Travel Expenses in 2024: A Guide to Claims and Definitions

We all acknowledge that handling travel expenses can be a headache. However, the process isn't as complex as it initially appears. This guide demystifies travel expenses for UK employers.

Download our personnel file checklist to keep all your information in order.What are travel expenses?

Travel expenses cover the costs an employee is likely to incur during business travel. These can include travel fares (be it car, train, or plane), accommodation, additional meal costs and other miscellaneous expenses.

Who is responsible for covering travel expenses?

As the employer, organisations are responsible for reimbursing your employees for business travel expenses. These expenses are tax-deductible for the company.

In instances where the business activity is closer to an employee’s home than their regular office, the employee might be eligible to claim these costs as income-related expenses against their own taxes.

Remember, however, that in the UK, specific rules and criteria apply. It's crucial to retain all relevant receipts and logs.

What are the requirements for travel expense claims?

In the UK, there aren't formal requirements concerning the format of a travel expense claim. However, having a standardised form facilitates the verification process and minimises errors.

For companies where business travel is frequent, automated expense tracking systems can streamline the process. In smaller operations, a well-designed Excel template suffices.

When is a travel expense report necessary?

A travel expense report is essential when an employee travels on company business. However, not all travel is classified as 'business travel.'

For instance, an employee visiting a client within the same city isn’t necessarily on a 'business trip' and may not be eligible for all travel reimbursements.

Common reasons for business travel:

Meetings with clients outside the local area

Engaging with external business partners

Visiting other branches of the company

Attending trade shows, courses, or conferences

Which costs are reimbursable?

To reimburse your employees, you'll need invoices, receipts or other valid proof of expense. These can include:

Transport costs: car, train, plane, including public transport, tolls, and parking fees

Accommodation costs

Meal allowances

Incidental costs: phone and internet

Other business-related expenses

Reimbursement procedures for different travel modes

When employees travel by car, a standard mileage rate can simplify reimbursements. In the UK, the mileage rate tends to fluctuate, so ensure you're up to date. Alternatively, a detailed logbook can be used to calculate actual expenses.

Accommodation and meal expenses

For overnight stays, you generally cover the costs within a pre-agreed budget. Keep in mind, meal expenses are often capped or may require valid proof for reimbursement.

Overseas travel expenses

For international travel, meal and accommodation allowances vary based on the destination. Always consult the HMRC guidelines or specific country allowances when planning international business trips.

Don't forget incidental costs

Additional costs such as parking, business-related calls, or currency exchange losses should also be considered. Always require your employees to provide receipts.

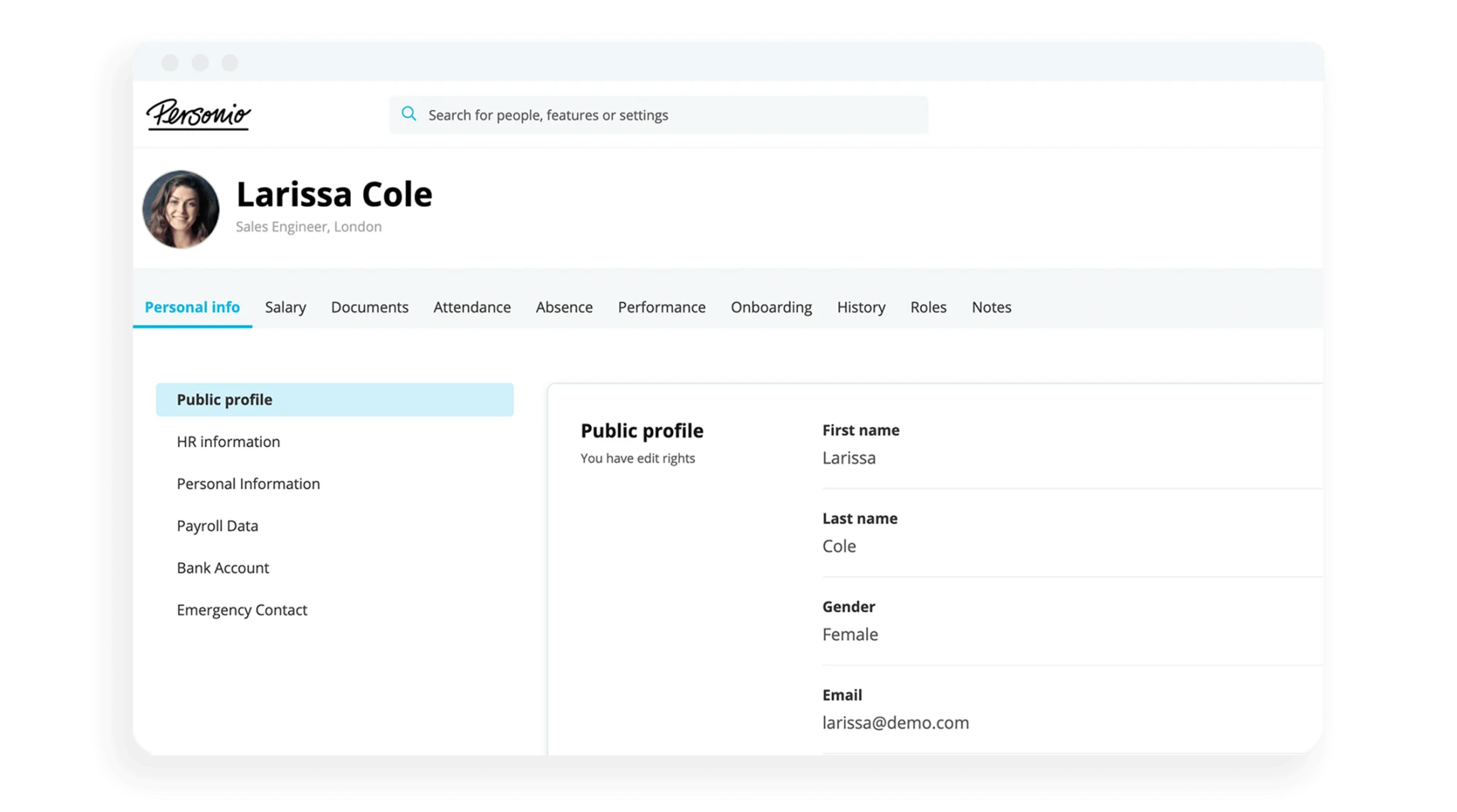

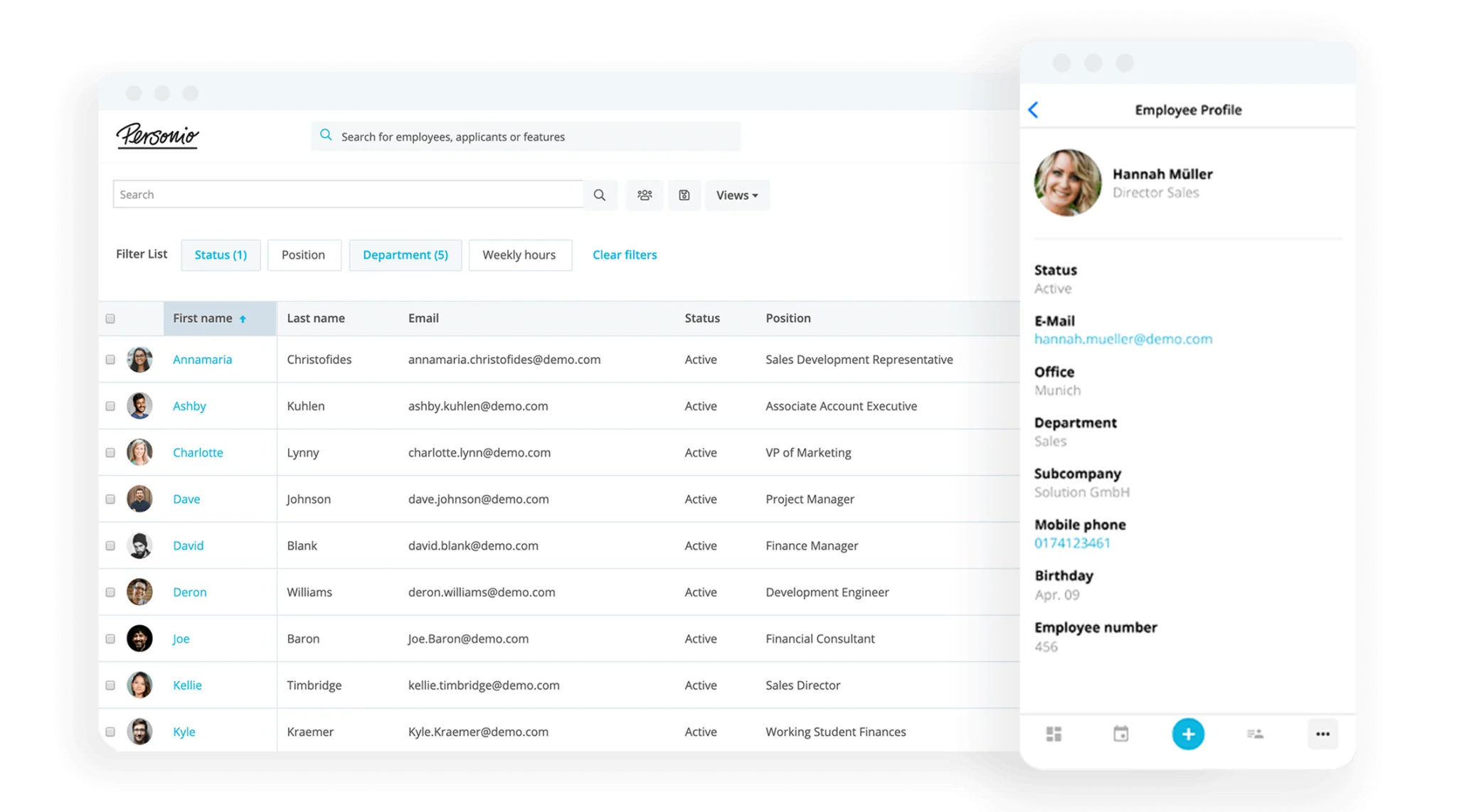

One source for all your employee information

And there you have it. Managing travel expenses need not be a convoluted process. With a consistent system and clear understanding of UK regulations, you can streamline the process for both the company and your employees.

With Personio, you can rely on an all-in-one HR software solution to help centralise all of your important employee data. Ditch the spreadsheets and emails, and go with a system that houses data in a compliant fashion. Speak with one of our experts today.

Disclaimer

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness. Die Inhalte unserer Internetseite – vor allem die Rechtsbeiträge – werden mit größter Sorgfalt recherchiert. Dennoch kann der Anbieter keine Haftung für die Richtigkeit, Vollständigkeit und Aktualität der bereitgestellten Informationen übernehmen. Die Informationen sind insbesondere auch allgemeiner Art und stellen keine Rechtsberatung im Einzelfall dar. Zur Lösung von konkreten Rechtsfällen konsultieren Sie bitte unbedingt einen Rechtsanwalt.