1250L Tax Code: What Does It Really Mean?

In a world of tax codes, what does the 1250L tax code mean? After all, there are so many to keep straight: 1250L, 1257L, K475, 669L, or 577L W1.

As an employer, you should be aware of how the right tax codes can make life for your and your business easier. In this article, we’ll go over the tax codes, their meanings and lived examples. We hope it helps bring order to the chaos!

Let us show you how Personio integrates with some of the UK's leading payroll providers.What is Tax Code 1250L?

Tax codes are essential. They tell you how your tax is being calculated and how much tax you will have to pay in that year. The tax code of 1250L is derived from the personal allowance number for employees in the UK: £12,500

Take the personal allowance number (£12,500) and divide that number by 10 to get 1250. At that point, HMRC steps in.

The HMRC (His Majesty’s Revenue and Customs) is a government department in charge of taxation in the UK handling direct taxes such as income and corporation tax, as well as indirect tax such as value-added tax (VAT).

They would add the code “L” which stands for an employee that’s entitled to the standard tax-free personal allowance and you would get the tax code 1250L.

The tax code 1250L was the most commonly used tax code in the UK in the tax years 2019/2020 and 2020/2021. After 2021, the tax code changed from 1250L to 1257L.

That occurred because the personal allowance that employees in the UK can earn tax-free was changed to £12,570 a year. This allowance used to change on a yearly basis, but the current £12,570 a year will stay like this until 2026.

HMRC froze the personal allowance at that number so it’s to be expected that the tax code of 1257L to stay the most commonly used tax code in the UK until 2026.

Tax Code 1250L Meaning

We know that if you have the 1250L or 1257L tax code, you can have up to £12,570 per year of tax-free personal allowance. When you divide that into months and weeks, you get the tax-free personal allowance of £1047.5 per month or £241 per week (for the 1257L tax code). But what about after that?

Once you get the funds that are above this level, you will be taxed at a 20% rate only for the excess earnings.

For example, let’s say you earned £30,000. You would deduct £12,570 from it and have £17,430 left over. Those £17,430 will be taxed at a 20% tax rate.

The 20% tax rate will be applicable for all earnings between £12,571 and £50,270.

After the employee crosses the £50,270 mark, they will get taxed at a higher rate; 40%.

And after the employee crosses £150,000, they will get taxed at the highest rate which is 45%.

As an employer, you need to be aware of the tax code changes for your employees. Usually, the tax-free income of employees changes over the years, sometimes going up and sometimes going down. If you gave your employee a taxable benefit like a company car, their tax code can change.

The HMRC will then send you an alert in case the tax code changes happen for one of your employees. If you receive the new tax code late in the year, you should start using it for the next year. Usually, HMRC will send alerts between January and March about tax code changes.

That’s because the new tax year starts on the 6th of April.

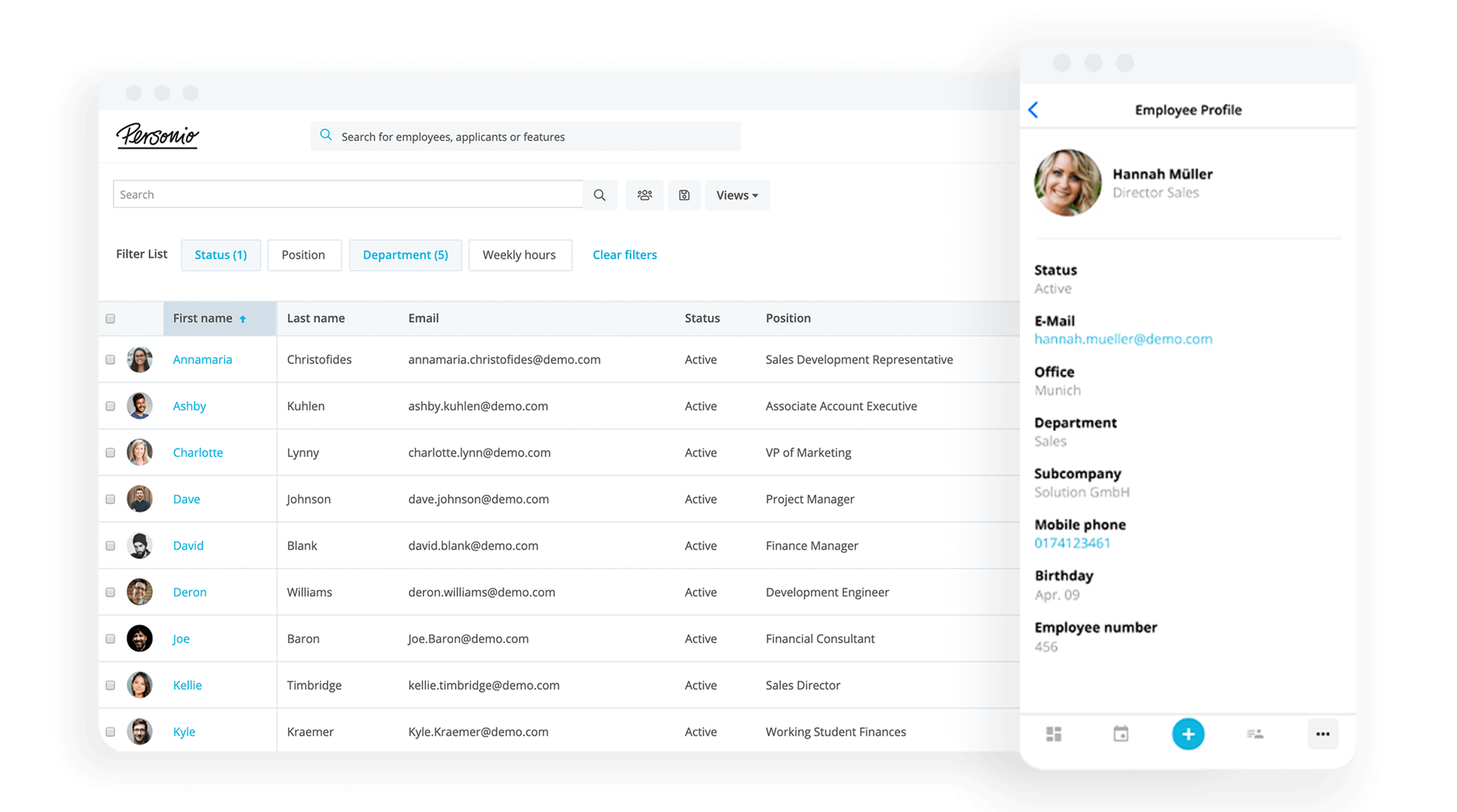

Discover Personio: All Your Employee Data In One Place

Digital employee files with Personio help house all of your important employee data. GDPR-compliant and completely secure, it is the ideal place to keep track of your employees and their critical information. Click the button below for a quick look at how it works.

Find Out More

Tax Code 1250L Example: In Action

1250L and 1257L aren’t the only tax codes in the UK. Construction workers and tradespeople can get emergency tax codes because of the nature of their work. Their tax code might be 1257 W1, 1257 M1, or 1257 X.

Also, there are 1256L or 1283L tax codes for employees that have yet to receive their tax reliefs.

There are many other codes such as:

BR (all income at a basic rate) which usually applies to people with a second job or for a pension.

N (variable rate according to the income) which usually applies to an employee who transferred a part of their personal allowance to their spouse or partner.

K which applies when the employee deductions are greater than their personal allowance for the previous tax year.

For example, an employee with a tax code K450 and a salary of £30,000 has a taxable income of £34,500 (£30,000 plus £4,500).

Frequently Asked Questions About Tax Codes

Here are the most frequently asked questions about the tax codes…

What Does It Mean To Get A 1250L Tax Code?

A 1250L tax code means that you can have up to £12,500 tax-free personal allowance in the tax year.

What Is Tax Code 1250L?

A tax code 1250L means that no matter how much you earn in that specific year, you will be entitled to £12,500 personal allowance (tax-free).

Tax Codes Aren’t Easy – But They’re Critical

Having all of your tax codes in order may seem like a monumental task. Getting all of the details right – it can seem overwhelming for even the most financially savvy HR professionals. Personio is here to help.

Preliminary Payroll with Personio means all of your details are collected together for you to simply check and approve. Any potential errors are flagged, and employee changes are made and updated – to take any chaos out of the equation.

Learn more about it today, or get an HR expert on your side by booking a demo with one of our Personio experts. They can help get all of your top HR processes in order right now.