Start simplifying your payroll management

Learn how to streamline your payroll process to save time and ensure accuracy.

Read our guideThe Employer’s Complete Guide To Calculating Holiday Pay

How do you calculate holiday pay? That's certainly the question on the minds of many UK employers. In this article, we offer a thorough break of what it is, common considerations, and why an HR software is the ideal solution moving forward.

Let’s cut to the chase and show you how holidays work better with Personio.Contents

- 1What Is Holiday Pay?

- 2How Do You Calculate Holiday Pay?

- 3Holiday Pay Policy: A Guide For Employers

- 4How Much Notice Do Employees Have To Give To Take Leave?

- 5How Does Overtime Effect Holiday Allowance?

- 6How Should Employers Calculate Holiday Pay For Overtime?

- 7What Is Holiday Entitlement?

- 8HR Software for Holiday Pay In The UK

What Is Holiday Pay?

Holiday pay is the amount of money paid to an employee when they are taking their statutory holiday entitlement. For full-time employees who work a set amount of hours per week, this is essentially getting paid the same amount as you would in a normal working week.

As per the government of the United Kingdom’s website, the average worker is entitled to a week’s pay for each week of statutory holiday taken. For most employees, they will be entitled to 5.6 weeks of paid holiday in a year.

How Do You Calculate Holiday Pay?

In order to calculate holiday pay, per employee, average out the number of hours worked (over the course of a week or month) and divide that by the amount paid. This average will typically help quantify each day’s labor to how much an employee would be compensated for it.

Do Employees Get Holiday Pay While On Furlough?

If a worker is currently on furlough, they are able to take holiday without disrupting their furlough. That said, the same requirements (which we will cover later) apply when it comes to making and approving/rejecting a request to take an absence.

How Do Bank Holiday Payments Work?

If an employee works during a ‘bank holiday,’ of which there are 8 in the UK, there is no statutory right to extra pay. This is true of both ‘time and a half’ or ‘double pay.’ That said, this also hinges on an employee’s employment contract, too.

