Payment In Lieu Of Notice (PILON): How Does It Work?

Payment in lieu of notice, otherwise known as PILON, is a favoured technique by some businesses when they're excusing an employee. But, what is it, how does it work, and when is it most appropriate? We’re covering the basics in this article for your consideration.

Looking to find your way around UK notice periods? Click here.Contents

- 1What Is Payment In Lieu Of Notice (PILON)?

- 2How Is PILON Useful For Employers?

- 3Should You Have A PILON Clause In Employment Contracts?

- 4How Is PILON Generally Calculated?

- 5What Is An Effective Date Of Termination (EDT) And Why Is This Important?

- 6Keep Track Of Employee Contracts, Safely, Easily, And Securely

What Is Payment In Lieu Of Notice (PILON)?

In the United Kingdom, payment in lieu of notice (PILON) is the practice of excusing an employee from working their notice by giving them a suitable payout. It is typically used when it would otherwise be unfavourable for an employee to work through their notice.

PILON can, and should, be covered by an employment contract. But, if it is not, the payment itself should cover the potential damages for the breach of contract arising from terminating an employee without giving notice.

PILON & Garden Leave: What’s The Difference?

PILON and the practice of garden leave may often be lumped together, but the main difference is that payment in lieu of notice represents an immediate end to an employee’s relationship with an employer. Garden leave still means that, while an employee doesn’t work through their notice period, they remain technically employed with the company.

In addition, garden leave often occurs when an employee already has a new position lined up (typically with a competitor), whereas PILON is typically used on the end of the employer to sever a working relationship with immediate effect.

How Is PILON Useful For Employers?

Does it sound like you’re giving an employee a paid holiday if you pay them PILON? Perhaps. But there are circumstances under which it is preferable to have an employee off the premises, or locked out of your systems during their notice period, or as soon as possible.

There are two circumstances where PILON is most helpful:

In a redundancy situation, where the employer does not require the employee to continue their employment (once they have completed the official statutory redundancy period).Where the employer does not wish the employee to continue working for them – but where they have not committed gross misconduct.

In the second option, when you give an employee PILON, you lock them out of any company systems immediately – so you mitigate any risk of them accessing, downloading, or sharing sensitive information out of malice. Removing them from their work environment prevents them from being a negative or disruptive influence on other employees.

If an employee would do more harm than good to a company by continuing to work for them (for example, there is concern that, despite any confidentiality clauses in your contract, they may be a risk of learning or sharing confidential information if they are not removed from the company property and systems immediately), then paying them in lieu of notice may be advisable. However, some unethical companies have been known to terminate employees by providing PILON under unscrupulous or suspicious circumstances.

Other businesses will occasionally make payment in lieu of notice as a kindness to an employee who desires to leave the company but is unwilling, or unable, to complete their notice period and when taking garden leave is not an option (for example, in the situation of redundancy). For example, if an employee resigns they may negotiate PILON as part of their leaving agreement.

But – beware – while it may seem like a kind gesture to give an employee free time off, instead of requiring them to work out their notice, if you don’t have a PILON clause in your contract and you don’t pay them off fairly, you could be seen to be in breach of contract!

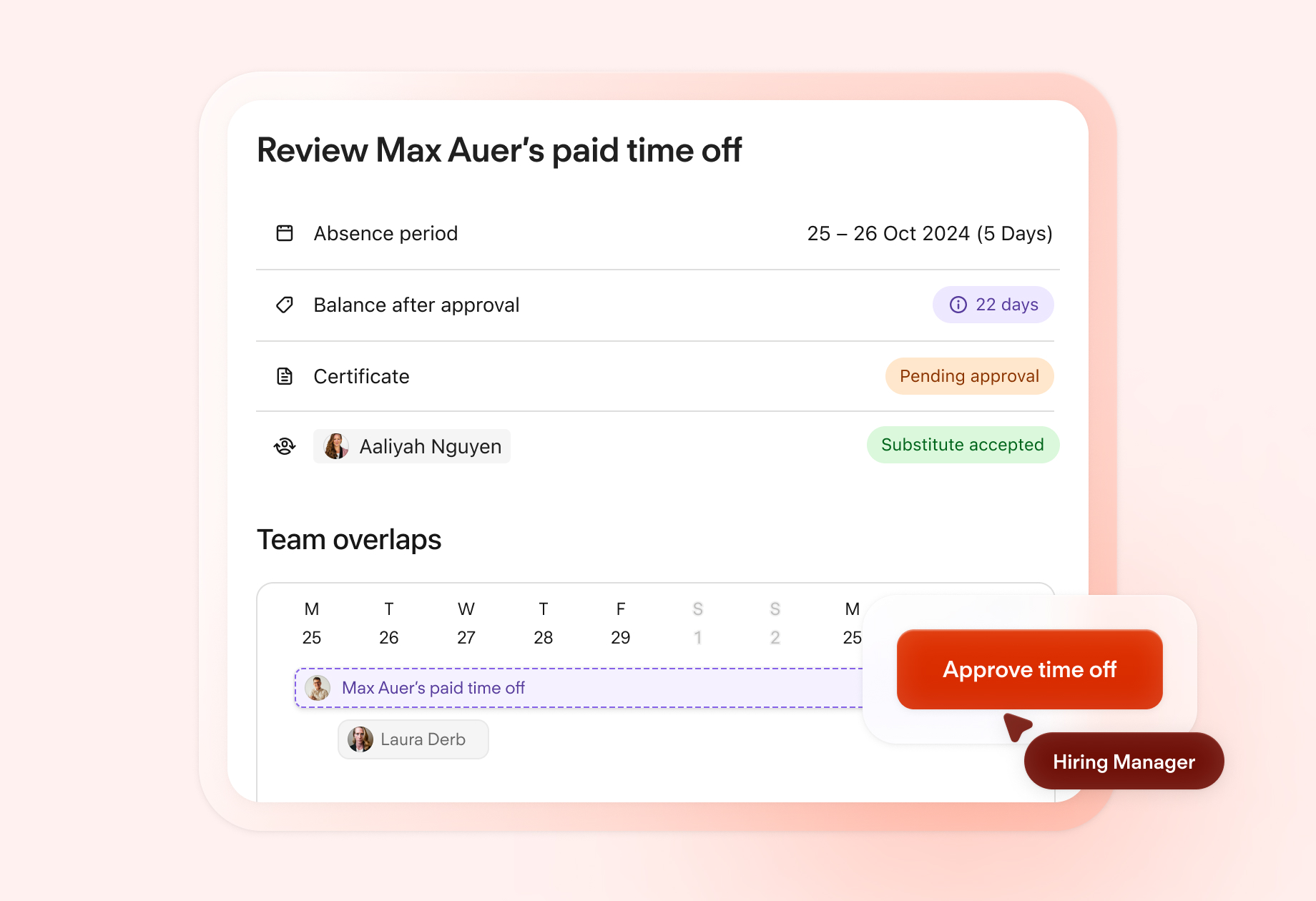

Automate Your Offboarding

Give departing employees a smooth goodbye. Automatically assign departing employees detailed offboarding tasks with clear deadlines.

Try Smarter OffboardingShould You Have A PILON Clause In Employment Contracts?

Ideally, every employment contract should have a clause that covers what happens if an employee is given PILON. However, many contracts do not contain one.

If you do have this clause in the contract, you must get the employee to agree to take payment in lieu of notice, rather than working out their notice otherwise, as the Labour Relations Agency explains, "enforcement of a payment in lieu without the contractual right or agreement to do so may be viewed as a breach of contract”.

When you include a PILON clause in a contract, be sure to explain:

When it will be enacted,

What the terms are (for example, how and when payments will be made).

Benefits of including a PILON clause in employees’ contracts include:

Non-competition and non-solicitation clauses are enforceable

The ability to limit payment – for example, to include basic pay only, and exclude any non-cash benefits an employee would normally receive during their notice period.

This could restrict you from having to pay out other costs such as bonuses, healthcare, additional non-statutory contributions, car allowances, and the like.

What If You Don’t Have A Clause?

If you don’t have a PILON clause in your contracts, acas says, “The employer can ask the employee to agree to payment in lieu of notice.”

However, they also say that “The employer cannot force an employee to agree to payment in lieu of notice if it’s not in their contract,” and they go on to point out that, “An employee could make a claim to an employment tribunal for breach of contract if they’re dismissed sooner than their notice period ends.”

How Is PILON Generally Calculated?

Paying PILON should be easy – simply pay the employee what they would earn during their standard notice period. If a PILON clause is included in the contract, gov.uk says, “Your employer will pay you instead of giving you a notice period. You get all of the basic pay you would’ve received during the notice period.” However, they also say, “You may get extras such as pension contributions or private health care insurance if they’re in your contract.”

When it comes to disputed situations, if PILON is not included in the contract, or if you want to be extremely cautious, the best way to be cautious is to pay them what they would have been entitled to if they were still working out their notice, as per normal.

In some instances, this calculation can be quite complex – for example, if employees’ notice period would entitle them to additional benefits, if their pay is calculated based on complex calculations, or if they may believe they have been unfairly treated.

We’re not lawyers (and it’s best if you consult one in these circumstances, if in doubt) but it’s better to be safe than sorry.

For reference, UK notice periods are stipulated by law. Or, rather, the amount of notice that must be given by an employer is stipulated (refer to the table below to see how much notice an employee must be given).

What Is An Effective Date Of Termination (EDT) And Why Is This Important?

The effective date of termination establishes the end of the period of continuous employment.

It’s important to note when an employment contract ends for tax and other reasons. It’s relevant in PILON situations, in constructive dismissal cases, when the employee resigns, and in appeals against dismissal. From an employee’s perspective, their EDT can also impact their ability to apply for government support like jobseeker’s allowance.

In PILON situations companies must make sure it’s clear when the contract of employment ends. So make sure they get a termination or dismissal letter from them where you state, in clear, and unambiguous terms, that they have been paid, and that they were paid per the contractual right to terminate the employment with immediate effect. Always put it in writing.

I Heard Something About The Government Allowing PILON payments of £30,000 Tax-Free In The Case Of Redundancy. Please explain!

In the case of redundancy, there used to be a few strange rules about whether PILON was taxable or not. Before 6 April 2018, the way PILON payments were made differed if these were or were not listed in a contract. The Citizens Advice Bureau explains, “If you get payment in lieu of notice but it isn’t mentioned in your contract and your employer doesn’t usually give it… you won’t pay tax on your notice pay unless it and your redundancy pay add up to more than £30,000.”

The law firm, Stone King, explains the situation now: after the 6th of April 2018, employers must “identify the amount of basic pay that the employee would have received if they had worked their notice period and to split a termination payment between (1) amounts treated as earnings and (2) amounts which are being paid in true compensation for loss of employment and which may benefit from the £30,000 threshold for tax exemption.”

Sound confusing? Essentially, in the case of redundancy, employers must pay tax on their normal pay – i.e. their notice period – as per usual. Anything over and above that, but below £30,000 might be tax-free. If in doubt, speak to HMRC.

Keep Track Of Employee Contracts, Safely, Easily, And Securely

One way of making sure that all your employees’ records – including when they leave, and whether they were given PILON – are stored safely, and securely is by using a tool like people workflow automation so. By using an error-free, complete, and legally compliant tool, everyone knows what digital personnel files are stored, and where.

If you’re ready for the days of searching for, recording, and retrieving employee data to be over, get in touch or start a free trial of Personio’s powerful HR software. We can’t guarantee that it will be any more pleasant to say goodbye to a staff member, but we can guarantee that your HR documents and processes will be efficient, effective, and secure so you can spend more time doing the right thing for your employees, and your company.

Disclaimer

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness.