18. February 2021

Spendesk: The 4 Reasons Why Employee Expenses Are an HR Issue

Our friends at Spendesk have provided this article to explore the tricky relationship between company expense policies and their impact on HR teams.

Employee expense claims are typically considered a purely financial matter. The CFO or financial controller creates the process and sets the rules, and employees simply have to follow along.

But, expenses can impact human resources directly. They're a company-wide process that affects everyone, increases interpersonal tension, and we’ll see that they place real financial strain on employees.

At the very least, they create extra work for teams, which usually means extra stress.

Which is why setting smart expense processes is more than simply a finance team goal – it should be an HR one, too. Here’s why improving employee expense management should be an HR goal, and how to do it.

Why Employee Expenses Are An HR Issue

You likely already know why expense reports can be tedious. What takes them beyond that, though, to the point that they require HR intervention?

1. They Create Unpleasant Admin For Employees

The average expense claims takes 20 minutes to process. That’s five minutes for the claimant, five minutes for their manager, and 10 minutes for the finance team (more on them shortly).

And that’s not 20 minutes per report, it’s 20 minutes per item. And if there are errors or missing information, that timeframe increases substantially.

2. They’re A Drain On Finance Team Time, Too

Even though finance teams typically build and enforce expense policies and processes, they don’t exactly enjoy them. Ask any accountant or financial controller why the end-of-year closing period is so tough, and they’ll tell you it’s chasing receipts and fixing unnecessary errors.

Overhauling (or removing entirely) expense claims would be an enormous stress relief for your finance employees.

3. They Put Financial Pressure On Team Members

Expense reports rely on an unfair system. We ask employees to make business payments using their own money, and then wait to be repaid. Essentially an interest-free loan.

One study found that a third of workers feel "financially unstable" as a result of being out of pocket. These are company costs, so they should never have an impact on employees’ financial wellbeing.

4. They Create Tension Between Teams

Expense claims involve multiple stakeholders: the claimant (employee), the approver (their manager), and the processor (finance). To progress the claim, you either have a long email chain involving all these parties, or a series of in- and out-trays, for more traditional companies.

This back-and-forth requires clear communication and empathy just to get through it, and often leads to arguments and misunderstandings.

Best Practices for more productive employee expenses

It’s all well and good pointing out the problems with expense claims. But how can you actually fix them?

Here are four best practices that eliminate most of your biggest headaches.

1. Stop Using Paper Expense Reports

Most of the critical administrative issues come from the fact that companies still rely on paper. And really, the only reason we do is that’s how expenses have always been done.

But think about the small steps that go into each claim:

Employees have to find, print, and fill out an expense report template.

They also need to scan and submit these documents – along with paper receipts – or physically place them in the filing system. (Which is hopeless during remote work, by the way).

Finance then has to input this same data into their own tools.

If anything is incorrect or missing, the whole process gets repeated. And information is incorrect or missing all the time.

One expense report is annoying enough. But if you’re processing dozens or hundreds in a month, paper is a serious hurdle.

If you’re focused on helping teams feel happy and respected at work, operational improvements make a big difference. So reducing paperwork is a big achievement.

Expense claims should be digital-first. And technology makes this easy, as we’ll see.

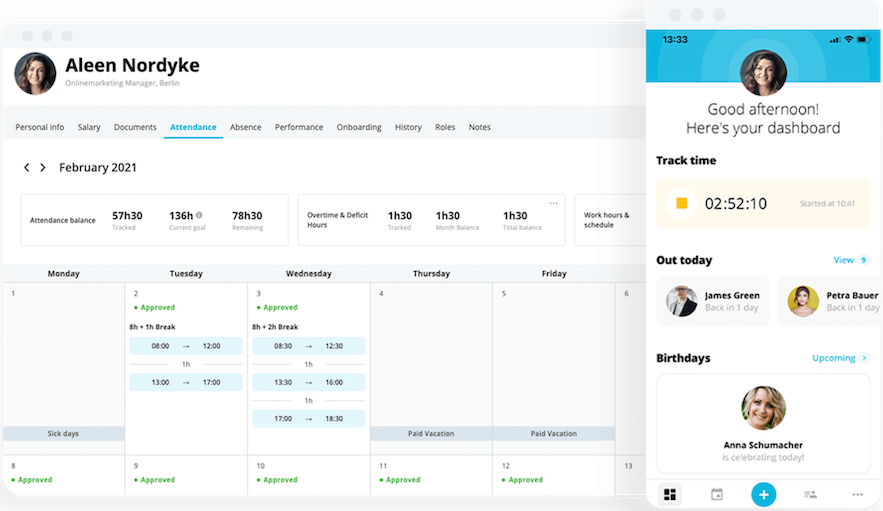

2. Use Mobile Expense Apps

You can easily replace that exact same paper process with a mobile app. You capture all the same information – including receipts – only faster and with fewer errors.

The reason is perfectly logical: instead of waiting until the end of the month to file claims, employees submit claims on the spot. The moment they make a purchase, they simply log it in the app and snap a photo of their receipt. And then they never have to worry about it again.

This has several benefits:

The information is more likely to be correct, and the app walks them through the steps

They upload the receipt right away, before it can get lost or damaged

The claim is fully digital

Each claim takes less than a minute

Again, you cut down on the administrative stress for every player involved. And you have a more efficient company, as a bonus.

3. Reimburse Employees Right Away

An extra benefit of having claims submitted in real time is that finance can make reimbursement payments sooner. Which takes some of that financial strain off employees. It’s typical for some team members to wait 2-3 months before being paid back, which is frankly unacceptable.

Instead of waiting to claim at the end of the month, and then waiting again for the “expense run” to be processed by finance, claims arrive immediately and reimbursements can be made more frequently.

This is an area where HR leaders can set clear expectations of finance teams. Of course, they may not want to make a bank run every week. It’s more convenient to do it once every few months. So HR needs to make it clear that this routine isn’t fair to employees.

Top tip: Good expense apps will even let companies reimburse employees from the app itself. This is faster and easier than a traditional bank run, and finance should be able to make these payments without issue.

4. Avoid Out-Of-Pocket Expenses Altogether

The final best practice is to prevent employee expense claims from becoming a habit in the first place. This doesn’t mean cutting back on expenses completely – there’s usually a good reason why money is spent.

Instead, encourage finance teams to find ways to spend that don’t rely on the employee’s own money. This could mean more widespread use of company cards, dedicated employee expense cards, or preferring invoices which are paid by the company directly.

A change of this nature will obviously belong to the CFO or Financial Director. They have to work out what’s best for the company. But you can be the catalyst to encourage change.

And of course, there will always be cases where expense claims are necessary. But these should be seen as the exception. And HR teams can implore finance to find better options for staff, choosing fairness and trust as the driving values.

Bad Processes Should Matter To HR

Modern HR teams have a lot on their plate. But whether you’re worried about remote working conditions, benefits, career progression, or just paying people on time, the core mission is the same: to keep team members happy and fulfilled at work.

Which comes back to the core thesis of this article: bad processes are an HR issue. If they impact morale and decrease productivity, they’re an HR issue. And if they hurt employees financially, they’re definitely an HR issue.

Manual, paper expense claims are all of the above, and nobody truly likes them. And they’re now perfectly simple to upgrade.

So make it your business, and make a change.

Jodie Codd

Jodie Codd, UK Market Expert, Spendesk

Jodie Codd is part of Spendesk’s UK Market team, where she helps growing businesses build robust expense processes, and frees finance teams from their biggest challenges.