Zero-hours contracts in the UK: Legal guide and holiday pay explained

Zero-hours contracts, also known as casual contracts, offer employers a certain level of flexibility, making them popular in industries like hospitality and retail. At the same time, these contracts are surrounded by controversy; they’ve been called exploitative and are often associated with bad working practices.

But in some contexts, they’re an appropriate and effective solution. If you plan to use zero-hours contracts, though, you need to ensure you’re doing so fairly and compliantly.

This guide covers everything you need to know about zero-hours contracts, including what they are, how to create one, the pros and cons of these working arrangements and best practices when employing zero-hours workers.

Contents

- 1What is a zero-hours contract?

- 2Zero-hours contracts and UK Law

- 3What should you include in a zero-hours contract?

- 4Calculating zero-hours contract holiday entitlement and pay

- 5When and why to use zero-hours contracts

- 6Pros and Cons of a Zero-Hours Contract

- 7Zero-hours contracts: Controversy and new developments

- 8Best practices for managing zero-hours workers

- 9Manage flexible work arrangements with Personio

What is a zero-hours contract?

Zero-hours contracts, which account for about 3% of total employment in the UK, are a type of employment contract type that formalises working relationships with employees who perform what is often called ‘piece work’ or ‘on-call work’. This makes them convenient in industries with fluctuating demand.

Employers or casual workers are paid depending on how many hours they have worked. By their nature, these contracts are not designed with full commitment in mind and can be considered casual.

Current zero-hours contract UK law states that employers don’t have to guarantee they’ll make work available to employees. Similarly, there’s no requirement for workers to accept the work when it’s made available. This is true even if workers are made to sign a contract stating that they must accept available work.

In addition to being exempt from the obligation to accept work, you cannot prohibit employees on flexible working contracts in the UK from looking for work elsewhere or accepting work from another employer.

Zero-hours contracts and UK Law

The UK government website states that zero-hours contract rights include statutory annual leave and the national minimum wage.

According to Acas, employers are also still responsible for their employees’ health and safety while they’re working on this type of contract. They’re also required to give them adequate rest breaks and pay their wages through PAYE, including tax and National Insurance (NI) deductions.

While zero-hours employees may agree to be generally available to work when you need them, you don’t have to give them work and they don’t have to work for you when you ask them to.

You also can’t stop them from working elsewhere. If you try to put a clause in their contract that prevents them from looking for work or accepting work from someone else (like an exclusivity clause, for example), UK law states they can ignore it.

Depending on whether they meet certain conditions, zero-hours employees may qualify for statutory sick pay (SSP). And like most other workers, zero-hours employees are legally entitled to statutory annual leave of up to 5.6 weeks per year, as well as holiday pay.

These rights remain theirs as long as they’re still working. Issues creep up if they’re not working (during breaks in their work), as they don’t have the same legal rights as full-time employees.

What should you include in a zero-hours contract?

As the CIPD says: ‘Although there is currently no legal definition for a zero-hours contract, employers need to ensure that written contracts contain provisions setting out the employment status, rights and obligations of their zero-hours staff.’

According to the HR, tax, audit and accounting firm, Croner-i, a zero-hours contract should include a general description of the type of work or services they will undertake – while making it clear that it is, in fact, a zero-hours contract.

You must provide clear information about the flexible nature of the contract, as well as details about how either party can terminate the contract. You should also include information about when or how planned work might be cancelled and explain how holiday and sick pay are calculated.

A zero-hours contract should also include information about:

When employees will be paid

What documentation they need to submit in order to demonstrate the hours they’ve worked

Whether their travel or expenses will be reimbursed

You cannot pay workers less than minimum wage and the contract should state the rate of pay.

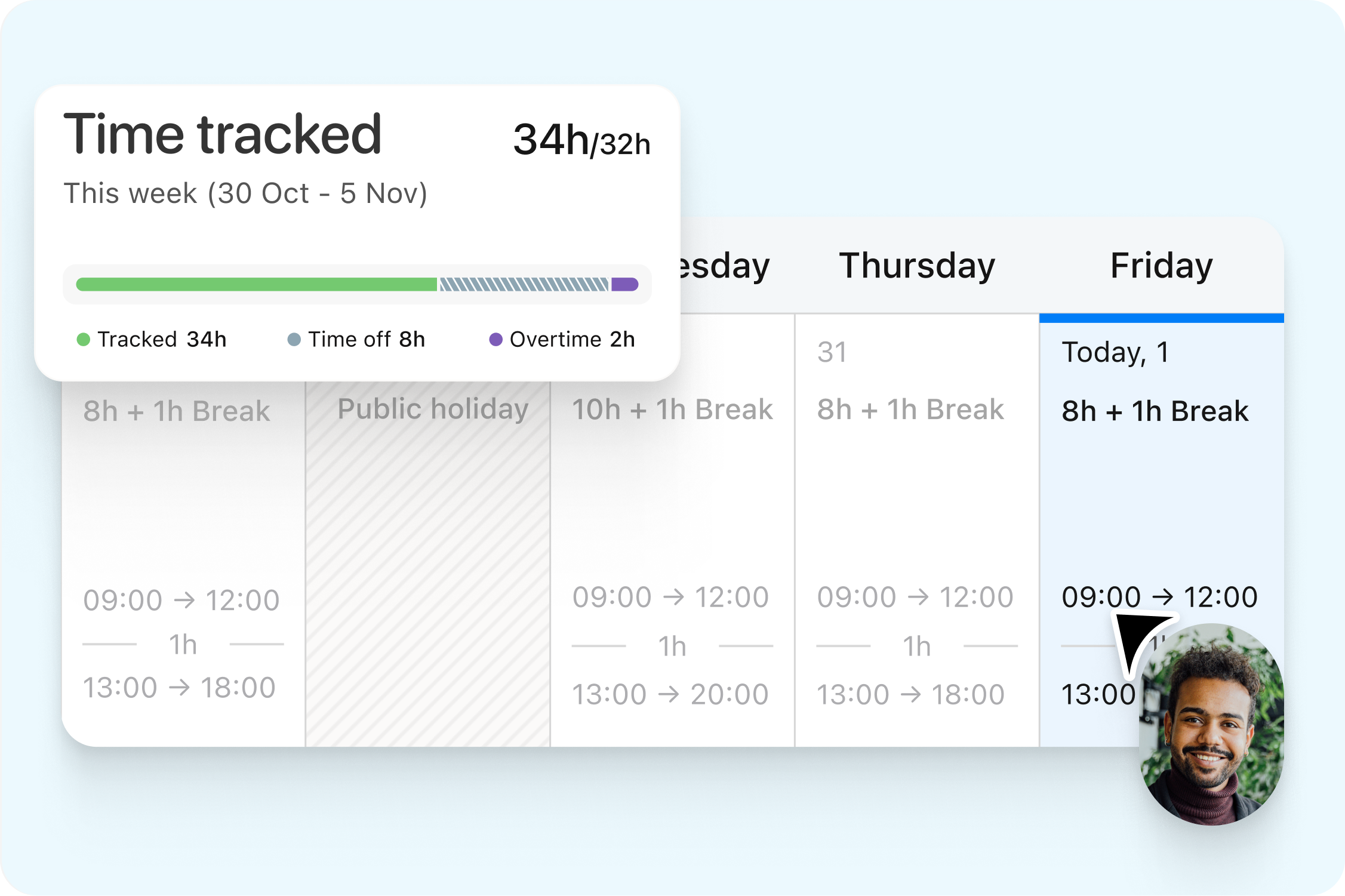

Is your organisation able to track attendance easily?

Let your employees enter their working hours, and supervisors can confirm them with a click of a button. All using Personio.

Learn moreCalculating zero-hours contract holiday entitlement and pay

Full-time employees start to accumulate their holiday entitlement as soon as they start work in your organisation. Those who have a fixed-term contract will accumulate holiday entitlement in advance, on a monthly basis. But it’s a bit different when it comes to calculations for zero-hours contract workers.

And because zero-hours contract holiday pay is tied up with the number of hours worked, you have to calculate holiday pay for each of your zero-hours contract employees separately (since they’ll likely have different numbers of hours worked).

Let’s take a closer look at how to calculate holiday entitlement and pay for these workers.

How to calculate holiday entitlement for zero-hours workers

Even though zero-hours contract employees accumulate their holiday entitlement the same way as fixed employees do (as soon as they start working), the calculations for their work are different because of the nature of their contract.