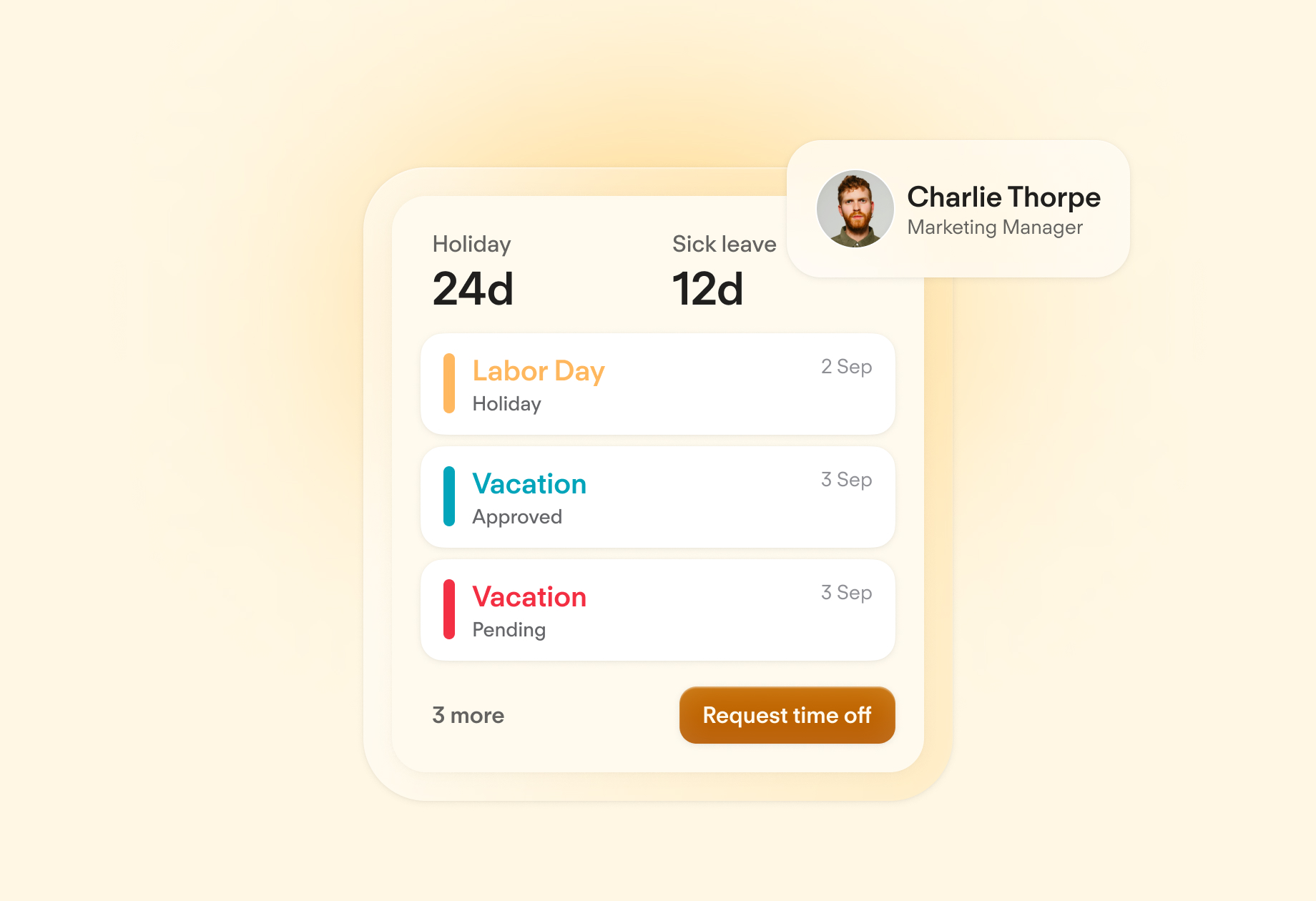

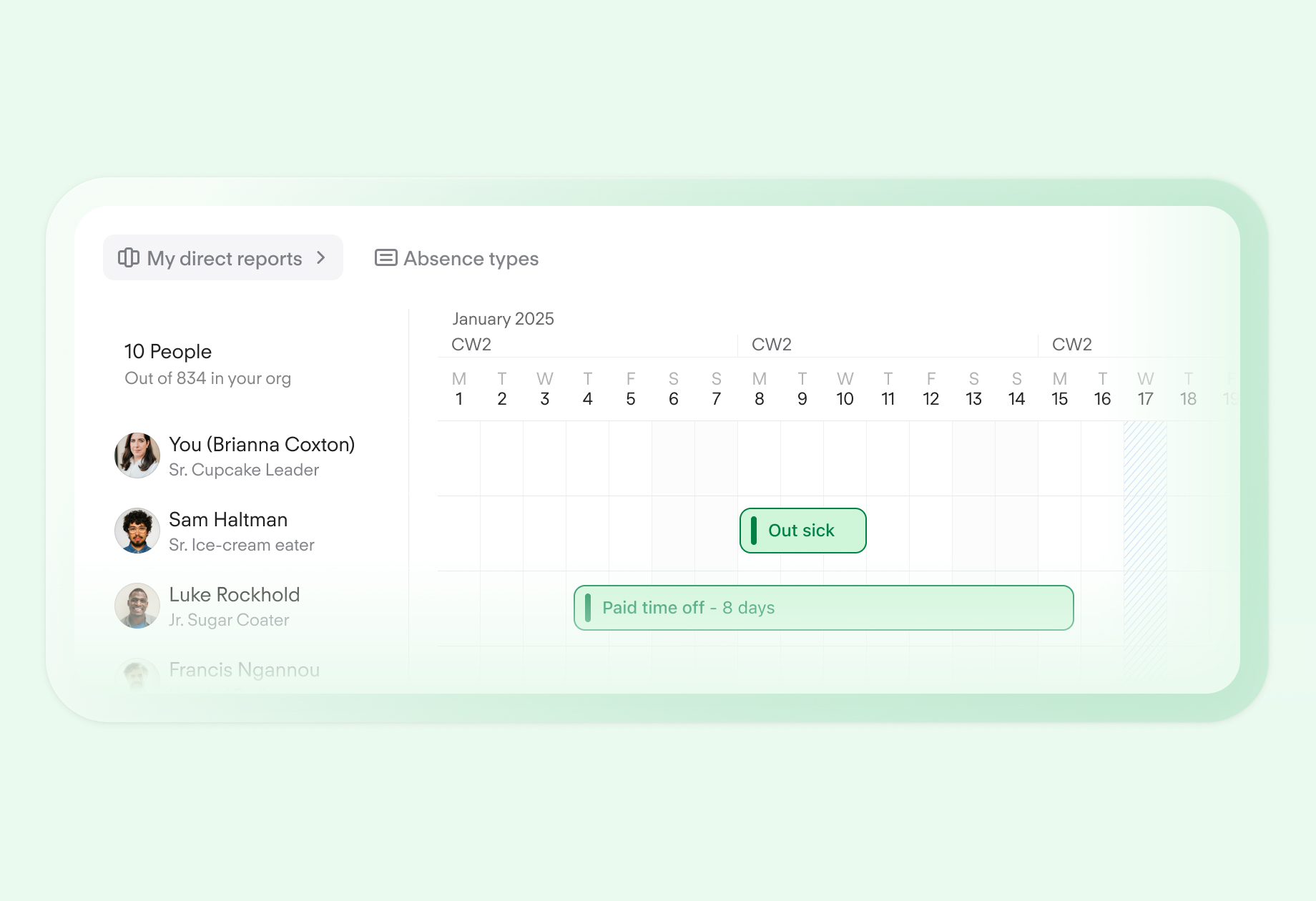

Manage Absences With Ease

Enable employees to quickly and efficiently apply for leave, automatically notifying their managers and marking them absent in their calendar once approved. Give HR a detailed overview of leave across the company.

Transform Your Absent ManagementHoliday Pay Policy: A Guide For Employers

When it comes to both statutory holiday entitlement, as well as holiday pay, there are a lot of considerations that employers should be making.

Here are some of the most critical questions to answer when it comes to holiday pay…

What Is A Holiday Pay Policy?

A holiday pay policy is exactly as it sounds, a policy surrounding the holidays that your organization observes and for which holidays your workforce can expect to receive holiday pay. In terms of having a policy, this is typically done for transparency and clarity measures.

Does Your Company Need A Holiday Pay Policy?

When it comes to making it clear about holiday allowance, and when workers are expected to be at their desks, it helps to have a policy to clearly illustrate things and clear up any questions. While holiday entitlement law cannot be changed, it helps for your employees to know which holidays you observe (like bank holidays, for instance).

Can Employers ‘Force’ Holidays?

Employers do have the opportunity to tell their staff when to take leave. Some may choose to close between Christmas and New Year, and make that a required holiday period. Employers can also restrict when staff are allowed to take leave, for example, during specifically busy times. But they can’t refuse to let workers take the leave at all!

How Much Notice Do Employees Have To Give To Take Leave?

The government website actually states that an employee should give twice as much notice as the leave period. So, for example, if someone wants to take a day off, they should let their employer know about these two days before the leave. However, if your contract says something different, the contract is king (and gov.uk agrees).

How Does Overtime Effect Holiday Allowance?

Should holiday pay include overtime?

This is a very thorny issue: so thorny, in fact, that multiple court cases have been fought over this. A few of these pertinent cases took place in 2013, 2014, 2016, and 2017. You can find a summary of these cases and their findings here but, in essence, they set the groundwork for an Employment Appeal Tribunal (EAT) ruling that holiday pay should reflect non-guaranteed overtime.

In other words, if employees are required to work overtime when their employers ask them to do so (called non-guaranteed overtime) then these overtime payments must be taken into account when their holiday pay is calculated if, there’s a ‘settled pattern of work’ and or the overtime varies but ‘is regularly paid’. As PWC summarizes it in their blog headline "Employment Appeal Tribunal confirms holiday pay calculation is much wider than basic pay.”

Regardless of what your employee’s contract says and how you document the processes and calculations for your business, the rules do seem to be fairly clear about the fact that holiday pay must reflect ‘normal’ remuneration and not be calculated on the basis of basic pay only.

One summary puts it like this: holiday pay should also “reflect both non-guaranteed and guaranteed overtime and commission, along with other payments intrinsically linked to the performance of contractual tasks or status”.

How Should Employers Calculate Holiday Pay For Overtime?

Unfortunately, the law is not yet clear on exactly how overtime and holiday entitlement should be calculated in all instances, but this response from Karen Bexley, Head of Employment Law at MLP Law, may serve as a helpful starting point.

If an employee has a settled pattern of work and pay doesn’t vary because of commission, for example, normal remuneration is easily identified. In cases where there is no settled pattern of work or where there are variable payments – shift workers, commission-based roles, etc. – it appears most likely that the standard 12-week reference period set down by section 221 of the Employment Rights Act 1996 will apply, regardless of the business or employee.

Can Employees Be Paid in Lieu of Taking Holiday?

Regardless of how your company calculates holiday pay overtime, your employees cannot be paid in lieu of taking holiday. Not unless they’re leaving a job.

If they are leaving, gov.uk says, “The only time someone can get paid in place of taking statutory leave (known as ‘payment in lieu’) is when they leave their job.”

Even if the worker was fired, or ‘dismissed for gross misconduct’ they still need to be paid out for untaken statutory leave.

Can Employees Earn Leave Instead of Overtime Pay?

Essentially, whether an employee is entitled to overtime or not is down to what’s written in their contract, as is how they are reimbursed for this overtime. Some employers might offer time off instead of overtime pay – that’s up to them, and it must be put into the contract.

Click here to read our complete guide to time off in lieu (TOIL).

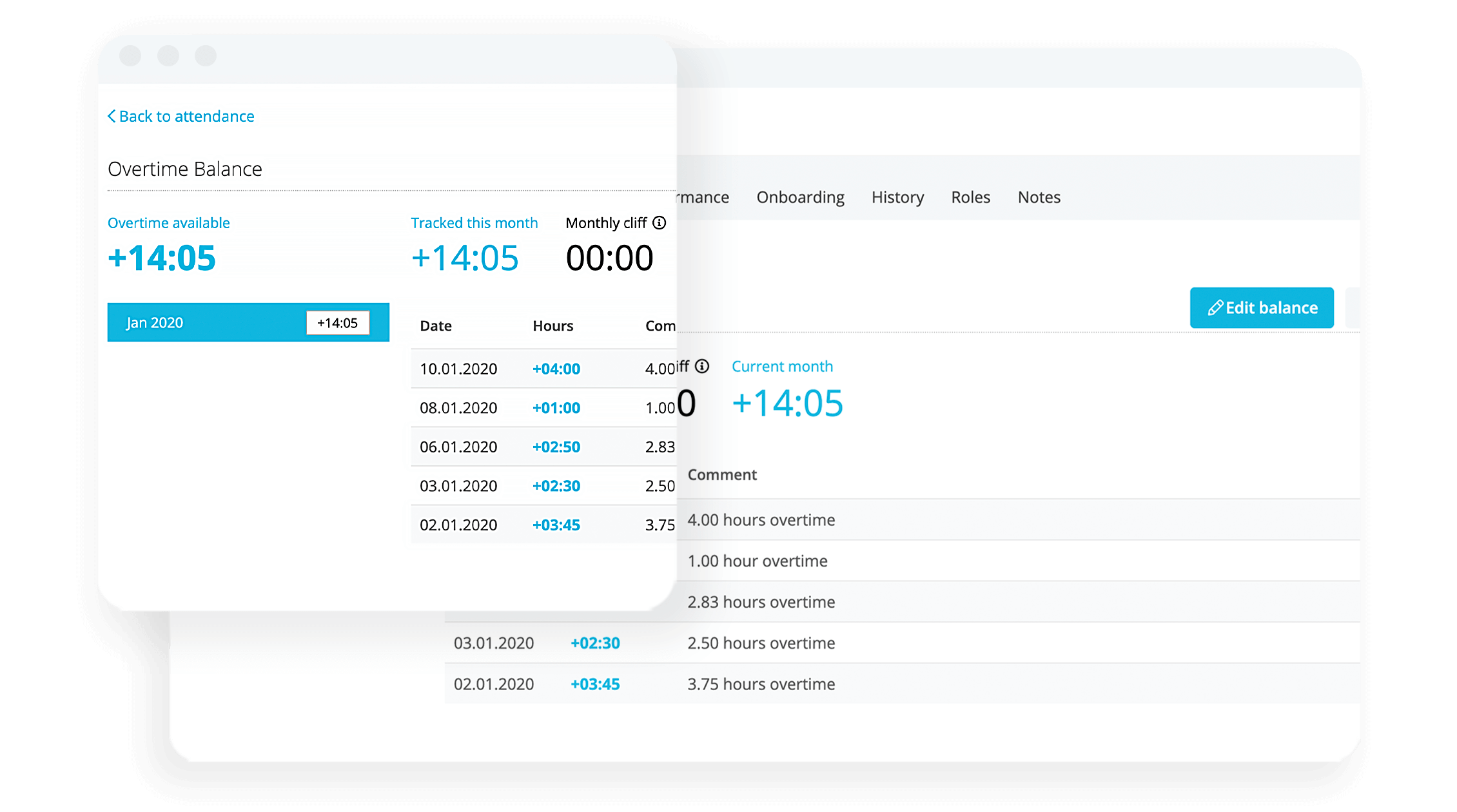

Track your teams' time seamlessly

Enable your employees to enter their working hours in an efficient, legally compliant and secure system. See working hours at a glance across your company.

Get Smarter Time TrackingWhat Is Holiday Entitlement?

Holiday entitlement is the minimum right to paid holiday for workers. Entitlements vary from country to country, but the overarching idea is that a worker who commits a certain amount of hours of work to a company, is then entitled to take leave in turn.

What Is Holiday Entitlement In The UK?

In the UK, most workers are entitled to 5.6 weeks or 28 days of paid holiday a year. In the UK, this often referred to as known as statutory holidayentitlementorannual leave. Keep in mind, though, that the definition of what a worker is will play a role here, too.

How Do You Calculate Holiday Entitlement?

The best way to calculate how many holidays an employee is entitled to, is to take the number of days a week they work by 5.6. For example, if an employee worked 5 days a week, that would result in the standard 28 days for full-time employees.

If an employee only worked three days a week, you would instead be looking at 16.8 days of statutory holiday entitlement.

Does Holiday Entitlement Include Bank Holidays?

Since there are eight bank holidays (also called public holidays) in England and Wales, if you require employees to take leave on these days you can drop the total days of paid leave to 20 days (or four weeks) per year. You don’t have to give employees bank holidays as paid leave, but if you don’t, then they are entitled to the full 28 days.

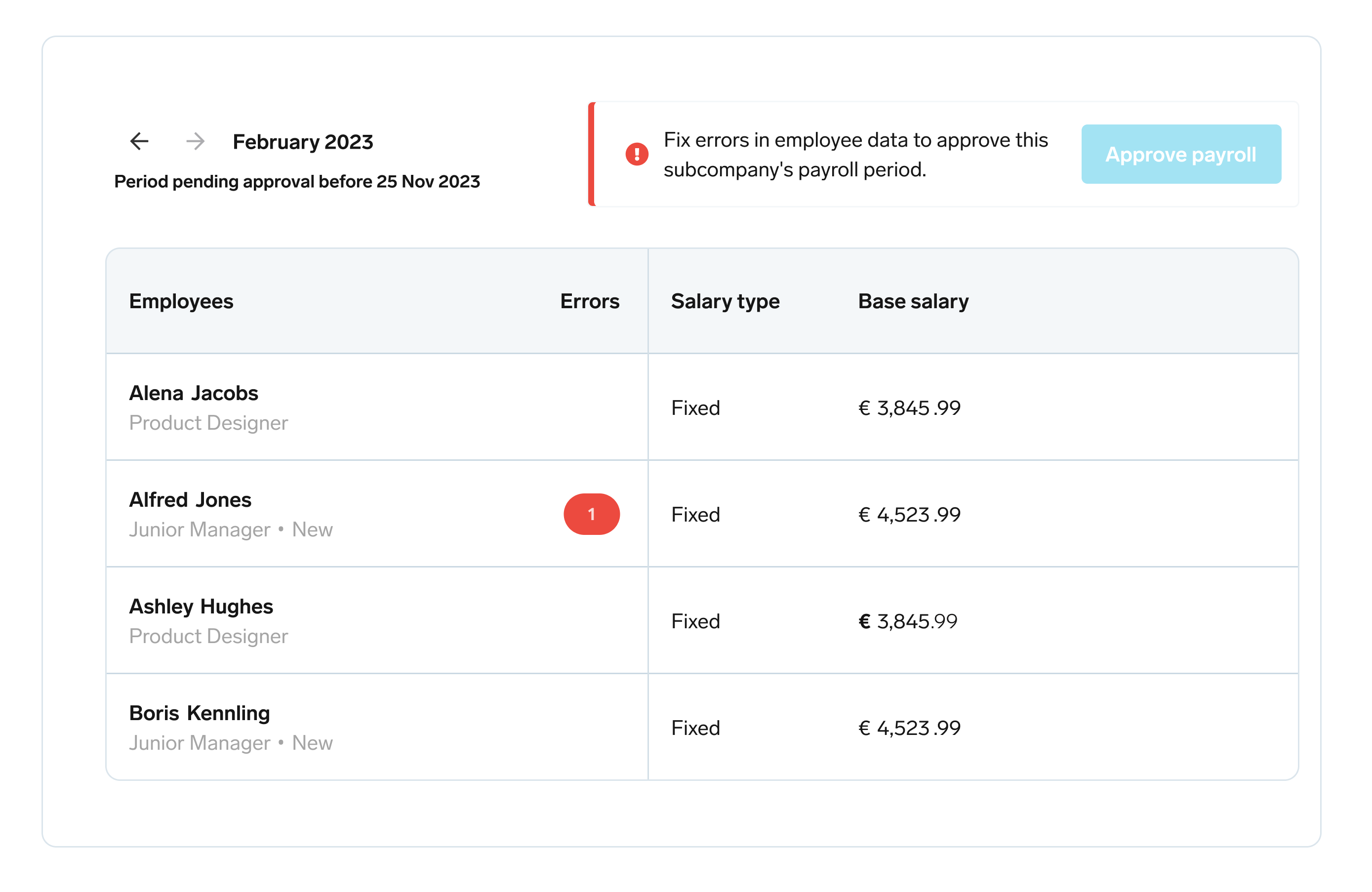

HR Software for Holiday Pay In The UK

Hopefully, this guide helped you work out the question of “how do you work out holiday pay?” when it comes to your employees. Keep in mind, of course, that holiday pay is a legal issue and, therefore, requires a great deal of diligence. It is also important to make sure that when employees do take leave, that you are tracking it correctly and making it visible for the entire organization. That is why an HR software, like Personio, offers attendance tracking to make this all the simpler.

Disclaimer

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness.