Attachment of Earnings: Definition & Deductions

In this article, we’ll provide an in-depth overview of an Attachment of Earnings. This comprehensive guide goes over what one is, how it affects you and your business and what you should do when you receive one.

Key Facts

An Attachment of Earnings defines how much money needs to be deducted from an employee’s pay due to unpaid Council Taxes.

The court predetermines the amount deducted from your employee’s wages according to how much they make.

While the employer can change when an Attachment of Earnings is deducted, only the employee can request a suspension of payments.

Contents

- 1What Is an Attachment of Earnings?

- 2Who Gets an Attachment of Earnings Order?

- 3What Is Included in the Attachment of Earnings Order?

- 4How Much Are the Deductions?

- 5Can an Attachment of Earnings Order Be Stopped?

- 6Keep Track of Attachment of Earning Orders with Personio

- 7Frequently Asked Questions About Attachment of Earnings

What Is an Attachment of Earnings?

An Attachment of Earnings is a legal document that directs you to divert a portion of your employee’s wages to pay off their Council Tax bill. If one is received, you must deduct the taxes stated on the form from your employee’s pay, unless they receive their wages within the next seven days. Overtime and holiday pay also count for these garnishments.

Additionally, if you receive an Attachment of Earnings for someone you don’t employ, you must inform the court within 10 days. Non-compliance with the order can result in your receiving a fine.

Who Gets an Attachment of Earnings Order?

Both the employee and employer receive the Attachment of Earnings order. You will mainly be responsible for deducting the required money from your employee’s wages, with most of the follow-up for the order being on the employee’s side.

Additionally, an employee can receive multiple orders at once. Each will be labelled as priority or non-priority; this determines how you’ll handle the order. Priority orders are deducted from wages first, and then non-priority orders are deducted. If there are several non-priority orders, then you can apply to the court to have them consolidated.

What Is Included in the Attachment of Earnings Order?

An Attachment of Earnings comes paired with several important pieces of information and forms that help employers and employees deal with them. The court order will tell you the following:

How much money your employee owes

The priority of the order

The Normal Deduction Rate (NDR), which tells you how much to deduct from the employee’s wage

The Protected Earnings Rate (PER), which is the lowest amount an employee should still be able to take home after deductions. PER is also called upon in cases of unpaid leave.

Whether deductions need to be made weekly or monthly

Additionally, the employee will receive an N56, or a “statement of means” form. It’s meant to explain their financial and employment situation to the courts and is typically submitted with a copy of their most recent payslip.

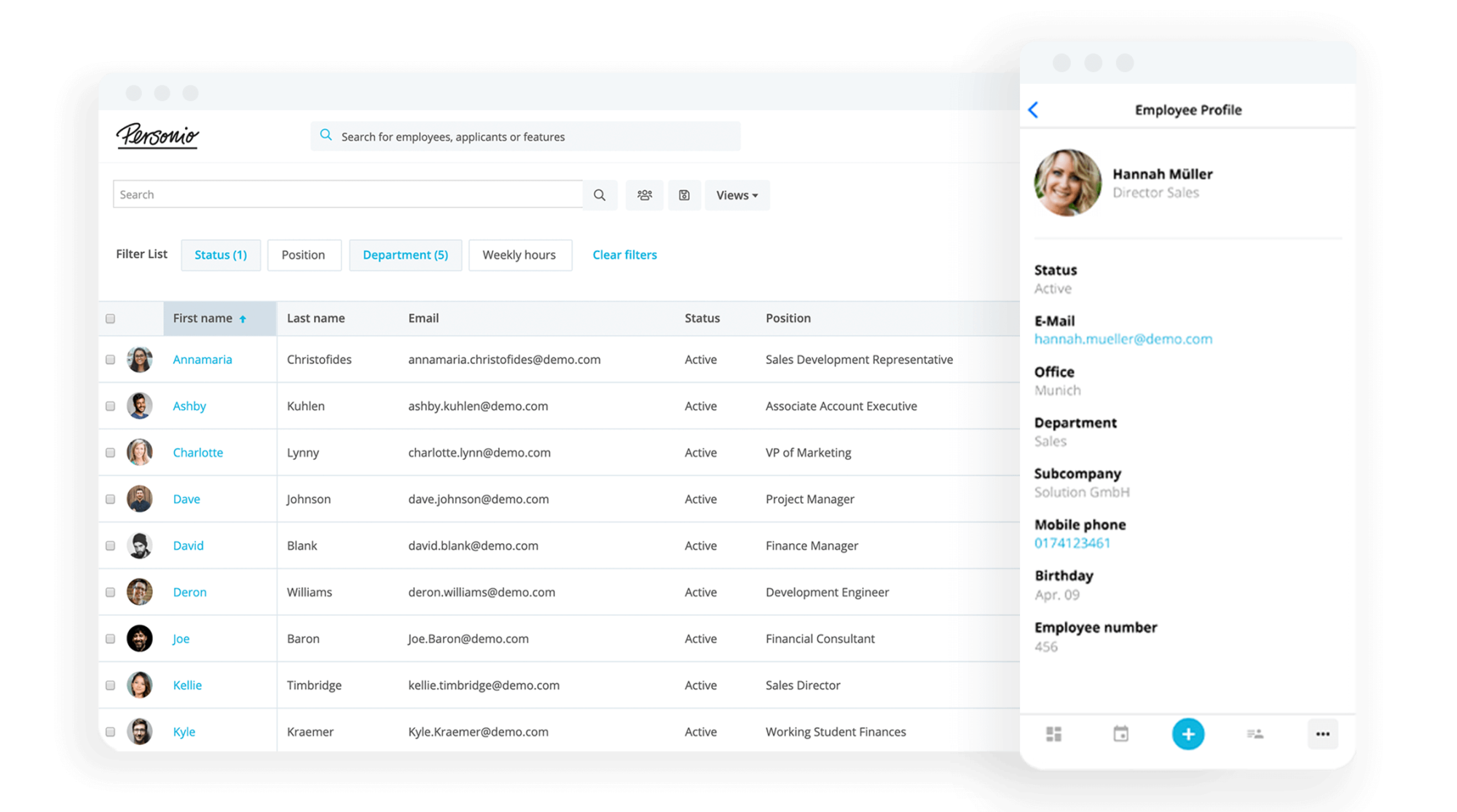

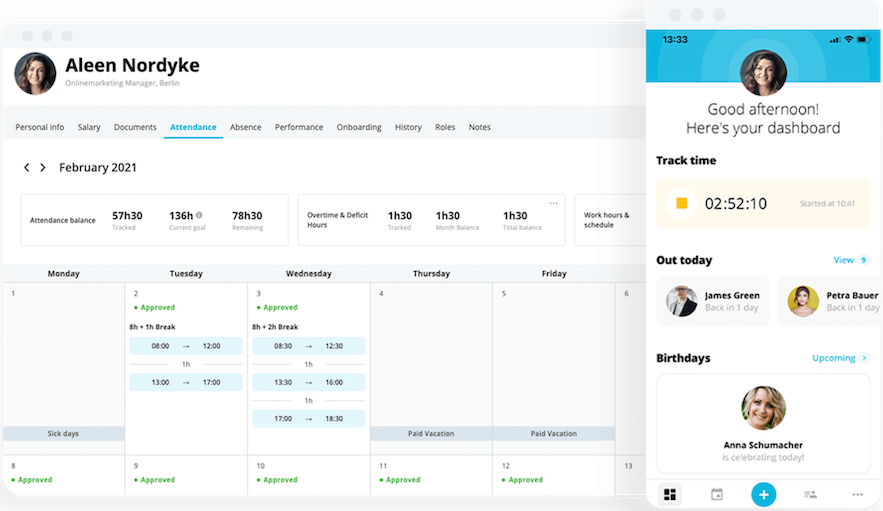

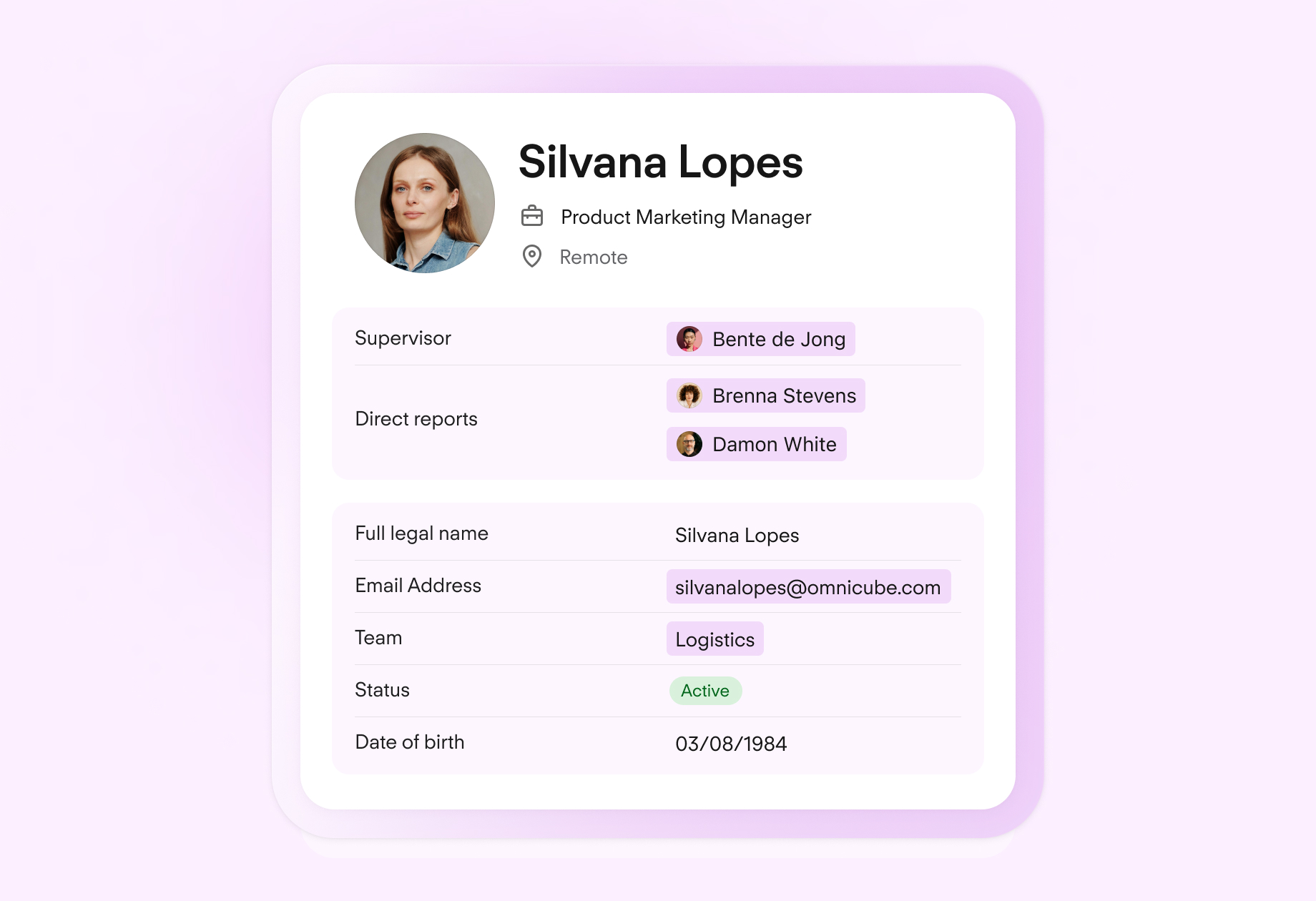

Centralise your employee data

Stop relying on lists and spreadsheets. Organise and edit personnel files and documents with ease, all in one secure, legally compliant place.

Protect your people filesHow Much Are the Deductions?

The amount deducted from the employee’s pay is determined based on their net weekly earnings. Typically, the courts want employers to start these deductions the next time the employee is paid, unless that date is within the next seven days.

Below is a table to help you know what weekly pay to expect:

Net Weekly Earnings | Weekly Deductions | Deduction Rate |

|---|---|---|

Below £75 | None | 0% |

Exceeding £75 but no more than £135 | £2.25 to £4.05 | 3% |

Exceeding £135 but no more than £185 | £6.75 to £9.25 | 5% |

Exceeding £185 but no more than £225 | £12.95 to £15.75 | 7% |

Exceeding £225 but no more than £355 | £27.00 to £42.60 | 12% |

Exceeding £355 but no more than £505 | £60.35 to £85.85 | 17% |

Above £505 | Minimum of £85.85 | 17% in respect of the first £505 and 50% of the remainder |

And monthly pay:

Net monthly earnings | Monthly deductions | Deduction rate |

|---|---|---|

Below £300 | None | 0% |

Exceeding £300 but no more than £550 | £9.00 to £16.50 | 3% |

Exceeding £550 but no more than £740 | £27.50 to £37.00 | 5% |

Exceeding £740 but no more than £900 | £51.80 to £63.00 | 7% |

Exceeding £900 but no more than £1.420 | £108.00 to £170.40 | 12% |

Exceeding £1.420 but no more than £2.020 | £241.40 to £343.40 | 17% |

Above £2.020 | Minimum of £343.40 | 17% in respect of the first £2.020 and 50% of the remainder |

Can an Attachment of Earnings Order Be Stopped?

Your employee can suspend an Attachment of Earnings by ticking a box on their N56 form. If the court accepts their reasoning for needing suspended payments, it’ll be on the condition that they repay the original Council tax. When the Attachment of Earnings is stopped, the court will not inform you unless the employee fails to meet the agreed-upon payment.

Keep Track of Attachment of Earning Orders with Personio

An Attachment of Earnings isn’t something to take lightly. Not abiding by the order can lead to significant and serious financial penalties for your company.

Personio can help you keep track of wage deductions with its digital personnel feature that keeps all employee information in one easy-to-use place. Book your free demo to learn how Personio can help you manage your workplace.

Frequently Asked Questions About Attachment of Earnings

What Is an Attachment of Earnings Order?

An Attachment of Earnings order instructs you to deduct a predetermined amount from your employee’s wages to pay off their council tax.

How Much Can Attachment of Earnings Take?

The amount that an Attachment of Earnings order can deduct is determined by the employee’s net weekly or monthly earnings. Deductions should never go beneath your worker’s protected earnings rate.

Can I Stop an Attachment of Earnings Order?

Employers cannot stop an Attachment of Earnings order, but you can ask the court to change the deductions from weekly to monthly to better fit in with your organisation’s payment schedule. The employee with unpaid council taxes can request a suspension of the Attachment of Earnings order by ticking the appropriate box on an N56 form.

Disclaimer

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness.