Expense report: Guide and helpful examples

When employees go on business trips, they often front the expenses, expecting to be reimbursed later by their employer. An expense report, commonly referred to as a travel expense report in various firms, allows employees to reclaim these outlays.

This article covers how to properly submit expense reports, key tax considerations and the importance of meticulousness when completing your expense claims.

Download our personnel file checklist to keep all your information in order.What is an expense report?

An expense report is a document used for reconciling costs incurred by employees on behalf of their employer during business trips. These may include food expenses, travel expenses, accommodation fees and other miscellaneous costs.

After the trip, the employer uses the expense report to reimburse the employee for the exact amounts they've initially covered.

Expenses settled via the expense report include:

Travel costs (personal car, train, aeroplane, bus, taxi, etc.)

Extra meal costs (food, beverages, snacks)

Accommodation (hotel, guesthouse, holiday flat, etc.)

Miscellaneous expenses (parking fees, toilet charges, telephone costs, postage, work-related events, etc.)

In the UK, employers must follow the tax authority’s annually updated flat-rate expense allowances. These allowances are categorised into a minor flat-rate expense allowance and a major flat-rate expense allowance.

Minor flat-rate expense allowance

Applicable to business trips lasting between 8 and 24 hours. On longer trips, it covers both the day of arrival and departure. The minor flat-rate allowance is set at £14 per day.

Major flat-rate expense allowance

This applies to longer business trips. A daily rate of £28 is set for every full 24-hour period away from the workplace. Pure overnight expenses are fixed at £20 per night.

Note: Business documents created with Excel or Word are not compliant with UK regulations on digital record-keeping.

Who is eligible to submit an expense report?

Both freelancers and salaried employees can submit expense reports. The key requirement is that the individual has travelled for business reasons, away from their primary workplace, and could not spend the night at their home for the same reason.

How to properly submit an expense report

Employers are only obligated to reimburse expenses if the submitted report is accurate. Failure to submit an expense report, or submission of a fraudulent or excessive claim, can lead to immediate termination.

Typically, companies provide pre-formatted forms or Excel spreadsheets that function as travel expense calculators. Employees complete the form, attach all necessary receipts or invoices and sign it.

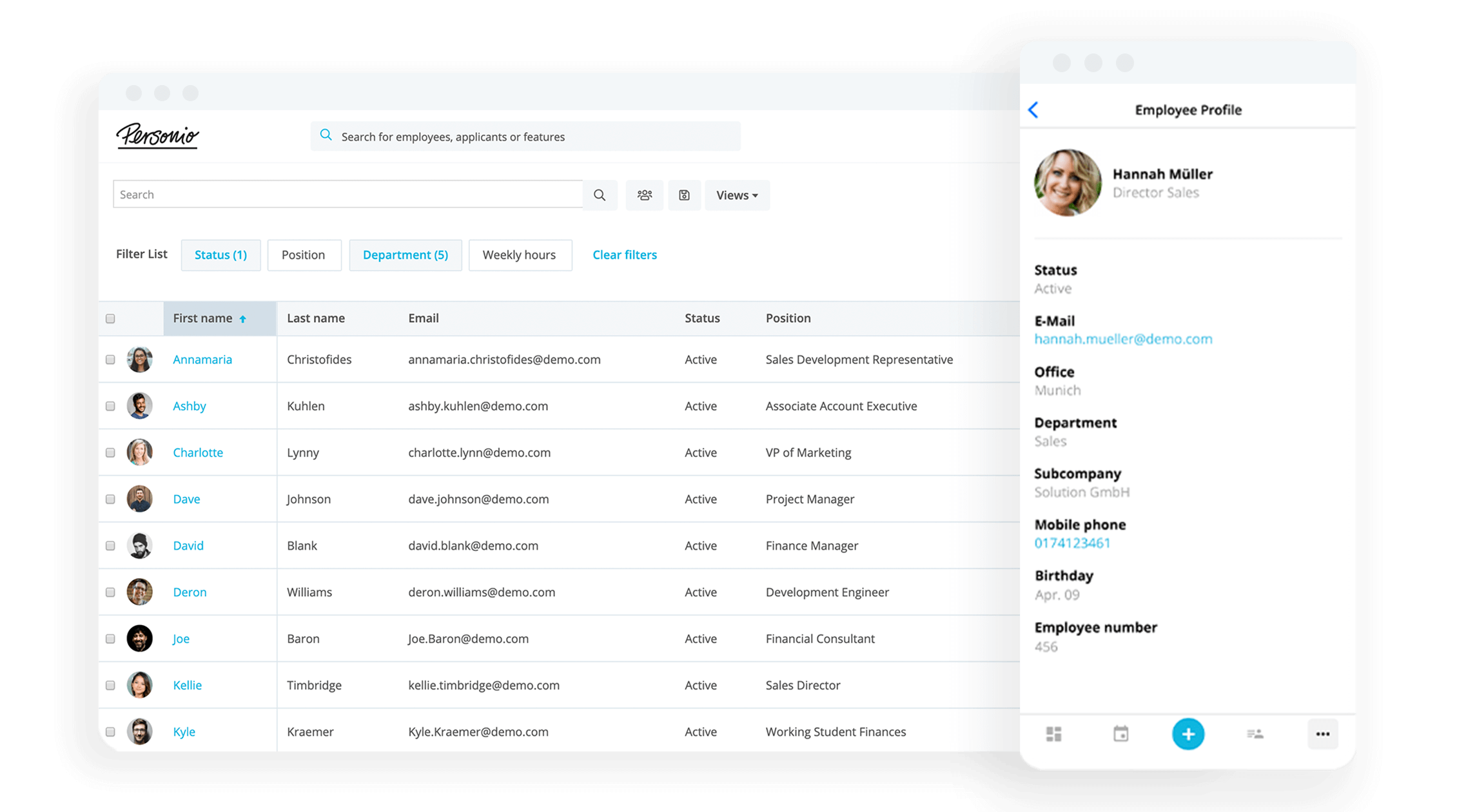

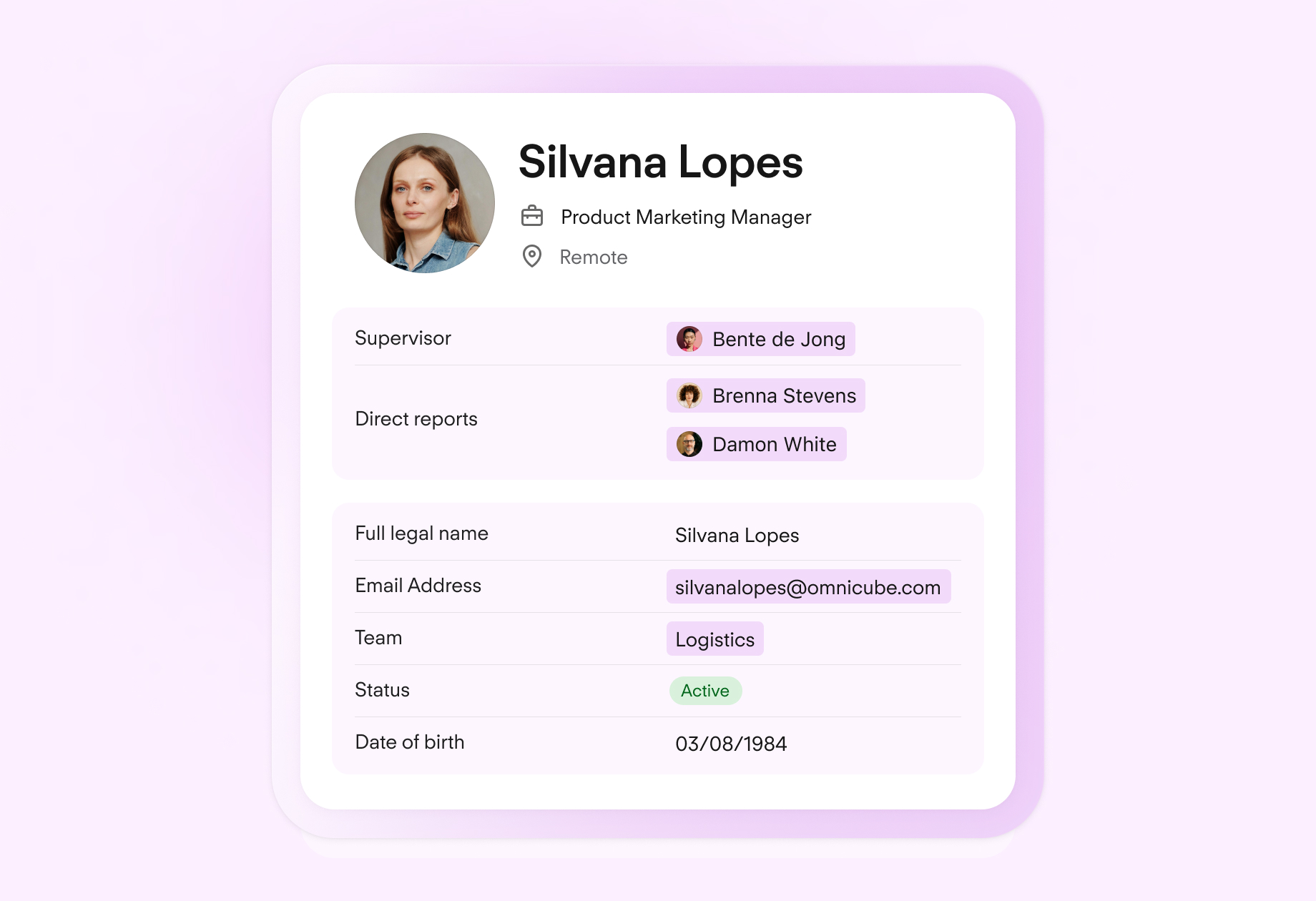

Centralise your employee data

Stop relying on lists and spreadsheets. Organise and edit personnel files and documents with ease, all in one secure, legally compliant place.

Protect your people filesAccounting for expenses

There are two methods for expense accounting:

Flat-rate accounting: If expenses are based on flat rates, it’s crucial to note the country visited. Flat rates can only be claimed for absences lasting 8 hours or more.

Actual cost accounting: Here, employees must gather all receipts and invoices, submitting them alongside their report. Only then will the employer reimburse the actual costs incurred.

Record-keeping requirements

Expense reports must be retained for a minimum of 6 years, as per UK regulations.

Special considerations

Company accommodations must be used if offered, and the use of personal options like hotels is not authorised.

Company canteens should be used where available.

For trips in company cars, no additional transport expenses can be claimed.

Example of a compliant expense report

Employee Susanne took a four-day business trip to Hamburg. She opted for sustainable travel and used the ICE train. She paid for her stays, which included breakfast, and her meals using her credit card. Here’s a breakdown of her allowable meal expenses:

Day | Meal per diem (£) |

|---|---|

Monday (arrival) | 12 |

Tuesday (stay) | 24 - 4.80 (breakfast) |

Wednesday (stay) | 24 - 4.80 (breakfast) |

Thursday (stay) | 24 - 4.80 (breakfast) |

Friday (departure) | 12 |

Total | 81.60 |

Susanne attached all the receipts and invoices to her expense report, and her employer reimbursed her accordingly.

Tips for claiming expenses on your tax return

Expenses reimbursed by employers are generally not taxable. Nonetheless, it's advisable to include them when filing your tax return under "Income-related expenses."

Simplify your employee data with Personio

Managing expense reports can be time-consuming and prone to errors. Streamline the entire process and maintain accurate employee data effortlessly with Personio's all-in-one HR software.

Speak with an expert today about how Personio can house all of your important employee data and how our solution integrates with a range of business expense providers in the United Kingdom.

Disclaimer

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness.