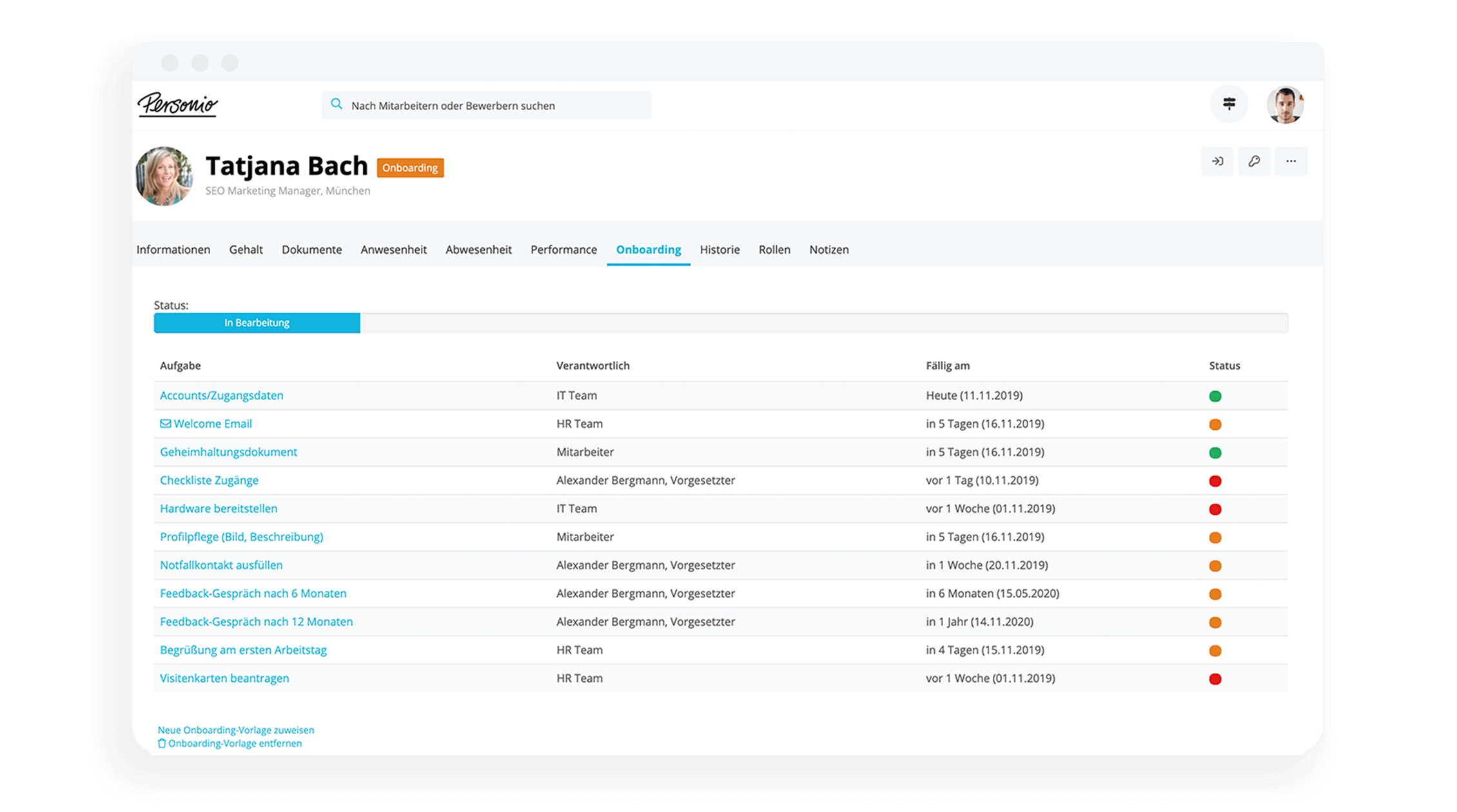

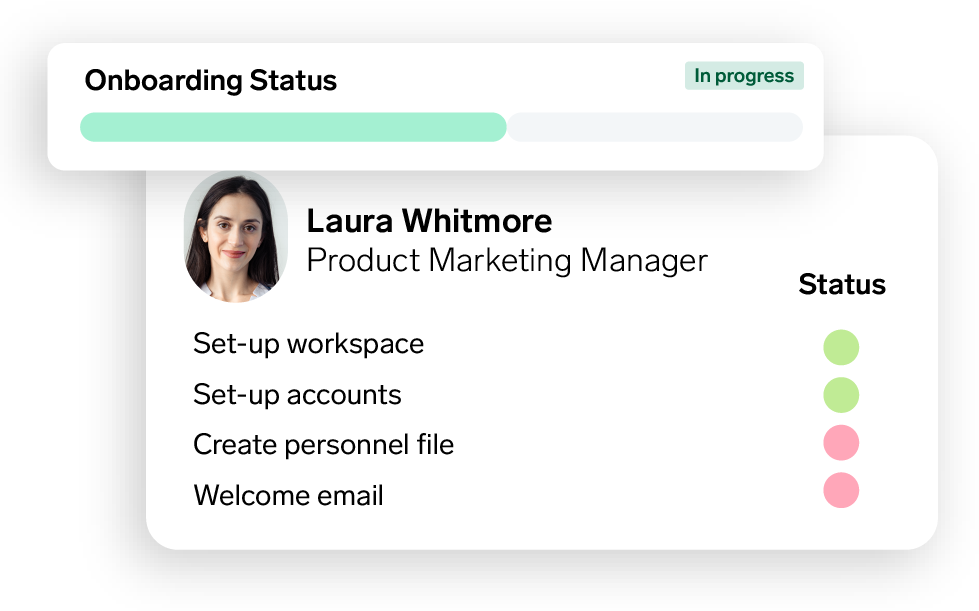

Streamline employee onboarding experiences

Streamline the onboarding experience for new employees with Personio's intuitive software.

Explore our productWhat Are New Starter Forms in the UK?

In the UK, a critical document for new hires to complete is their new starter form. This helps employers discern the circumstances of the employee and get them set up for payroll.

In this quick guide, you’ll learn about the contents of the new starter form and why your organisation needs one.

Kick things off by downloading our complimentary onboarding checklist right now.What Is a New Starter Form?

A new starter form is a document that the employee and employer complete together when the new hire starts working. Also called a starter checklist, this form helps the employer gather any details needed to set up payroll for the employee and decide the proper tax code.

Typically, the HR team or manager will work with the employee to complete the new starter form before sending it to the payroll team with the employee’s P45 attached. Ensuring this information is correct will help avoid headaches (and scrutiny from authorities like HMRC) down the line.

Why Does Your Organisation Need a New Starter Form?

Organisations in the UK need to use the new starter checklist form during onboarding because it informs them of their employees’ circumstances, ensuring they don’t end up paying too much or too little in taxes. The form is not meant to be sent to the HMRC directly, but gathers key information that the employer should hold onto for the current and next three tax years.

Recharge your employee induction

Our automated onboarding automatically creates checklists, reminders and more. See it in action with your free demo.

Book your free demoWhat Should Be Included in a New Starter Form?

There are four main sections that are included on a new starter form, and answering each question completely is crucial. This information is up-to-date based on the most recent form (October 2022):

1) Employee’s Personal Details

The first seven questions of the new starter form ask the employee to enter their personal information:

Last name

First name(s)

Sex

Date of birth

Home address

National Insurance number (if known)

Employment start date

This last question declares the date of the employee’s first paid day of work. This is the date at which the employee would have received the relevant tax code.

Since this section is typically filled in by the employee, they should double-check with the employer to ensure the correct start date is used. They should also make note of this start date as it may be needed later for reference checks later on (e.g. when applying for a mortgage).

2) Employee Statement

This section is particularly important for tax reasons, as it enables the employer to give the individual the correct tax code. The employee will choose from three statement options, each one describing a different financial situation:

Statement A – ‘This is my first job since 6 April and since the 6 April I have not received payments from any of the following: Jobseeker’s Allowance, Employment and Support Allowance, Incapacity Benefit.’

Statement B – Since 6 April I have had another job but I do not have a P45. And/or since 6 April I have received payments from any of the following: Jobseeker’s Allowance, Employment and Support Allowance, Incapacity Benefit.’

Statement C – ‘I have another job and/or I am in receipt of a State, workplace or private pension.’

There are several questions that help the employee choose the correct statement. If they aren’t sure, they can work with their HR or payroll teams to make the right choice.

3) Student Loans

The last three questions are about the employee’s student loan status. It helps determine if the employee has a student loan and what position they are in when it comes to repaying that loan.

The first question asks whether the employee has an outstanding student loan to repay. If they don’t, they can skip straight to the declaration. If they do have a loan, then they go to the next question.

Next, the employee is asked whether any of these statements apply:

you're still studying on a course that your student loan relates to

you completed or left your course after the start of the current tax year, which started on 6 April

you’ve already repaid your loan in full

you’re paying the Student Loans Company by Direct Debit from your bank to manage your end of loan repayments

If they answer ‘yes’ to any of these statements, they can skip to the declaration. If not, they move on.

The final question asks the employee to indicate which student loan plan(s) they are on. There are four options that differ in terms of where the employee studied and when. For more information on the type of student loan they have or the remaining balance, employees can visit: www.gov.uk/sign-in-to-manage-your-student-loan-balance.

4) Declaration

The last section of the new starter form is called the ‘declaration’. It asks the employee to confirm that the information they’ve given on the form is, to the best of their knowledge, correct. The employee dates the checklist, writes their name, and adds a signature.

Once the declaration and all other parts of the form are complete, the employer can use the information to set up the employee in their payroll system.

How Long Should a New Starter Form Take To Complete?

The new starter form should not take employees very long to complete. It consists of only 13 questions and a declaration, and most information should be fairly easy to track down. If the employee has difficulties with the new starter form, the HR or payroll teams should be able to assist.

What Else is Needed Besides a New Starter Form for a Great Onboarding Experience?

The new starter form is certainly part of creating a positive onboarding experience for new hires in the UK, but there is much more to the process than that.

Using Personio’s onboarding feature, you can offer an automated way to track tasks, remind stakeholders and ensure that your new employees get the start they deserve. Speak with an expert today to learn more about it.