Wage Slip Definition and Content Terms Explained

Wage slips an important part of any employee's life. Employers need to understand the requirements so they can provide adequate and accurate information. In this guide, we’ll walk you through all the wage slip basics: contents, requirements for employers, what to do if you find a mistake, and more.

Contents

- 1Wage Slip or Payslip?

- 2When Do Employers Need to Provide a Wage Slip?

- 3What Does a Wage Slip Include?

- 4How Long Do Employees Have to Keep Their Wage Slips?

- 5Wage Slip Contents Explained

- 6Other Wage Slip Common Terms

- 7Checked Your Wage Slip and Found It Wrong?

- 8Frequently Asked Questions (FAQ) About Wage Slips

- 9Preliminary Payroll – Simplified

Wage Slip or Payslip?

A wage slip and payslip are the same thing: a document issued by an employer that lists details about your wages before taxes, along with information on any other deductions that apply to your situation.

Other names include pay stub, salary slip, itemised pay statements, and paycheque stub.

When Do Employers Need to Provide a Wage Slip?

Because of the Employment Rights Act of 1996, employers must provide wage slips to all employees and workers.

The term “workers” can include those working in an agency or on a zero-hours contract.

There are some types of work where people do not receive wage slips, including:

Police

Armed forces

Self-employed (because they organise payment of tax and deductions themselves)

Merchant seamen and women

Etc.

What Does a Wage Slip Include?

A wage slip may include the following:

Earnings before and after any deductions (gross pay and net pay)

The amount of any variable deductions; e.g. taxes, National Insurance, pension schemes, student loan payments

The amount of any fixed deductions; e.g. union subscriptions

How many hours you worked (if your wages are hourly)

How the wages will be paid if/when there is more than one payment method (e.g. bank payment and cash)

How Long Do Employees Have to Keep Their Wage Slips?

HMRC guidance says employees should keep wage slips for as long as 22 months following the end of the tax year. For example, an employee’s wage slips issued in tax year 2021/22 should be kept until February 2024.

Additionally, the P60 – the year-end document summarising annual wages paid by the employer – should be saved for at least two years, but potentially up to six. There may be situations where the employee will need to use P60s as proof of the taxes paid.

Wage Slip Contents Explained

For both employers and employees/workers, it’s important to know all the sections that must or should be included on the wage slip. Whether you’re looking at the wage slip you’ve received from an employer or creating wage slips for your workers, these are the contents you might need to know:

1. Payroll Number

Some employers (particularly large organisations) use a payroll number to identify each individual on their payroll. It’s typically a unique sequence of numbers and letters.

2. Personal Information

The wage slip will include the employee’s full name and sometimes their home address.

3. Date

Typically, the date listed is the date on which your wages should be credited to your bank account. (Depending on the bank, there could be a delay, so this may not be the date when the money actually shows up and is ready to use.)

4. National Insurance Number (NI)

In order to work in the UK, you must have a National Insurance Number. It stays the same throughout your life, regardless of name changes and other factors. The NI is a personal identifier for the UK’s entire social security system.

5. Base Pay or Basic Pay

The base or basic pay shown on a wage slip is the total amount of money earned during the pay period.

6. Tax Period

This number is the tax period for that payslip. Since the UK’s tax year runs from 6 April to 5 April, the tax periods start in April. If an employee is paid monthly, for example, 01 = April, 02 = May, 03 = June, and so on until 12 = March.

7. Tax Code

HM Revenue & Customs (HMRC) will send each employee or worker their tax code. It tells the employer how much tax-free pay the worker should receive before tax is deducted from the remaining amount.

It’s important that this tax code is always checked against the employee’s latest tax code notice from HMRC. If the code is wrong on the wage slip, the employee could end up paying too much or too little tax during the year.

8. Deductions

This section will list all the deductions taken from the worker’s pay. Deductions can include:

PAYE Tax – PAYE stands for “Pay As You Earn”. Most people in the UK pay income tax this way. The tax code on the wage slip tells the employer how much to deduct.

National Insurance – This is the employee’s contribution into the National Insurance. As with the income tax, it is deducted through PAYE.

Employee Pension – If the employee is a member of a Defined Benefit (DB) pension scheme (salary-related), then the wage slip will show a deduction from gross wages (i.e. pre-tax). This is typically a percentage of salary.

Student Loans – If the employee is making repayments on a student loan, this will usually be shown on the wage slip.

9. Pay Year to Date

Pay Year to Date (sometimes shortened to Pay TD or Pay YTD) shows how much the employee has been paid so far in the current financial year (since April 6th).

10. Net Pay

Net pay is often what employees and workers look for first on their wage slip: it’s the amount of pay they receive after all deductions, taxes, and workplace benefits have been taken out.

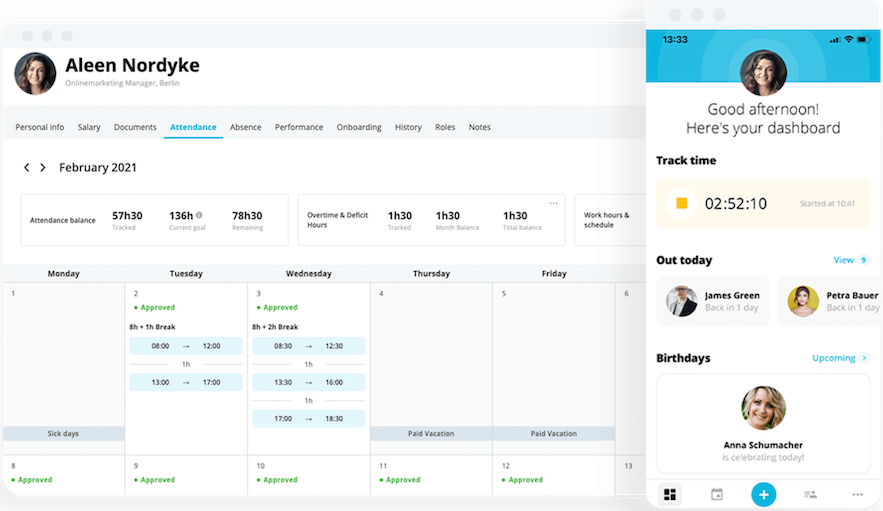

Keep Your Employee Files Accurate, Always

Ensure all employee files are always up-to-date, organised, complete and data-compliant.

Get the checklistOther Wage Slip Common Terms

As you can see from the contents section above, there are many terms to be aware of when it comes to wage slips. Some other common terms include:

BACS

BACS stands for Bankers Automated Clearing Services. It’s an electronic system that allows one bank account to make direct payments to another – in this case, for the employer to pay the employee or worker.

SSP

SSP, or Statutory Sick Pay, is paid out and shown on a wage slip in situations where an employee was unable to work due to illness for at least four consecutive days.

SMP and SPP

These are different types of parental pay: Statutory Maternity Pay (SMP) for new mothers and Statutory Paternity Pay (SPP) for new fathers.

Other types of parental pay include Shared Parental Pay (ShPP) – for parents who share time off – and Statutory Adoption Pay (SAP) – for parents who recently adopted a child.

BA

The Bereavement Allowance (BA) is a weekly benefit paid out to those who have lost their partners: widows, widowers, and surviving civil partners.

CHB and CTC

The Child Benefit, or CHB, is paid to parents who have children under the age of 16. Child Tax Credits, or CTC, are another benefit for parents with children under 16.

Checked Your Wage Slip and Found It Wrong?

If an employee or worker receives a wage slip and believes they’ve found a mistake, they should first speak to their manager, employer, or payroll department to see if it can be sorted out informally.

If the problem is still not fixed, the employee or worker can file a formal complaint, or “raise a grievance”.

Frequently Asked Questions (FAQ) About Wage Slips

What Is a Wage Slip or Payslip?

A wage slip (also called a payslip) is a document issued by an employer to workers and employees listing details about your pay before tax, along with any deductions that apply in your situation.

Is the Employer Required to Provide a Wage Slip?

The Employment Rights Act of 1996 requires employers to provide wage slips to all employees and workers. There are some groups who do not receive wage slips, including police, armed forces, the self-employed, merchant seamen and women, and some others.

What Is Included in a Wage Slip?

A wage slip includes a variety of important information about an employee or worker’s pay, including:

Earnings before and after any deductions (gross pay and net pay)

The amount of any variable deductions; e.g. taxes, National Insurance, pension schemes, student loan payments

The amount of any fixed deductions; e.g. union subscriptions

How many hours you worked (if your wages are hourly)

How the wages will be paid if/when there is more than one payment method (e.g. bank payment and cash)

Preliminary Payroll – Simplified

Personio makes it simple to perfectly prepare all salary documents for your employees and workers.

No more working with chaotic lists leading up to every payroll date. All salary-relevant data is automatically transferred to the preliminary payroll, so you just have to check and approve.

Ready to try it out? Book your demo.