In short, you don’t calculate statutory leave for zero-hours contract employees based on the number of weeks worked because it’s not a fixed amount. Instead, you calculate their holiday entitlement by calculating the number of hours worked.

Let’s crunch some numbers:

There are 52 weeks in a single year. Once you deduct the 5.6 weeks of holiday entitlement from that number, you get that the employees should work 46.4 weeks in a single year.

These 5.6 weeks amount to 12.07% of all the hours an employee may work in a single year. So to generate holiday entitlement for zero-hours contract workers, you need to take their number of hours worked and multiply it by 12.07%.

If you had a zero-hours contract employee work for 77 hours in a single month, then their holiday entitlement would be:

Hours worked in month x 12.07%

77 hours x 12.07% = 9.29 hours

So the zero-hours contract worker has the right to 9.29 hours of holiday entitlement. You can use the government holiday calculator to determine your zero-hours contract workers’ holiday entitlement.

Now let’s look at how you can calculate holiday pay for your zero-hours contract employees.

How to calculate holiday pay for zero-hours contracts

Zero-hours contract employees receive holiday pay based on their average pay in the previous 12 weeks. There’s a caveat though; you need to calculate only the weeks in which contracted employees were actually paid.

So while you calculate full-time employees’ holiday pay based on the number of weeks they’ve worked (since they work a fixed weekly schedule), you’re required to calculate holiday pay for zero-hours contract workers not based on weeks, but on hours

Take a look at an example:

Meet Mark. Mark is a zero-hours contract worker who, in the past 15 weeks, worked in blocks of 4 weeks. He worked 4 weeks in a row and followed that up by taking a week off work.

So in the past 15 weeks, Mark worked 12 weeks and rested for 3 weeks. Let’s break it down:

Mark worked 4 weeks

Mark took 1 week off

Mark worked another 4 weeks

Mark took 1 week off work

Mark then worked another 4 weeks

Mark took another week off

When calculating Mark’s zero-hours contract holiday pay, you would only calculate the 12 weeks during which Mark worked and got paid.

If a contracted employee has been working less than 12 weeks in your organisation, you should take an average of the pay rate they received when they worked full weeks. For contract workers who are paid monthly, you should:

Calculate their average hourly pay from the previous month

Divide their pay from the last month by the number of hours worked in the previous month

Multiply that number by the number of hours they worked each week

Repeat this calculation over the next 12 weeks

Here’s an example:

Mark received £1,930 last month and worked a total of 56 hours in that month.

Divide £1,930 with 56 hours to get their average hourly pay – £34.46.

Mark worked the first three weeks for 10 hours each week and then worked in the fourth week for 16 hours

Multiply Mark’s average hourly pay of £34.46 with the number of hours he worked each week.

In the first week, Mark made £344.64.

In the second week, Mark made £344.64.

In the third week, Mark made £344.64.

In the fourth week, Mark made £551.36.

You can then use these amounts to calculate the holiday pay Mark is entitled to.

Simplify time tracking for your zero-hours employees

Personio ensures your time tracking data is reliable and up-to-date for increased payroll accuracy.

Learn moreWhen and why to use zero-hours contracts

Almost a third of zero-hours contracts in the UK work in the accommodation and food sector, the highest of any industry. These contracts are often used in professions where workload fluctuates, such as translation and interpretation, where workers face varying demand.

The types of people often put on these types of contracts include:

Hospitality workers

Warehouse employees

Delivery drivers or gig-economy workers (like Uber or Just Eat employees)

Care workers

Some bank workers

Employees doing casual hours (like students who only work during their school or university holidays)

Upsides and challenges of these contracts for employers and staff

According to CIPD research, the majority of employers use zero-hours contracts to manage fluctuations in demand (64%) and provide flexibility for employees (46%). Flexibility is one of the biggest benefits of these contracts for both businesses and workers.

Employers can better adapt to accommodate busy and slow periods, and employees have the chance to pick up extra shifts when it suits them and turn down work when they don’t want or need it. As a result, zero-hours employees, on average, report having a greater work-life balance than non zero-hours contract workers.

However, there are downsides for both parties. Employers can face potential challenges in managing zero-hours staff, as there are much lower levels of commitment required from employees than in a traditional full-time role.

As employees aren’t required to accept work, employers may find themselves obligated to hire and manage a larger workforce to have backup for unfilled shifts.

On the employee side, zero-hours contracts fit under the Trades Union Congress (TUC) definition of insecure work and these workers are more likely to describe their job as not being permanent in some way.

This insecurity disproportionately impacts young people, as individuals aged 16–24 have consistently made up the largest group of the population with these contracts over the past decade.

Pros and Cons of a Zero-Hours Contract

Here is a list of the pros and cons of a zero-hours contract from an employers’ perspective.

Pros | Cons |

|---|---|

Flexible | Low stability for employees may mean they are less loyal to their employers |

Good for use in retail industries or for employing people on an ad-hoc basis | Lower commitment: You can’t stop zero-hours workers from looking for work or accepting work from another employer |

Good for employers who need different staffing levels and different times of year, often on short notice | A zero-hours contract doesn’t mean zero admin: You still need to pay statutory annual leave, minimum wage and take care of their health and safety at work |

You don’t have to spend money on staff wages if you don’t need them | Employees still need to be paid for being on call and for work-related travel, which may increase overall costs |

Good for people who want to work part-time or work on flexible hours | Workers who don’t understand the nature of a zero-hours contract can become dissatisfied with the infrequent work, affecting employee morale |

Good for people (such as older employees) who just want to ‘keep their hand in’ or keep themselves active and engaged with work | Employers’ use of these contracts can be open to accusations of employer bias or favoritism: especially if a supervisor prioritizes certain workers over others |

Zero-hours contracts: Controversy and new developments

The use of zero-hours contracts has been historically criticised. Almost a decade ago, Ed Miliband called zero-hours contracts ‘exploitative’, stirring up concerns that they don’t offer employees enough financial stability and security. Currently, the majority of UK adults feel that “zero-hours contracts are normally a bad thing”.

The COVID-19 crisis exposed some of the issues with these contracts, leaving gig workers and zero-hours employees vulnerable to unemployment and economic insecurity.

At the same time, zero-hours contracts proved to be helpful for getting people back on their feet after the pandemic crisis halted the economy – offering additional income for those who considered themselves underemployed and providing piece work for those doing whatever work they could to get by.

They also provided benefits to employers who needed the flexible labour to keep their business afloat without the long-term commitment that employing permanent staff requires.

The UK government has taken recent measures to ban ‘exploitative’ zero-hours contracts in the recent Employment Rights Bill. This doesn’t propose an outright ban but rather stipulates that employers must make ‘a guaranteed hours offer’ to zero-hours employees.

Best practices for managing zero-hours workers

If you do choose to hire employees under a zero-hours contract, there are a few best practices you can follow to foster trust and transparency with your staff.

Clear and transparent communication | Clearly explain the terms of the contract when hiring employees, and be upfront about expected hours and shift opportunities. |

Fair allocation of work | Rotate shifts fairly among employees, and where possible, offer consistent and predictable hours. |

Respect for employee time and availability | Reassure staff they can turn shifts down without being penalised and respect employees’ other personal and professional commitments. |

Pay and benefit fairness | Ensure employees are paid at least minimum wage and compensate them for additional expenses like travel and training. Inform employees of their access to benefits like holidays and sick leave. |

Training and development opportunities | Offer your zero-hours workers opportunities to grow and learn through training sessions and other skills development initiatives. |

A commitment to employee wellbeing | Monitor employee morale and avoid overscheduling individual team members to prevent burnout and provide employees support such as mental health resources. |

Fair treatment in dismissals | Follow fair procedures in the case of contract terminations, giving the employee a sufficient notice period. |

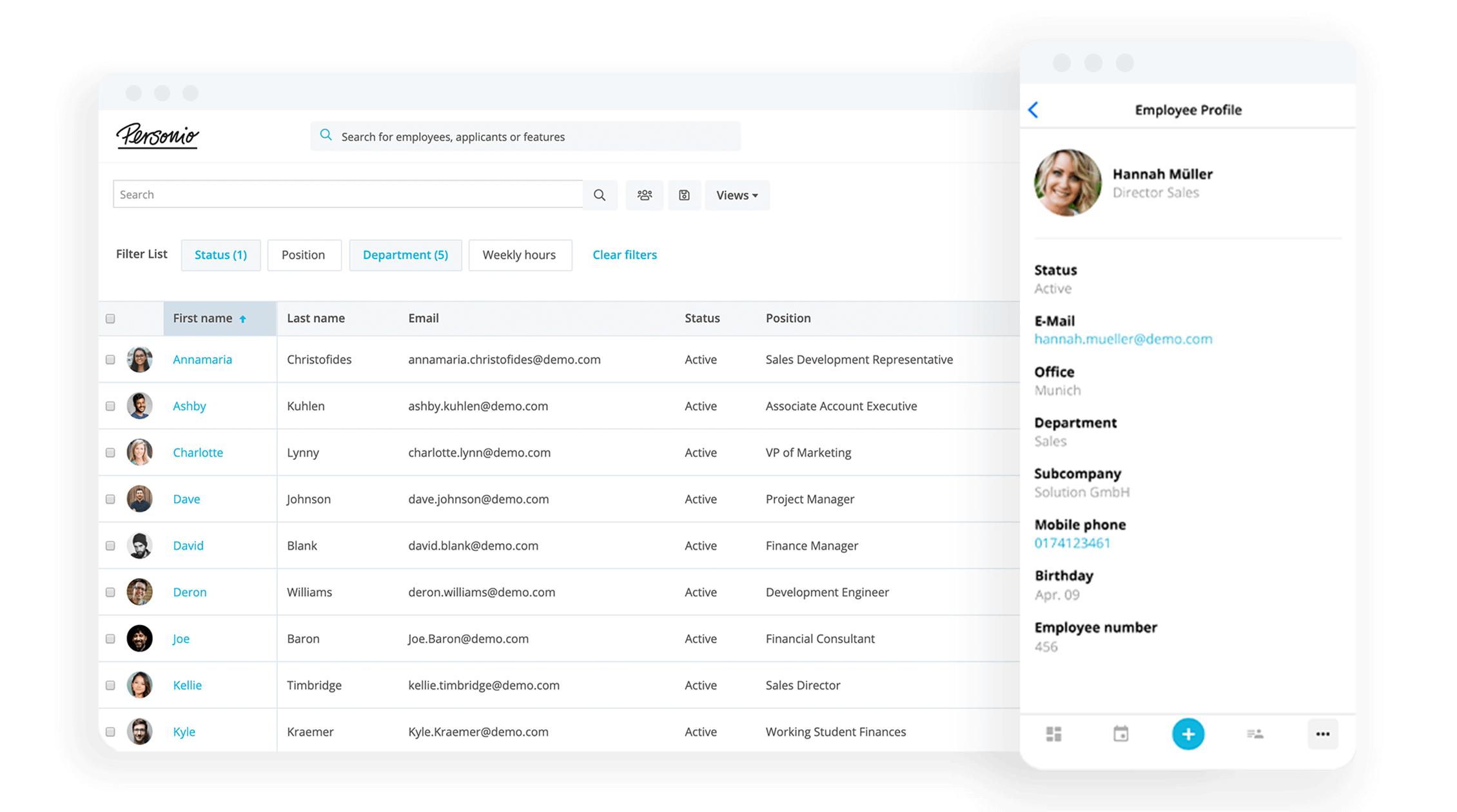

In addition to following these best practices for hiring and managing zero-hours employees, lighten the administrative burden of these types of contracts with specialised software. Instead of having to manually track employee hours and manage absence, a tool like Personio automates key HR processes and reduces your manual tasks.

The software supports employers of zero-hours workers by:

Simplifying time tracking with straightforward employee self-service tools

Automating absence management and making it easier to calculate and track employee leave

Streamlining payroll and integrating employee data with popular accounting software

Manage flexible work arrangements with Personio

The bad press that zero-hours contracts often get stems more from the way employers approach these work arrangements than the nature of the contract itself. Zero-hours contracts can offer flexibility to both employers and employees, but only when you take a thoughtful, responsible approach.

Specialised HR management software like Personio keeps track of these employees’ hours to ensure you’re allocating shifts fairly. Plus, the platform helps you track holiday allowance to guarantee your staff can access all the benefits they’re due and run accurate, on-time payroll.

Manage your zero-hours workers more efficiently

Personio’s powerful tools, from time tracking and leave management to payroll and analytics, simplify and automate time-consuming HR tasks.

Request a Demo