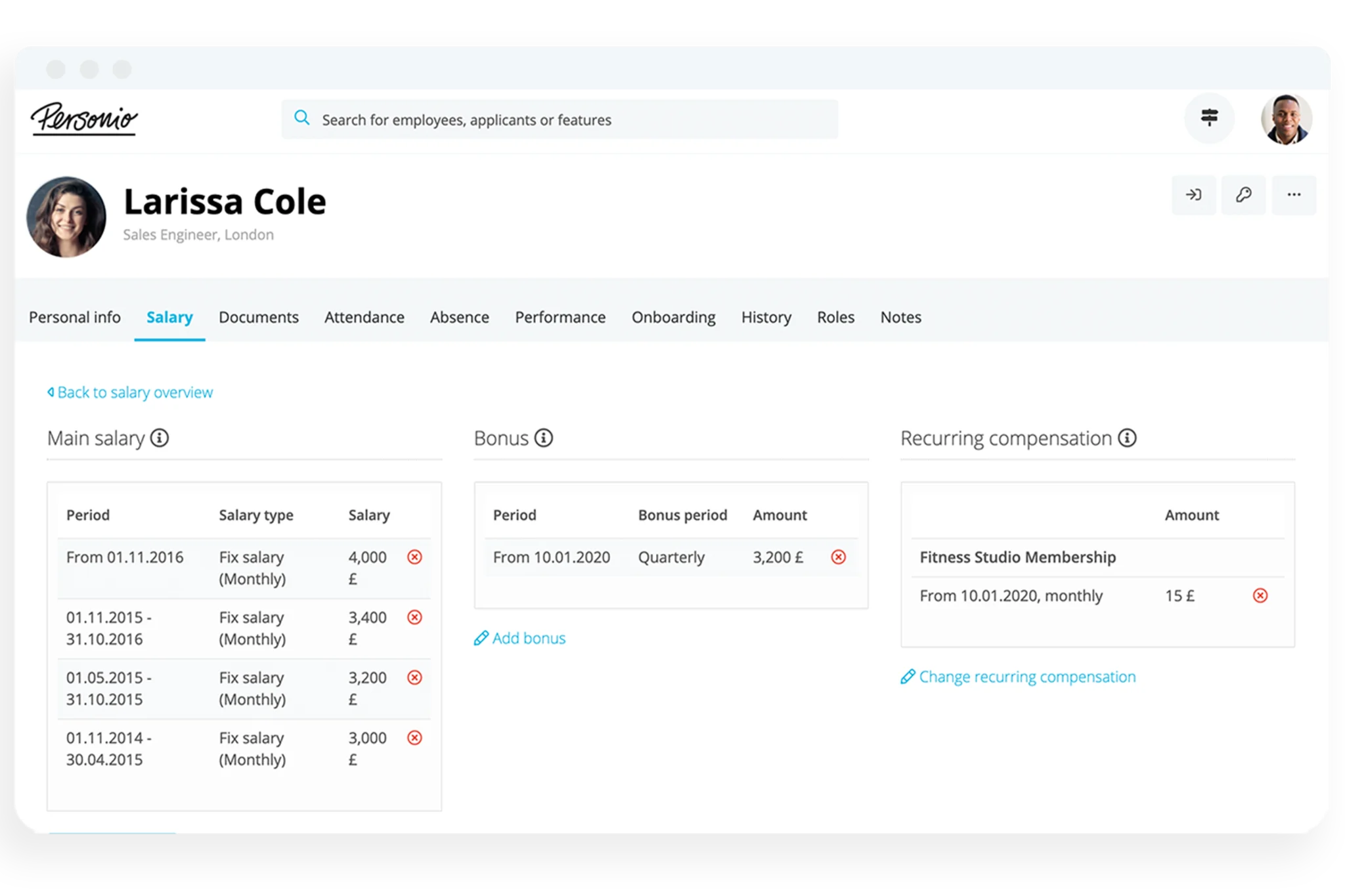

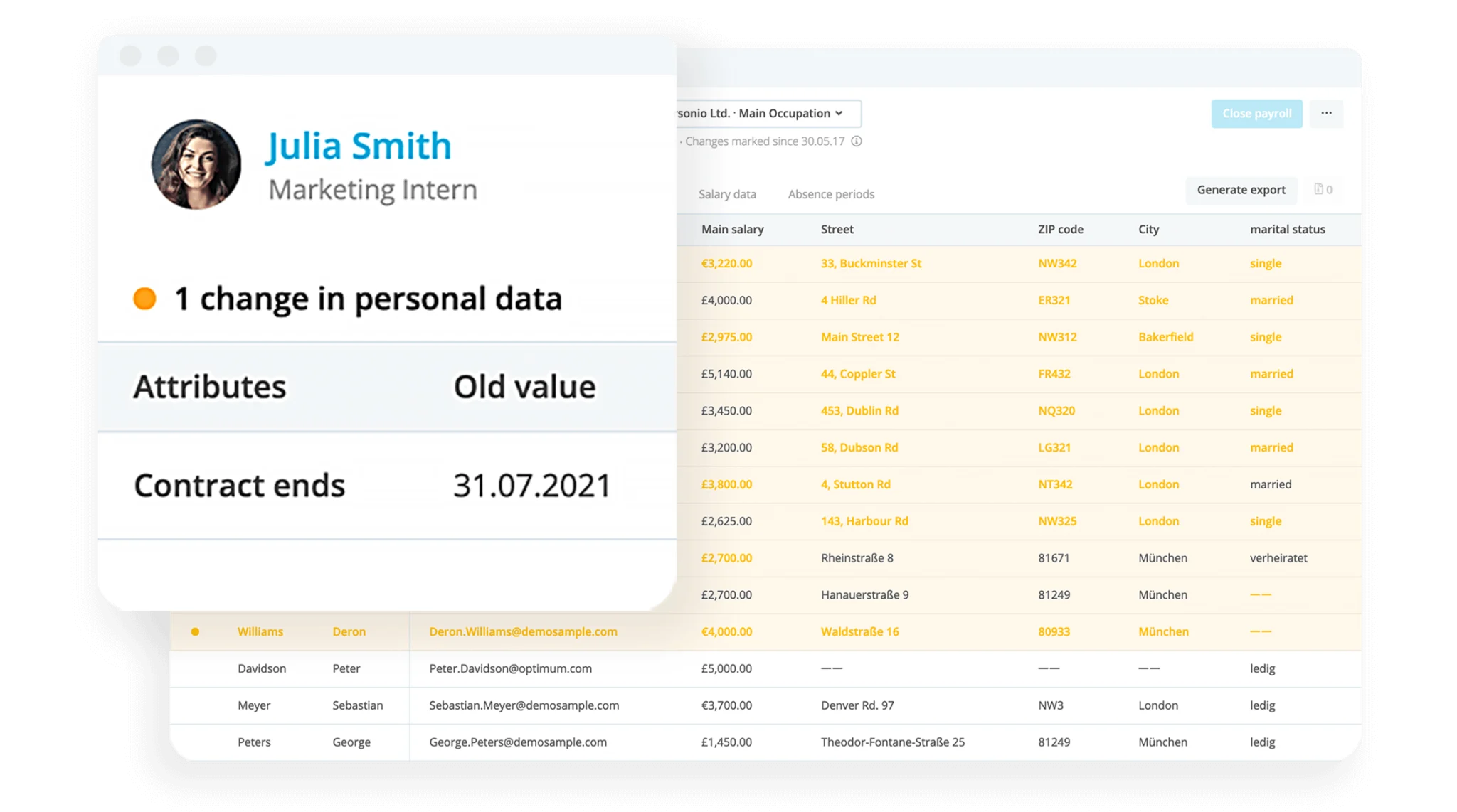

Handle Payroll With Personio

Personio’s preliminary payroll feature helps make payroll as easy as possible. As part of an all-in-one HR software solution, you can keep track of employee information that would change their payslip and automatically account for any changes to their wage. Book your free demo to learn how Personio can help take the mayday out of payday.

Disclaimer

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness.