Travel allowance: How it works for employers

A travel allowance is an optional perk offered by the employer and is discussed on a case-by-case basis between the employer and the employee. The goal of the travel allowance is to help commuters financially. This article will give you all the information you need about the travel allowance, covering the benefits and rules that come with it.

What is a travel allowance?

In the UK, a travel allowance is a form of financial assistance provided by employers to employees to cover their commuting costs. This allowance helps employees offset the expenses incurred while traveling between their residence and their workplace.

Here's how a travel allowance typically works in the UK:

Employer decision: The provision of a travel allowance is at the discretion of the employer. It's not a mandatory benefit and is usually offered as an incentive to attract and retain employees.

Negotiation and agreement: If an employer offers a travel allowance, the terms are usually negotiated and agreed upon between the employer and the employee. This can include the amount of the allowance, the frequency of payment and any specific conditions.

Commute distance: The travel allowance may be influenced by the distance the employee has to travel to reach their workplace. Longer distances often result in higher allowance amounts.

Taxation: In the UK, travel allowances are subject to taxation. The amount of tax varies depending on various factors, including whether the allowance is considered a taxable benefit or not. Generally, travel allowances are subject to income tax and National Insurance contributions.

Claiming expenses: Alternatively, some employers may provide a travel expense reimbursement system instead of a fixed allowance. In this case, employees can claim expenses for their actual travel costs, such as public transport fares or mileage if they use their own vehicle for commuting.

Reporting and documentation: Employers and employees need to keep accurate records of travel expenses, such as receipts for public transport tickets or mileage logs. These records are important for tax purposes and may be requested by tax authorities.

Tax relief: Some employees may be eligible for tax relief on their travel expenses. This is typically applicable if an employee's travel is necessary for their job and the employer doesn't reimburse the full amount of expenses. The employee can claim tax relief through HM Revenue and Customs (HMRC).

Cycle to work scheme: In the UK, there's a specific scheme called the "Cycle to Work" scheme, which allows employees to obtain bicycles and cycling equipment through salary sacrifice, thereby saving on tax and National Insurance contributions.

Public transport schemes: Some employers may offer discounted or subsidised public transport schemes to their employees as part of their travel allowance benefits.

It's important to note that the specifics of how a travel allowance works can vary from one employer to another. Additionally, tax laws and regulations may change over time, so it's essential to stay informed about the latest guidelines.

Using travel allowance to retain employees

The rising rents in major cities will likely lead more employees to relocate to rural areas in the future. The scarcity of skilled professionals makes finding capable employees even tougher due to sometimes lengthy commutes.

Despite the high number of commuters, many employees prefer workplaces close to home to minimise travel time and expenses. Employers can use travel allowances as an extra tool for retaining employees, alongside other measures.

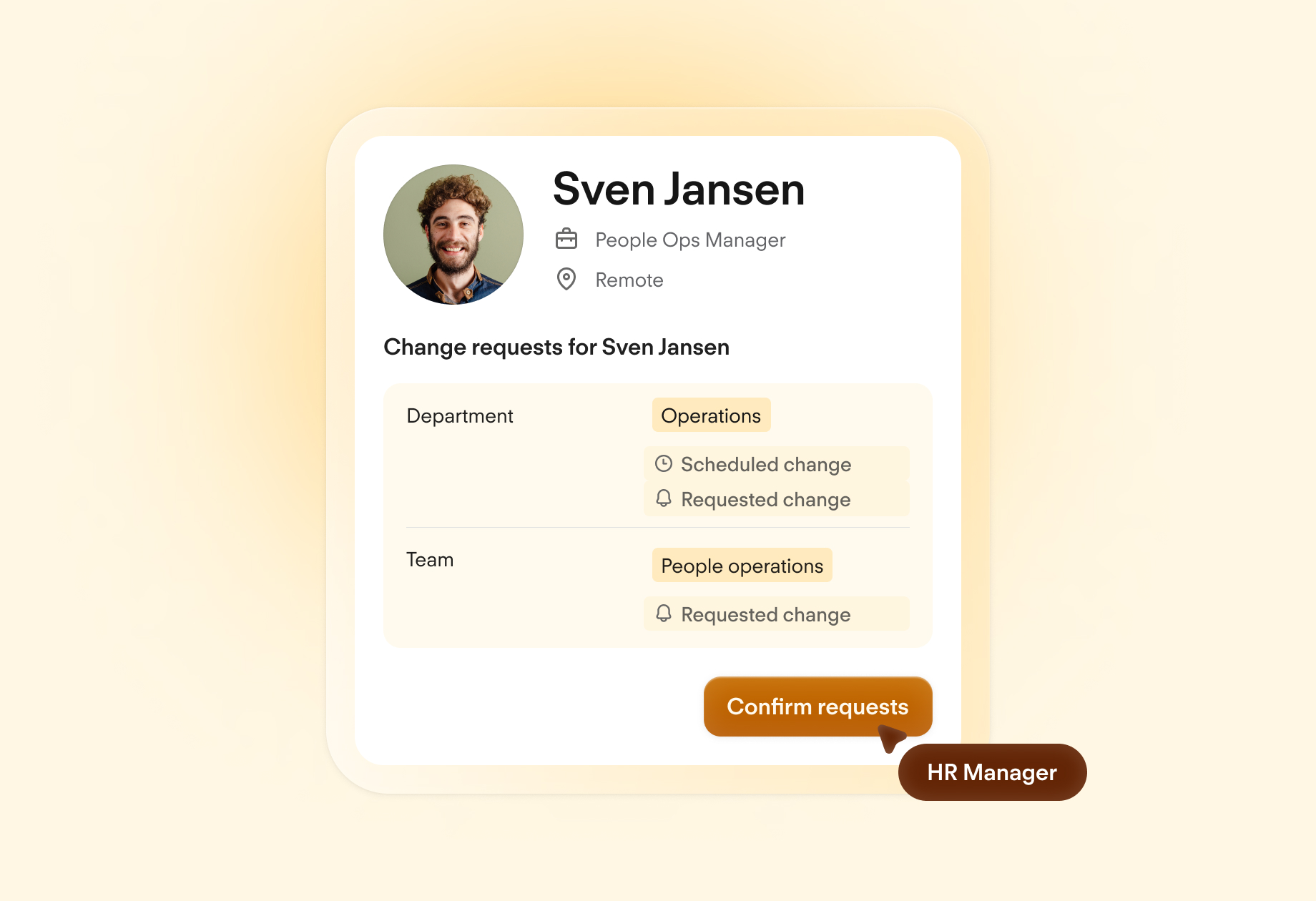

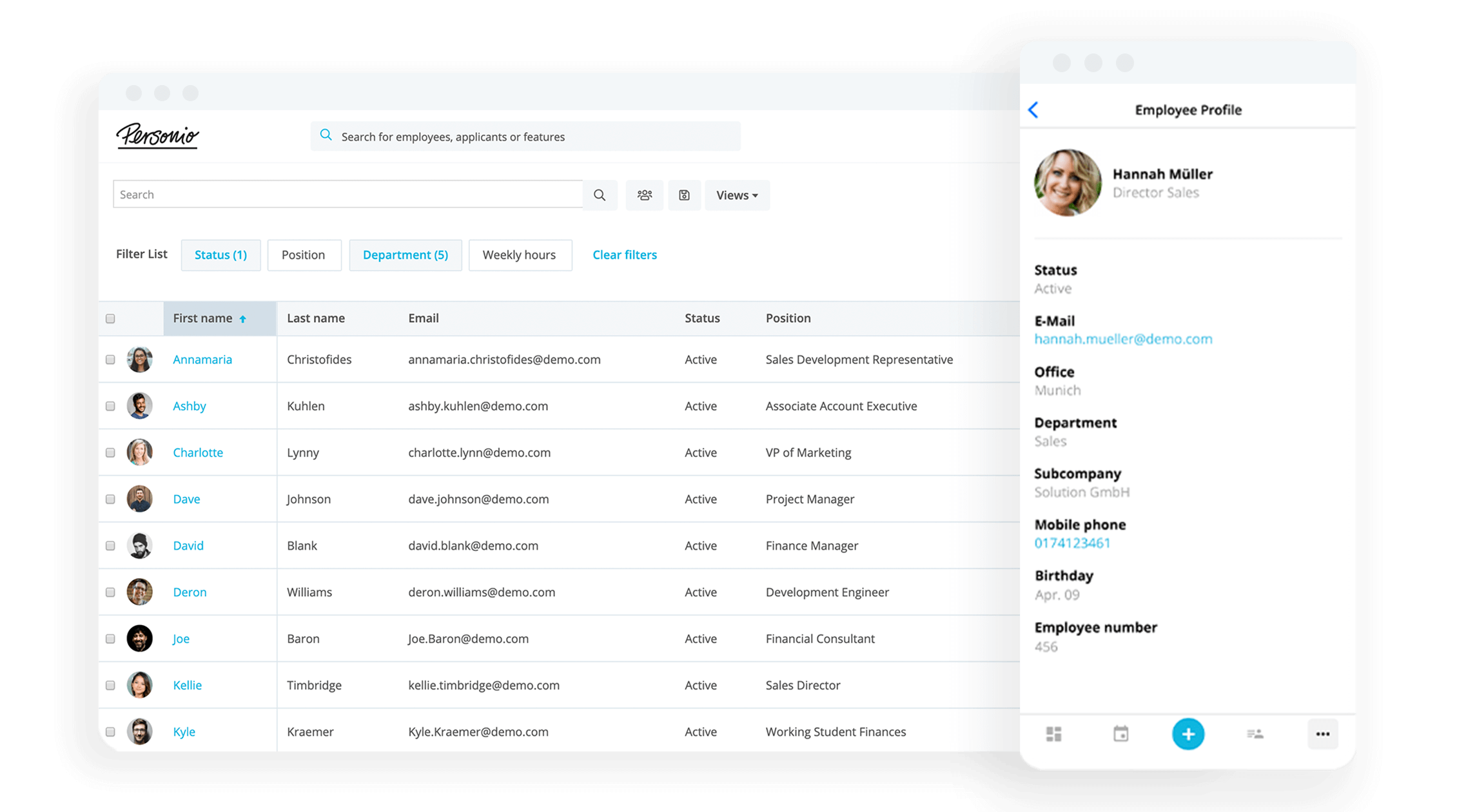

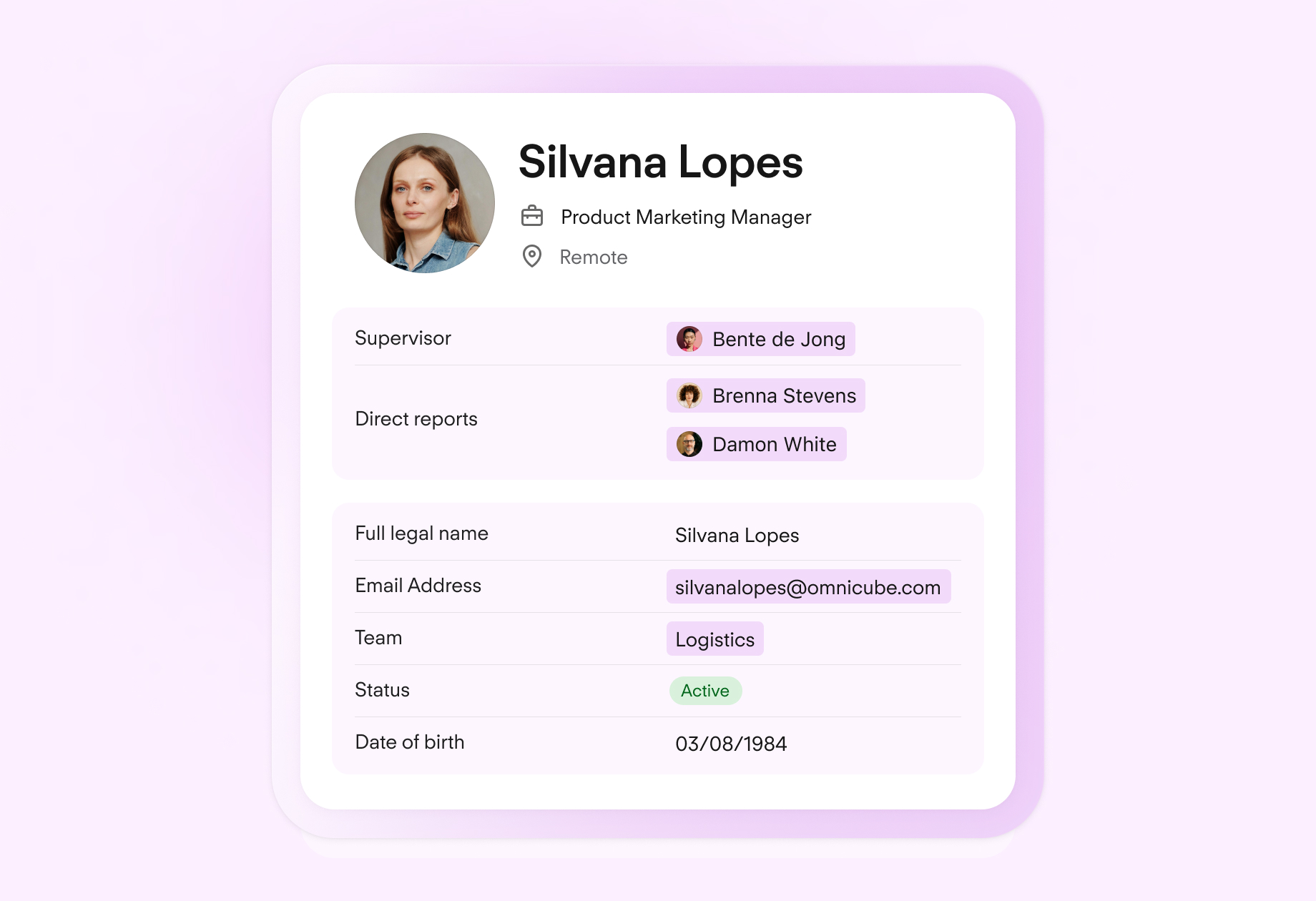

Centralise your employee data

Stop relying on lists and spreadsheets. Organise and edit personnel files and documents with ease, all in one secure, legally compliant place.

