The Full Guide to UK Tax Codes (for HR Teams)

UK tax codes are incredibly important pieces of information. They tell HR and payroll teams exactly how much tax should be deducted from the employee’s salary. But if you’re not familiar with the format, a tax code can look a bit confusing. Read on for everything HR teams need to know about tax codes in the UK.

Download our personnel file checklist to keep all your information in order.

What Are Tax Codes?

In the UK, a tax code is a combination of letters and numbers that HMRC assigns to every PAYE employee. The code tells employers how much Income Tax they should deduct from each employee’s pay, as well as the amount that the employee can earn in a year without being taxed on it (their tax-free Personal Allowance). An employee’s tax code should appear on their payslip.

What Is the Purpose of a Tax Code?

The purpose of a tax code in the UK is to tell employers how much tax to deduct from their employees’ salaries. It’s an important piece of data because an incorrect tax code could result in an employee paying too much or not enough tax, which can take time to rectify.

In practice, HR or payroll teams usually input each employee’s tax code into their payroll software, which makes the calculations for them and tells them how much tax to deduct. However, it’s still important to understand what tax codes mean, because this makes it easier to spot if HMRC has made a mistake in assigning a tax code, and to answer questions about tax codes from employees.

UK Tax Codes and What They Mean

A UK tax code is made up of a combination of letters and numbers, which each have specific meanings.

What the Numbers Mean

The numbers in an employee’s tax code represent their Personal Allowance, which is the amount they can earn each year before they have to start paying tax. In the tax year 2022–2023, the standard Personal Allowance in the UK is £12,570. However, this is different for some people.

For example, if someone has more than one job, has income from another source or owes tax from a previous year, their Personal Allowance might be different from the standard figure. HMRC also takes into account any benefits that the employee receives from their employer, such as a company car or medical insurance, for example. In this case, the employee’s Personal Allowance will be lowered, which means they’ll pay more tax each month.

To determine how much tax-free income the employee is entitled to, all you need to do is to take the numbers in the tax code and multiply them by 10. For example, if an employee’s tax code was 1257L, their Personal Allowance would be £12,570 (the standard allowance).

What the Letters Mean

The other part of a tax code is a letter, or sometimes two letters. These reflect the person’s situation and how it affects their Personal Allowance. For example, the most common letter in a UK tax code is ‘L’, which simply means that they are entitled to the standard tax-free personal allowance of £12,570.

Here are some of the other letters that a UK tax code can contain, and what they mean:

Letter | Meaning |

L | The employee is entitled to the standard tax-free Personal Allowance. This is the most common letter. |

M | The employee has received a transfer of 10% of their partner’s Personal Allowance through the Marriage Allowance. |

N | The employee has transferred 10% of their Personal Allowance to their partner through the Marriage Allowance. |

T | HMRC needs to review some information with the employee to determine the correct tax code. |

0T | The employee’s Personal Allowance has been used up, or they have recently started a new job and the employer doesn’t have the details they need to determine the correct tax code. |

BR | All of the employee’s income from this job is taxed at the basic rate. This is usually used when the employee has more than one job or pension (meaning that their Personal Allowance has already been used up). |

D0 | All of the employee’s income from this job is taxed at the higher rate. |

D1 | All of the employee’s income from this job is taxed at the additional rate. |

NT | The employee’s income from this job is not taxed. |

S | The employee’s income is taxed using the rates in Scotland. |

C | The employee’s income is taxed using the rates in Wales. |

For a full list of the letters that can appear in a UK tax code, including those used in Scotland and Wales, head to the HMRC website.

Tax Code 1257L

The tax code that you’ll probably see most often is 1257L. As we mentioned above, the ‘L’ here means that the employee is entitled to the standard tax-free Personal Allowance. The numbers, when multiplied by 10, show that their Personal Allowance is £12,570.

What Are Emergency Tax Codes?

HMRC sometimes assigns an emergency tax code when they don’t have enough information to determine the right code to use. This is usually because the person has recently changed jobs and hasn’t provided their new employer with their P45, or because they’ve started a job after being self-employed.

Emergency tax codes end with either:

W1

M1

X

When someone is assigned one of these tax codes, they’ll pay tax on all of their income above the standard Personal Allowance. However, emergency tax codes are temporary and will change as soon as either the employee or their employer provides HMRC with the correct information.

At this point, if the employee’s change in circumstances means they haven’t been paying enough tax, they’ll stay on the emergency tax code until they have paid the correct amount for the year. If they have paid too much tax, they will be able to claim a tax refund.

Why Do Tax Codes Change?

Tax codes change when a person’s situation changes. For example, HMRC might update a person’s tax code if they:

Start to earn income from an additional job or pension

Start or stop receiving benefits from their job (e.g. a company car)

Start getting taxable state benefits

Claim the Marriage Allowance

Claim expenses that they get tax relief on

What If an Employee’s Tax Code Is Wrong?

HMRC usually updates tax codes automatically when a person’s income changes. However, mistakes can happen. If one of your employees believes that their tax code is incorrect, you should advise them to contact HMRC as soon as possible.

How Do You Check a Tax Code?

HR and payroll teams need to know their employees’ tax codes so that they can input them into their payroll software and ensure that everyone is paying the correct amount of tax. When you employ someone new, you’ll usually figure out their tax code using their P45 — you can use this guide from HMRC to help you.

When an employee’s tax code changes, HMRC usually sends a letter to both you and the employee. As an employer, you can also check this information in PAYE Online, the PAYE Desktop app or (depending on the program you use) in your payroll software.

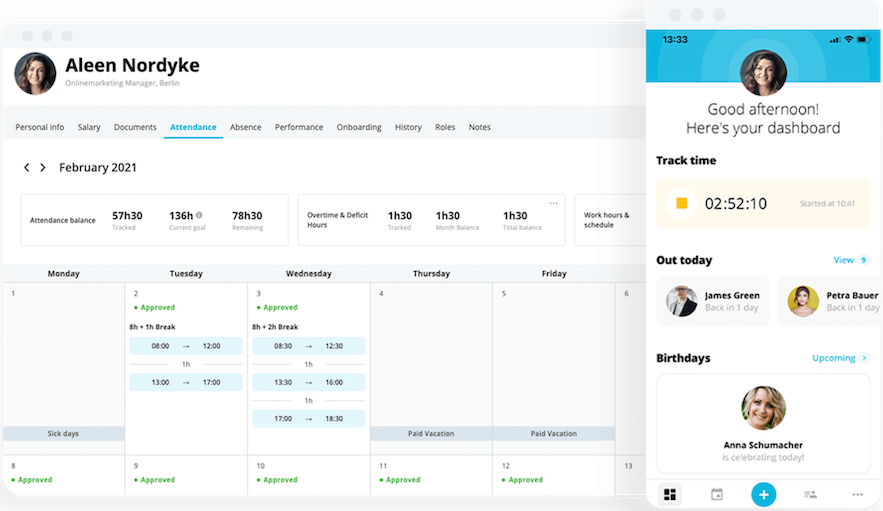

Of course, payroll data like employee tax codes are just one of many moving parts that HR teams have to keep track of. To make your team’s life easier, think about exploring a holistic HR software solution, like Personio.

Personio can help you to streamline payroll, track employee performance and transform manual processes into automated workflows. Plus, our platform makes things easy by giving you a bird’s eye view of all of your employee data, all in one place.

Interested? Book your free demo to find out more.