Ensure payroll accuracy

Learn how to ensure accuracy in payroll calculations and avoid costly errors.

Read our guidePayslip Abbreviations in the UK: Codes and Information Explained

Payslip abbreviations in the UK are anything but obvious. If you pull out your average payslip, you may find yourself quickly confused. In this article, we want to quickly cover all of the payslip-based abbreviations to keep in mind for UK employers.

Ready to talk compliance? Personio is versed in all things data protection and compliance.Key Terms for Understanding a UK Payslip

A payslip is a summary of earnings for each employee issued by their employer. Whether weekly, bi-weekly or monthly, a payslip must always be issued to an employee. On the payslip, there are certain items employees should know:

Income Tax (IT)

Income tax is the item on the payslip that states how much tax the employee pays. This item depends on their tax code (more on that later).

Payroll Number

A payroll number, sometimes called employee ID, is a number with which the employer classifies their employee for payroll purposes. This number is used by the accounting team of the employee to identify the right employee (so that every employee gets their payroll and not someone else's).

Employer Reference Number (PAYE)

An employer reference number, or as it’s something called the PAYE reference number, is a number that’s issued to every single employer in the UK. The PAYE number classifies the employer as a company in the UK.

Tax Period

The tax period states the time for which the employee has been taxed.

Gross Pay (GP)

Gross pay is the amount of earnings every employee had for a set period of time before any deductions happen to those earnings.

Taxable Pay (TP)

To get taxable pay, we need to take the gross pay from the employee’s payslip and deduct any tax reliefs from it such as pension contributions. The amount left after those deductions is the taxable pay.

Net Pay (NP)

Net pay is the amount of earnings the employee will get in their bank account. After you take all the deductions from their gross pay, the leftover earnings are the employee’s net pay.

Variable Deductions

Variable deductions are deductions that change from payslips to payslips. They include elements such as national insurance and tax.

Fixed Deductions

Fixed deductions are deductions that don’t change from payslips to payslips. They always stay the same amount, such as union memberships.

National Insurance Contributions (NIC)

National insurance contributions are a type of tax that helps employees build up benefits for future conditions. On a regular payslip, the employee will usually see their National insurance (NI) category and their National insurance number.

Pension Deductions

Pension deductions are deductions from the employee’s salary that go into their workplace pension fund.

Leave Details

Leave details is the summary of all the periods of leave the employee had in the year. The leave details provide the accrued leave, used leave, and remaining leave days for that specific employee.

Year-to-date (YTD)

A year-to-date column states how much tax the employee has paid from the start of the year up until this point.

Period Starting/Ending

This item informs the employee of the timeframe through which they’re paid. The usual timeframes are weekly, bi-weekly and monthly.

Bankers Automated Clearing Services (BACS)

Most payments for the employee’s payslips are made through BACS and the bank names can be stated on the payslips.

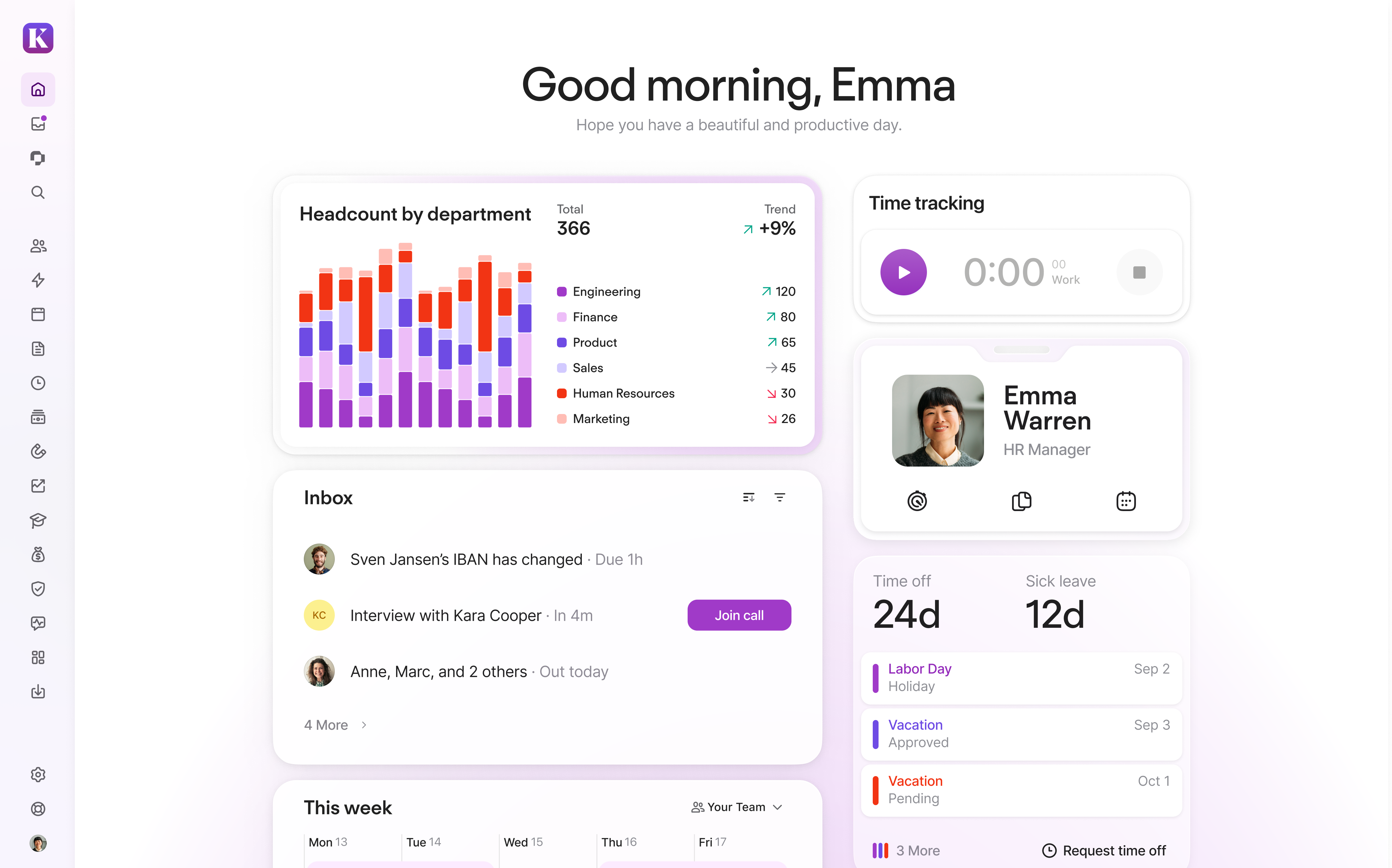

Simplify your payroll tasks

Prepare your payroll more efficiently for accounts. Enable employees to change personal data themselves that HR approves. Working hours and bonus details are automatically transferred to your payroll system.

Streamline How You Pay EmployeesWhat Are Tax Codes On UK Payslips?

An employee’s payslips will also contain various tax codes. They explain which tax level the employee can find themselves in. Usually, tax codes start with the following:

L. The most common tax code that provides standard tax-free Personal Allowance to the person.

M. Marriage allowance where the person receives a 10% transfer of their partner's Personal Allowance.

N. Marriage allowance where the person gives/transfers 10% of their Personal Allowance to their partner.

W1, M1 or X. They stand for temporary Emergency Tax Code, usually coming to employees when they change their jobs.

What Is Legally Obligated To Show On A Payslip?

You will find a lot of things written on a UK payslip. Even though the items will depend from employer to employer, there are certain elements that every single payslip needs to have according to the Employment Rights Act 1996. They are:

The employee’s gross pay

The employee’s net pay.

The variable and fixed deductions (taxes, National insurance etc.)

The amount of time (hours) the employee has worked

Frequently Asked Questions About Payslip Abbreviations

Here are the three most frequently asked questions when it comes to payslip abbreviations:

What Is A Salary Slip In The Uk?

A salary slip is a document that the employer provides to an employee where they state the earnings for a specific timeframe for that employee.

How Can I Check My Payslip UK?

Each employee, by law, needs to receive a payslip from their employer for a specific timeframe (weekly, bi-weekly or monthly payouts).

What Are Emergency Tax Codes?

Emergency tax codes are marked with W1, M1 or X. Usually people who change their jobs get emergency tax codes.

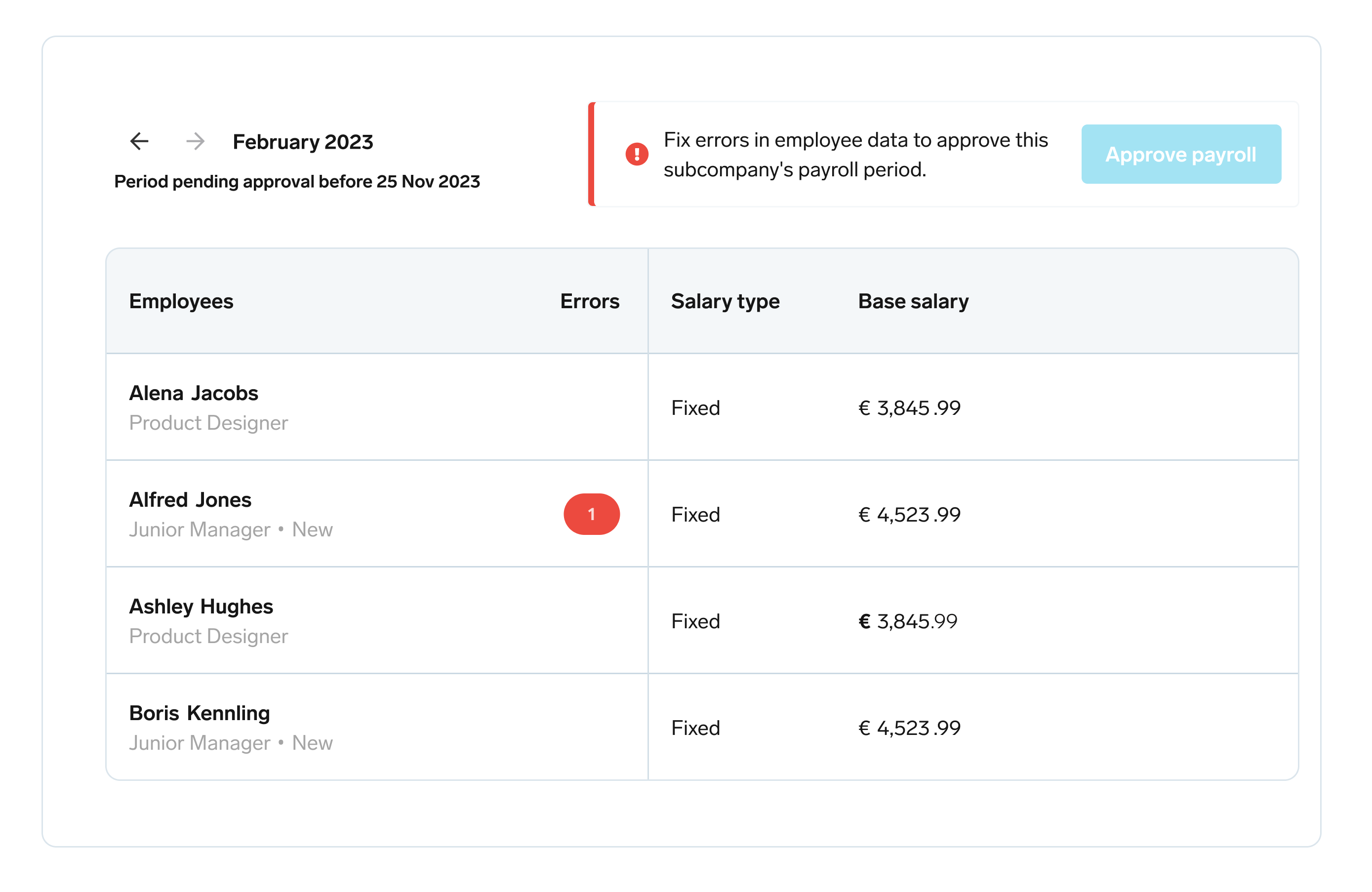

Prep Your UK Payroll with Ease

Avoid working with chaotic lists before every payroll date. As part of Personio’s all-in-one HR software solution, all of your salary-relevant data is automatically transferred to the preliminary payroll. Your job? Simply check and approve. Click here to learn more.