Protect your people filesTravel allowance: employer's tax responsibility

An employer's tax responsibility for a travel allowance in the UK involves ensuring proper taxation and reporting of the allowance according to the guidelines set by HM Revenue and Customs (HMRC). The tax treatment of a travel allowance depends on various factors, including the nature of the allowance and the method of payment.

Here's an overview of an employer's tax responsibilities for a travel allowance:

Classifying the allowance: Employers need to determine whether the travel allowance is a taxable benefit or an expense reimbursement. This classification affects how the allowance is treated for tax purposes.

Taxable benefit: If the travel allowance is considered a taxable benefit, it will be subject to income tax and National Insurance contributions. Employers are responsible for deducting the appropriate tax and National Insurance from the allowance before paying it to the employee. The value of the taxable benefit is usually calculated based on the amount of the allowance provided.

Expense reimbursement: If the travel allowance is purely a reimbursement of actual expenses incurred by the employee, it may not be subject to income tax and National Insurance. However, the reimbursement must be supported by valid receipts or documentation, and the expenses must be directly related to the employee's business travel.

Flat Rate Scheme: In some cases, employers may choose to use a flat rate scheme for travel allowances. This involves applying a fixed amount for tax purposes, regardless of the actual expenses incurred. The use of a flat rate scheme is subject to HMRC's rules and limitations.

Record keeping: Employers are responsible for maintaining accurate records of the travel allowances provided to each employee. Proper documentation should include details of the allowance, dates, amounts, and the purpose of the travel.

Reporting to HMRC: Employers are required to report taxable benefits and expenses provided to employees on the annual P11D form. This form outlines the value of benefits and expenses provided during the tax year. Employers must submit the P11D form to HMRC and provide a copy to the employee.

PAYE Settlement Agreement (PSA): In certain cases, employers may choose to include travel allowances within a PAYE Settlement Agreement (PSA). A PSA allows employers to settle the tax liability on behalf of the employee, simplifying the reporting process.

Compliance: Employers must ensure compliance with all relevant tax laws, regulations, and guidelines when providing travel allowances to employees. Failure to accurately report and deduct the appropriate taxes can lead to penalties.

It's important for employers to stay informed about any changes in tax laws and regulations related to travel allowances. Consulting with tax professionals or seeking guidance from HMRC can help ensure that an employer's tax responsibilities are met accurately and in line with the current regulations.

How to calculate travel allowance

Calculating a travel allowance in the UK involves considering various factors, including the distance of the commute, the method of transportation and whether the allowance is a flat rate or based on actual expenses.

Here's a general overview of how travel allowances can be calculated:

1. Determine the method of calculation: Some employers use a flat rate for travel allowances. In this case, a fixed amount is provided for each qualifying journey. Alternatively, employers may reimburse employees for the actual expenses incurred during their commute. This requires employees to provide valid receipts or documentation.

2. Calculate the commute distance: For a flat rate allowance, the commute distance may not be a direct factor in the calculation. For reimbursement based on actual expenses, calculate the distance between the employee's home and workplace. This can be done using tools like Google Maps or GPS devices.

3. Calculate the allowance amount: If using a flat rate, the employer decides on a fixed amount to be paid per qualifying journey. This amount could be based on typical travel costs, distance, or other relevant factors.

If reimbursing actual expenses, the allowance amount would be based on the expenses submitted by the employee. These expenses may include public transport fares, mileage for using a personal vehicle, parking fees, and tolls.

4. Take into account tax considerations: Determine whether the travel allowance is taxable or not. Taxable allowances are subject to income tax and National Insurance contributions, while non-taxable reimbursements are not.

5. Report and document everything: Keep accurate records of the allowance calculations, receipts and documentation for each employee. This is important for tax reporting and compliance.

6. Decide on frequency of payment: - Decide how frequently the travel allowance will be paid (e.g. weekly or monthly).

7. Notify employees: Communicate the details of the travel allowance calculation method, amount and payment schedule to employees.

8. Apply tax and national insurance deductions: If the travel allowance is taxable, deduct the appropriate income tax and National Insurance contributions before paying the allowance to the employee. The amount deducted depends on the employee's tax code and earnings.

It's important to note that travel allowance calculations can be complex, and employers should ensure compliance with HMRC guidelines and regulations. Employers may also consider consulting with tax professionals or payroll experts to ensure accurate calculations and reporting. Additionally, employees should be aware of the tax implications and any reporting requirements related to the travel allowance they receive.

Disclaimer

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness.